Curaleaf Holdings, Inc. (CSE: CURA) (OTCQX: CURLF) (“Curaleaf” or the “Company”), a leading U.S. provider of consumer products in cannabis, today reported its financial and operating results for the fourth quarter and year ended December 31, 2020. All financial information is provided in U.S. dollars unless otherwise indicated.

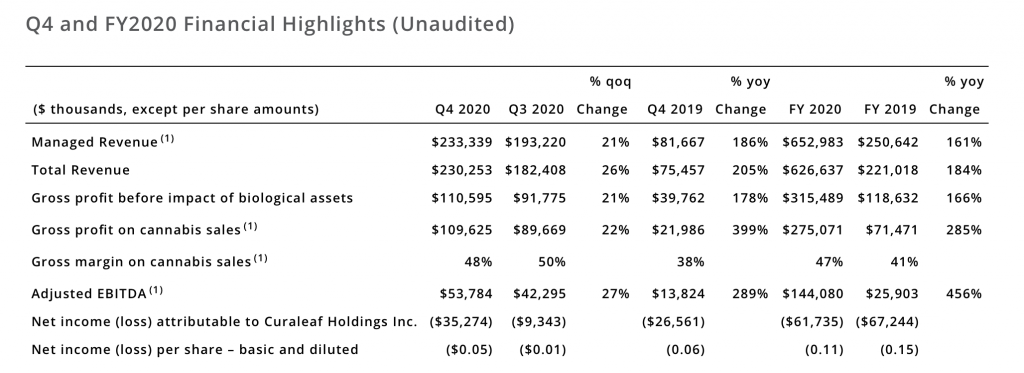

| (1) | See “Non-IFRS Financial and Performance Measures” below for more information regarding Curaleaf’s use of Non-IFRS financial measures and other reconciliations. |

| (2) | Fourth Quarter Pro Forma for the period included the revenue from Alternative Therapies Group, Inc. (“ATG”) as if the acquisition had occurred on October 1, 2020, the revenue of then pending acquisitions of Maryland Compassionate Care and Wellness, LLC (Grassroots related subsidiary) as if it occurred on October 1, 2020 and excluded revenue of the pending asset sales of HMS Health, LLC, HMS Processing, LLC and Town Center Wellness, LLC as if the sales had occurred on October 1, 2020. Fiscal Year 2020 Pro Forma includes the revenue from Cura Partners, Inc. (“Select”), Arrow Companies (“Arrow”), Remedy Compassion Center, Inc. (“Remedy”), GR Companies, Inc. (“Grassroots”), Virginia’s Kitchen, LLC (“Blue Kudu”), Curaleaf NJ, Inc. (“CLNJ”), Prime Organic Therapy, Inc. (“MEOT”) and ATG as if the acquisitions had occurred on January 1, 2020 and excluded revenue of the pending asset sales of HMS Health, LLC, HMS Processing, LLC and Town Center Wellness, LLC as if the sales had occurred on January 1, 2020. |

Fourth Quarter Highlights

- Record managed revenue of $233.3 million, which grew 186% year-over-year and 21% sequentially

- Record total revenue of $230.3 million, which grew 205% year-over-year and 26% sequentially

- Record adjusted EBITDA of $53.8 million, which grew 289% year-over-year and 27% sequentially

- Completed acquisition of Alternative Therapies Group (“ATG”)

- Completed divestiture of Curaleaf Maryland’s assets for a total consideration of $4.0 million

- R&D activities drove the launch of 32 new formulated products across form factors during the quarter

Full Year Highlights

- Record managed revenue of $653.0 million, which grew 161% year-over-year

- Record total revenue of $626.6 million, which grew 184% year-over-year

- Record adjusted EBITDA of $144.1 million, which grew more than four times 2019 levels

- Successfully completed eight acquisitions, including Select, Grassroots, Curaleaf NJ, Arrow, MEOT, Remedy, Blue Kudu and ATG

- Significantly expanded retail and wholesale operations through both acquisitions and organic growth, growing retail operations from 51 to 96, cultivation sites from 14 to 23, and processing sites from 15 to 30, along with expanding operations from 14 states to 23 states

- R&D activities drove the launch of 84 new formulated products across form factors during the year

Post Fourth Quarter Highlights

- Curaleaf to enter European cannabis market with proposed acquisition of EMMAC Life Sciences Limited, Europe’s largest vertically integrated independent cannabis company, making Curaleaf the undisputed global cannabis market leader based on revenue. The transaction is expected to close early in the second quarter of 2021.

