The sleeper of the year goes to Goodness Growth Holdings, formerly Vireo Health (they still use the Vireo brand). In early June, the company had an investor day to announce their name change and provide investors a look the future of the company. It’s clear to me that most cannabis investors aren’t paying attention because the stock has decline 25% since their name change and investor day.

Here are ten reasons Goodness Growth’s stock is a deep sleeper and will move significantly higher over the next two years.

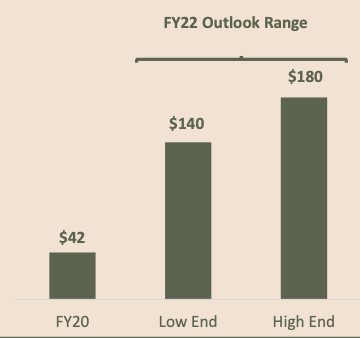

1. Explosive revenue growth. Goodness Growth provided revenue guidance of $140-$180 million in 2022, up significantly from $42 million in 2020 revenue and from previous 2022 guidance. If we split the difference and use $160 million, that would put the stock at 1.7x revenue based on a $280 million fully diluted market cap. If the company does achieve the high end guidance of $180 million in revenue, that would mean a price/sales of 1.5. Compare that to Green Thumb (7.5x), Innovative Industrial Properties (19x) to Canaopy Growth (11x), the stock is a steal.

2. Very attractive 2022 EBITDA multiple. Goodness Growth estimates $35-$55 in adj. EBITDA. If we again split the difference and us $45 million, the company trades at 6x 2022 EBITDA.

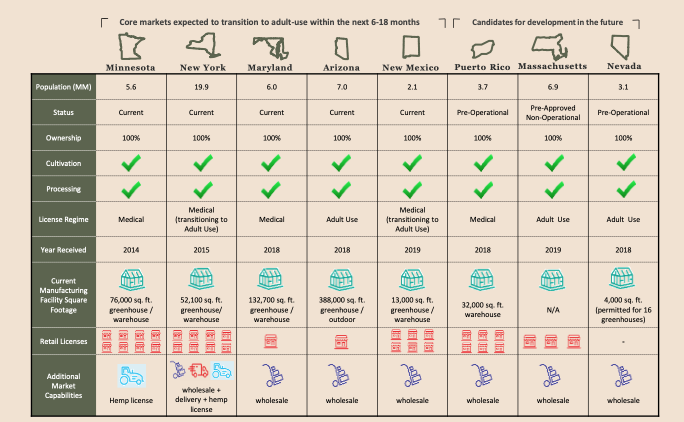

3. An explosive New York. Goodness Growth’s New York assets alone is a valid reason to invest in the company. New York will eventually be a $5+ billion legal cannabis market. If Goodness Growth gets just 5% market shares, that would be $250+ million in revenue compared to Goodness Growth’s $280 million market cap.

Being one of the original 10 New York licenses allows Goodness Growth to be one of the 10 fully vertical cannabis companies in the state as all new players to the industry must choose retail or grow (most will choose retail). The short-term boom will be New York introducing flower into the medical program and expanding who can qualify for a medical card. Recreational sales are about a year away and when sales numbers will explode.

Goodness currently operates 46k sqft of grow in New York, but plans on adding an additional 200k sqft to take advantage of their planned 8 store total, recreational wholesale and delivery.

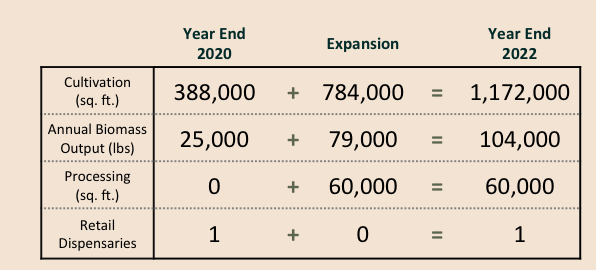

4. A under-the-rader Arizona play. Arizona fully legalized recreational sales in Q1 2021 and Goodness Growth is rarely talked about, but it should be. While Harvest Health, Curaleaf and Verano are know for their Arizona assets, Goodness Growth is rarely talked bout. While the company only operates one retail dispensary, the company started selling wholesale products in June. Goodness Growth plans to grow their cultivation facility from 388k sqft to nearly 1.2 million sqft by the end of 2022. 2022 will be an explosive year in Arizona.

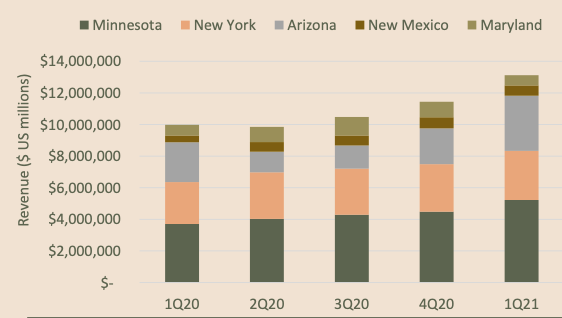

While the company is know for its Minnesota and New York assets, Arizona has seen the biggest growth in revenue and that should continue as it’s Goodness Growth’s biggest recreational use market.