- See the additional Curaleaf press release issued today regarding the acquisition of EMMAC Life Sciences Group at: https://ir.curaleaf.com/press-releases

- Raised net proceeds of $240.6 million in a public offering of 18,975,000 subordinate voting shares and net proceeds of $49.2 million from a tack-on to the Company’s existing secured credit facility

- Opened 5 new stores since December 31, 2020 in Florida, Pennsylvania and Maine, bringing total retail locations to 101

Joe Bayern, Chief Executive Officer of Curaleaf stated, “Curaleaf’s record fourth quarter results reflected the benefit of our acquisition of Grassroots, which expanded our presence into 6 new states, including high-growth markets such as Illinois and Pennsylvania as well as the continued ramp up of Select, which is now in 17 states. In 2021, we expect to see the positive benefits of the transformative legalization of adult-use cannabis in Arizona and New Jersey. As we have stated, we believe New Jersey will accelerate the potential of future adult-use in key states such as New York, Pennsylvania and Connecticut. Each of these markets present an enormous growth opportunity for us, as Curaleaf is the only MSO with a leading presence in every one of these states.”

Boris Jordan, Executive Chairman of Curaleaf commented, “In parallel with the announcement of our record financial results, earlier today Curaleaf issued a separate press release announcing its entrance into the European cannabis market with acquisition of EMMAC Life Sciences Limited, Europe’s largest vertically integrated independent cannabis company. This milestone transaction will give Curaleaf a leading presence in key European medical cannabis markets including the United Kingdom, Germany, Italy, Spain, and Portugal, among others. The proposed transaction will provide Curaleaf with access to the European market of 748 million people, representing another transformational growth driver for Curaleaf for years to come.”

Mike Carlotti, Chief Financial Officer of Curaleaf, added, “Curaleaf, once again, delivered record quarterly and annual results highlighted by record Managed Revenue, Pro Forma Revenue, and a 27% sequential improvement in Adjusted EBITDA. With our successful integration of Alternative Therapies Group in October 2020, starting next quarter, we will no longer report Managed Revenue thus simplifying our financial reporting. Our recent capital raises further strengthen the Company’s balance sheet providing it with ample capital to pursue planned organic growth initiatives, potential investments in states that may go adult-use sooner than later and for strategic acquisition opportunities. We believe that 2021 will be yet another record year for Curaleaf as we continue to expand our cultivation in key markets, open additional stores, expand our product and brand platforms, invest in future growth opportunities as well as see the benefit from Arizona’s recently approved adult use market and potentially New Jersey’s in late 2021.”