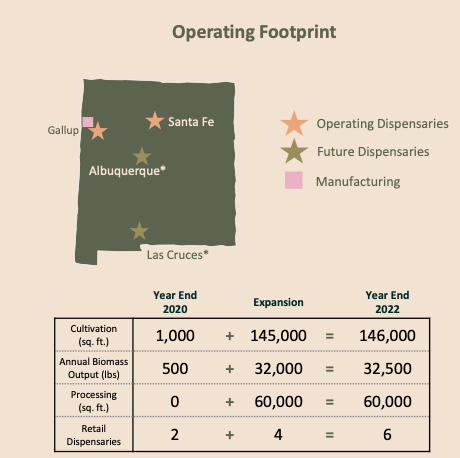

5. New Mexico will be a major 2022 revenue contributor. Goodness Growth is the only publicly traded MSO operating in New Mexico. The state recently passed recreational legislation with sales expected in Q1 2022. Currently, Goodness Growth operates two retail stores with plans to add four more stores to include Albuquerque, a city of half a million people. Two of the four stores have already been built and waiting for approval by the state. The company plans to expand their 1k sqft of grow to 146k sqft over the next year and a half.

6. A dominant Minnesota market shares. Minnesota is a tiny medical market now, but the state recently voted to expand the medical program with flower sales expected early in 2022. No one dominates the state like Goodness Growth, operating 8 retail dispensaries or 62% of the states total stores. Flower will ramp up revenue and Minnesota seems to fully legalizing marijuana in 2022 or 2023. No company will benefit more than Goodness Growth.

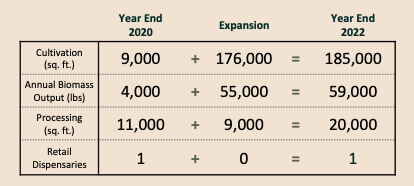

7. Maryland – a 2022 story. Goodness Growth recently opened its first medical dispensary in Maryland and started wholesale sales in June. The state is currently a $500+ million medical market and Goodness Growth is planning on expanding their cultivation in a major way, from 9k to 185k sqft by the end of 2022. UPDATE: Goodness Growth purchased a second dispensary in Baltimore.

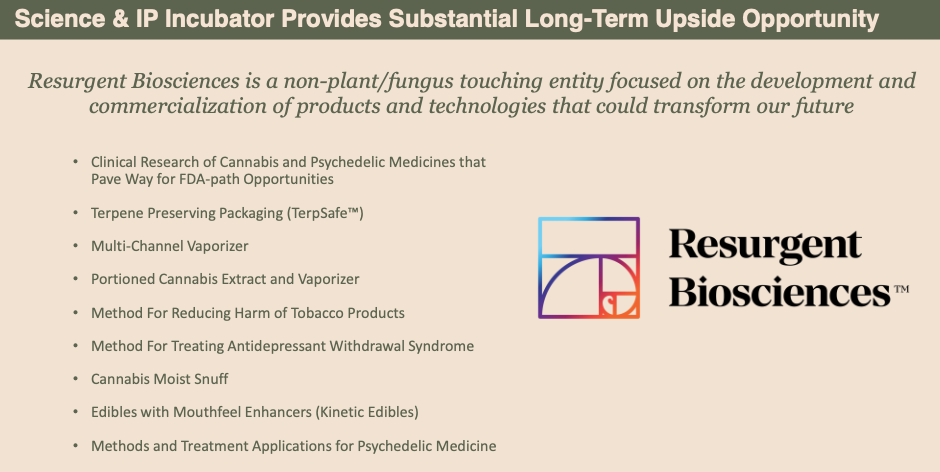

8. Goodness Growth has dedicated some significant resources to biosciences and intellectual property. This also includes the red hot psychedelic medicine market. While likely not to contribute positively to financials any time soon, these investments could pay off years down the road.

9. Non-core states look attractive. Goodness Growth is just now seeing the benefit of operating in medical markets that are either expanding their medical programs or becoming fully recreational. Puerto Rico and Nevada don’t provide much value today to Goodness Growth financials, but they do offer a call option on interstate commerce (inexpensive places to grow). While Massachusetts is notoriously slow in approving new operations, the state does offer an attractive market in the future.

10. Good balance sheet. Goodness growth ended Q1 2021 with over $58 million in current assets to include $40 million in cash with $24 million in current liabilities. While the company had a net loss of $7 million last quarter, they have plenty of cash to operate the rest of the year without the need to take on new debt or conduct a secondary stock offer.

I have a 12-month price target for Goodness Growth of $4.27 a share or a gain of 135% from today’s $1.82 stock price based on the stock going from 1.7x to 4x 2022 revenue of $160 million which I feel may be conservative. I also believe Goodness Wellness is at the top of the M&A list for companies like Trulieve and Verano who do not have a New York and very little overlap with other core and secondary states.