Financial Results for the Fourth Quarter Ended December 31, 2020

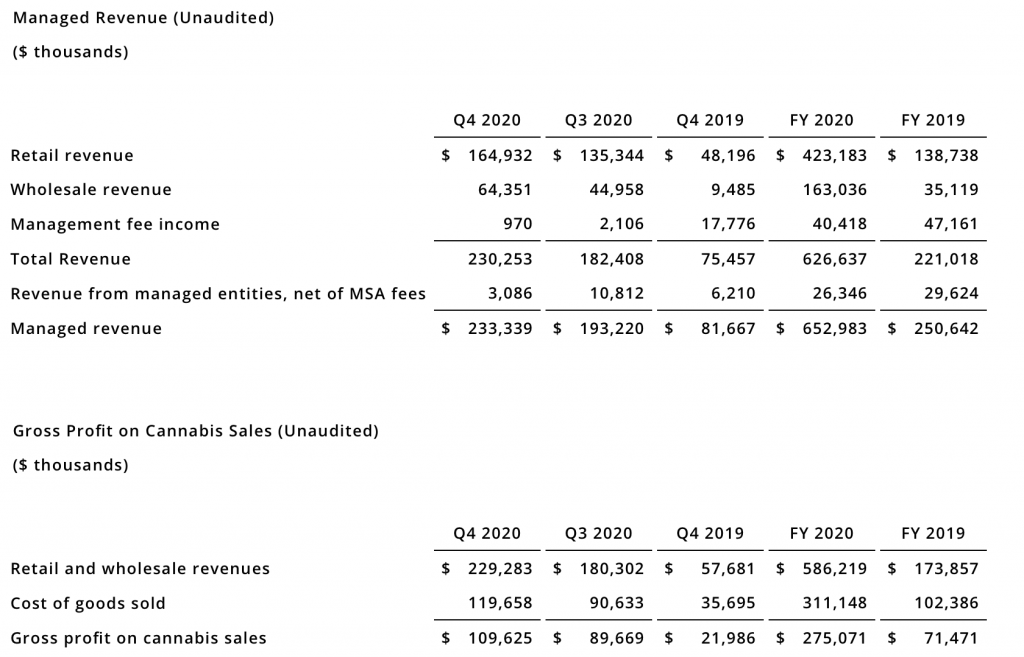

Managed Revenue for the fourth quarter of 2020 was a record $233.3 million, an increase of 185.7% compared to $81.7 million in the fourth quarter of 2019. Managed Revenue for the fourth quarter increased 20.8% sequentially.

Total Revenue for the fourth quarter of 2020 was a record $230.3 million, an increase of 205.1% compared to $75.5 million in the fourth quarter of 2019. Total Revenue for the fourth quarter of 2020 increased 26.2% sequentially.

Retail revenue increased by 242.2% to $164.9 million during the fourth quarter of 2020, compared to $48.2 million in the fourth quarter of 2019. The increase in retail revenue was primarily due to organic growth and new store openings in Florida, Massachusetts, Arizona, Illinois and New York, coupled with the impact of Grassroots, Curaleaf NJ, Arrow, and Maine Organic Therapy acquisitions in 2020, as well as acquisitions of two dispensaries in Arizona in the third quarter of 2019 and acquisition of Acres in Nevada in late 2019.

Wholesale revenue increased 578.5% to $64.4 million during the fourth quarter of 2020, compared to $9.5 million in the fourth quarter of 2019. Growth in wholesale revenue was due primarily to the addition of Select, Grassroots, Curaleaf NJ, Blue Kudu and ATG as well as an increase in Maryland and New York as a result of increased cultivation and harvest.

Management fee income decreased by 94.5% to $1.0 million during the fourth quarter of 2020, compared to $17.8 million in the fourth quarter of 2019. The decrease in the management fee income was primarily due to the acquisitions of Curaleaf NJ, the managed not-for-profit in New Jersey in July 2020 and ATG in November 2020.

Gross profit before impact of biological assets for the fourth quarter of 2020 was $110.6 million, compared to $39.8 million for the fourth quarter of 2019. The increase was primarily due to the continued improvement and increases in the operating capacity and efficiency of the Company’s cultivation and processing facilities.

Gross profit on cannabis sales was $109.6 million for the fourth quarter of 2020, resulting in a 48% margin, compared to $22.0 million in the fourth quarter of 2019. The increase was primarily due to the continued improvement and increases in the operating capacity and efficiency of the Company’s cultivation and processing facilities.

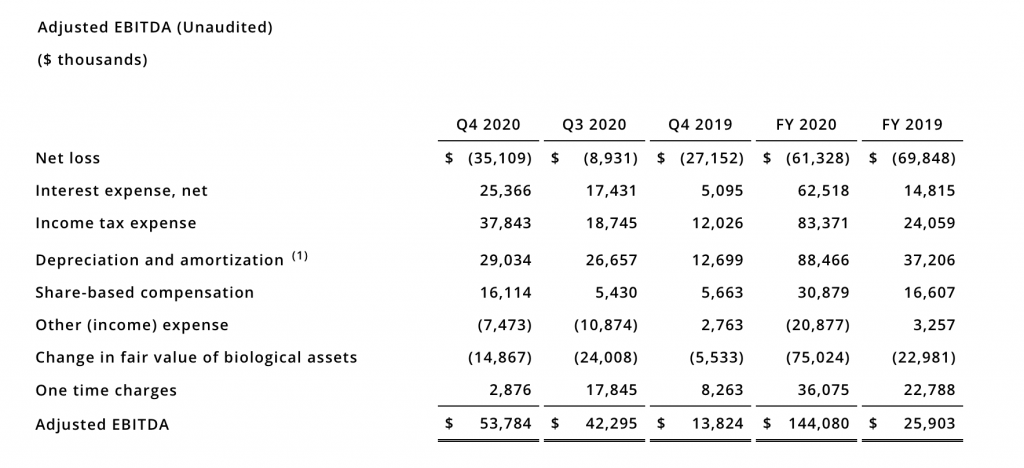

Adjusted EBITDA was a record $53.8 million for the fourth quarter of 2020, compared to $13.8 million for the fourth quarter of 2019.

Net loss, attributable to Curaleaf Holdings, Inc., for the fourth quarter of 2020 was $35.3 million, compared to a net loss of $26.6 million in the fourth quarter of 2019. The increase was a result of a $16.3 million increase in depreciation and amortization and a $10.5 million increase in share-based compensation, both of which are non-cash, a $25.8 million increase in income tax expense and a $20.3 million increase in net interest expense. These were partially offset by a $10.2 million increase in other income, which is mainly driven by gains on investments offset by impairment on the Eureka license, a $9.3 million increase in the fair value of biological assets, and a $5.4 million decrease in one-time expenses.

Financial Results for the Year Ended December 31, 2020

Managed Revenue for the year ended 2020 was a record $653.0 million, an increase of 160.5% compared to $250.6 million in for the year ended 2019.

Total Revenue for the year ended 2020 was a record $626.6 million, an increase of 183.5% compared to $221.0 million for the year ended 2019.

Retail revenue increased by 205.0% to $423.2 million during the year ended 2020, compared to $138.7 million for the year ended 2019. The increase in retail revenue was primarily due to organic growth and new store openings in in Florida, Massachusetts, Arizona, Illinois and New York, coupled with the impact of Grassroots, Curaleaf NJ, Arrow, and Maine Organic Therapy acquisitions in 2020, as well as acquisitions of two dispensaries in Arizona in the third quarter of 2019 and acquisition of Acres in Nevada in late 2019.

Wholesale revenue increased 364.2% to $163.0 million during the year ended 2020, compared to $35.1 million for the year ended 2019. Growth in wholesale revenue was due primarily to the addition of Select, Grassroots, Curaleaf NJ, Blue Kudu and ATG as well as an increase in Marylandand New York as a result of increased cultivation and harvest.

Management fee income decreased by 14.3% to $40.4 million during the year ended 2020, compared to $47.2 million for the year ended 2019. The decrease in the management fee income was primarily due to the acquisitions of Curaleaf NJ, the managed not-for-profit in New Jersey in July 2020 and ATG in November 2020.

Gross profit before impact of biological assets for the year ended 2020 was $315.5 million, compared to $118.6 million for the year ended 2019. The increase was primarily due to the continued improvement in the operating capacity and efficiency of the Company’s cultivation and processing facilities.

Gross profit on cannabis sales was $275.1 million for the year ended 2020, resulting in a 47% margin, compared to $71.5 million for the year ended 2019. The increase was primarily due to the continued improvement in the operating capacity and efficiency of the Company’s cultivation and processing facilities.

Adjusted EBITDA was a record $144.1 million for the year ended 2020, compared to $25.9 million for the year ended 2019.

Net loss, attributable to Curaleaf Holdings, Inc., for the year ended 2020 was $61.7 million, compared to a net loss of $67.2 million for the year ended 2019. The decrease was a result of a $24.1 million increase in other income, which is mainly driven by gains on investments partially offset by impairment on the Eureka license, and a $52.0 million increase in the fair value of biological assets. These were partially offset by an increase of $51.3 million in depreciation and amortization and a $14.3 million increase in share-based compensation, both of which are non-cash, a $59.3 million increase in income tax expense, a $47.7 million increase in net interest expense, and a $13.3 million increase in one-time expenses.

Balance Sheet and Liquidity

As of December 31, 2020, and prior to the Company’s recent capital raises, it had $73.5 million of cash on hand, $291.5 million of outstanding debt net of unamortized debt discounts and the weighted average fully diluted shares outstanding during the year were 557.2 million.

Conference Call and Webcast Information

Curaleaf will host a conference call and audio webcast today at 4:30 pm ET to answer questions about the Company’s operational and financial highlights. The dial-in numbers for the conference call are +1-888-317-6003 (U.S.), +1-866-284-3684 (Canada) or +1-412-317-6061 (Int’l) Passcode: 5071585. Please dial-in 10 to 15 minutes prior to the start time of the conference call and an operator will register your name and organization.

The conference call will also be available via webcast, which can be accessed through the Investor Relations section of Curaleaf’s website, https://ir.curaleaf.com/events.

For interested individuals unable to join the conference call, a dial-in replay of the call will be available until March 16, 2021 at 11:59 pm ET and can be accessed by dialing +1-877-344-7529 (U.S.), +1-855-669-9658 (Canada) or +1-412-317-0088 (International) and entering replay pin number: 10152585. The online archive of the webcast will be available on https://ir.curaleaf.com/events for 90 days following the call.

Non-IFRS Financial and Performance Measures

In this press release Curaleaf refers to certain non-IFRS financial measures such as “Pro Forma Revenue”, “Managed Revenue”, “Gross Profit on Cannabis Sales” and “Adjusted EBITDA”. These measures do not have any standardized meaning prescribed by IFRS and may not be comparable to similar measures presented by other issuers. Curaleaf defines “Managed Revenue” as total revenue plus revenue from entities for which the Company has a management contract but does not consolidate the financial results based on IFRS 10 – Consolidated Financial Statements. Curaleaf defines “Pro Forma Revenue” as “Managed Revenue” plus revenue from operations of pending and closed acquisitions as if such acquisitions occurred on January 1, 2020 for the Company’s fiscal year and as of October 1, 2020 for the Company’s fourth quarter. The Company defines “Gross Profit on Cannabis Sales” as retail and wholesale revenues less cost of goods sold. “Adjusted EBITDA” is defined by Curaleaf as earnings before interest, taxes, depreciation and amortization less share-based compensation expense and one-time charges related to business development, acquisition, financing and reorganization costs. Curaleaf considers these measures to be an important indicator of the financial strength and performance of our business. We believe the adjusted results presented provide relevant and useful information for investors because they clarify our actual operating performance, make it easier to compare our results with those of other companies and allow investors to review performance in the same way as our management. Since these measures are not calculated in accordance with IFRS, they should not be considered in isolation of, or as a substitute for, our reported results as indicators of our performance, and they may not be comparable to similarly named measures from other companies. The following tables provide a reconciliation of each of the non-IFRS measures to its closest IFRS measure.

| (1) | Depreciation and amortization expense in Q4 2020, Q3 2020, Q4 2019, FY2020 and FY2019 include amounts charged to cost of goods sold on the statement of profits and losses. Prior periods Q4 2019 and FY2019 have been adjusted to reflect the current period calculation of Adjusted EBITDA. |