Curaleaf Holdings, Inc. (CSE: CURA / OTCQX: CURLF) (“Curaleaf” or the “Company”), a leading international provider of consumer products in cannabis has successfully completed the previously announced acquisition of EMMAC Life Sciences Limited (“EMMAC”), the largest vertically integrated independent cannabis company in Europe, for base consideration of approximately US$50 million in cash and 17.5 million shares of Curaleaf, with additional consideration to be paid based upon the successful achievement of performance milestones. Curaleaf has simultaneously established Curaleaf International Holdings Limited (“Curaleaf International”) in Guernsey to hold the EMMAC investment and further its European expansion.

To accelerate the expansion of Curaleaf International, Curaleaf has secured an investment of US$130 million from a single strategic institutional investor in exchange for 31.5% equity stake in Curaleaf International, implying a $413 million Post Money valuation, with US$80 million in cash available to spend. The subscription will fund the entire cash portion of the EMMAC acquisition consideration of US$50 million with the remaining US$80 million to be used to fund Curaleaf International’s current capital expenditures plan through 2022, as well as its pipeline of potential acquisitions. This infusion of outside capital into Curaleaf International significantly accelerates Curaleaf’s expansion plans in Europe by fully funding Curaleaf’s cash outlay for the EMMAC acquisition and providing the capital required to support Curaleaf International’s near-term European rollout. With its foreseeable expansion budget fully funded, Curaleaf’s new international business can focus on executing its further European expansion.

Curaleaf and the strategic investor have entered into a shareholders’ agreement regarding the governance of Curaleaf International pursuant to which Curaleaf will have control over operational issues as well as raising capital and the ability to exit the business. In addition, the strategic investor’s stake is subject to put/call rights which permits either party to cause the stake to be bought out by Curaleaf for Curaleaf equity starting in 2025.

Boris Jordan, Executive Chairman of Curaleaf, stated, “The successful completion of our acquisition of EMMAC, and the formation of our new Curaleaf International business, marks a transformational launching point for our entrance into the European cannabis market. Building on our market leading position in the U.S., this transaction establishes Curaleaf as the global, pure play, cannabis market leader by revenue and geographic reach. With our single strategic institutional investor, we have set a strong foundation for Curaleaf International’s future growth trajectory. On behalf of the Curaleaf Board of Directors and management team, we are thrilled to welcome Antonio Costanzo, co-founder and CEO of EMMAC, as the CEO of Curaleaf International, and the entire EMMAC team to Curaleaf.”

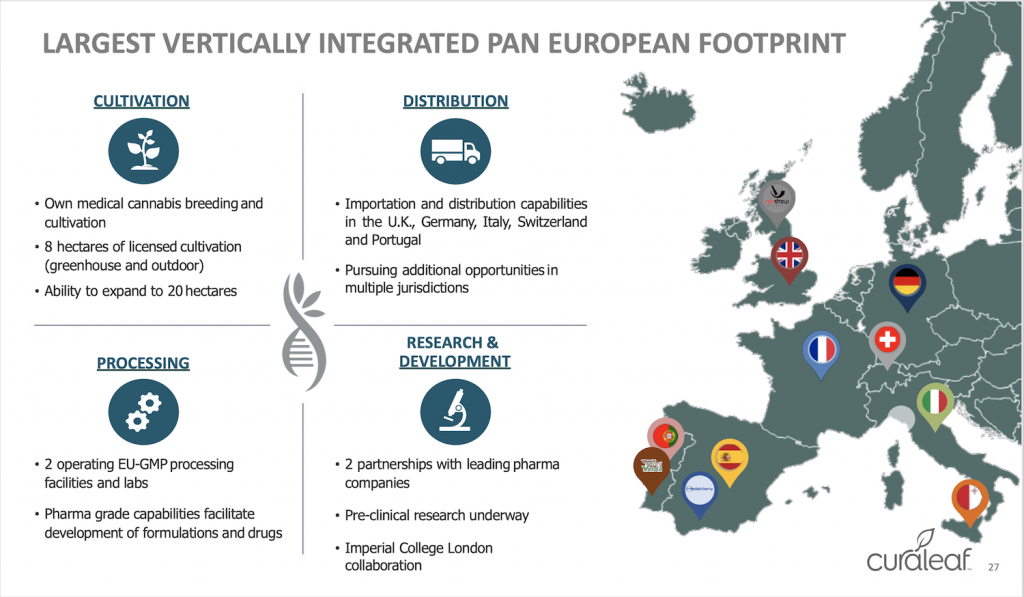

The new Curaleaf International platform includes cultivation, EU GMP-certified processing, distribution, and R&D operations across several key European medical cannabis markets, including the United Kingdom, Germany, Italy, Spain and Portugal. Terra Verde, Curaleaf International’s European market cultivation facility in Portugal, is one of the oldest licensed cannabis growing facilities in Europe with approximately 2 hectares of cultivation area and is an industry leader on the cannabis production cost efficiency front. The Portugal based cultivation facility provides Curaleaf International with the potential to serve customers across key European medical cannabis markets as well as supporting exports to countries such as Israel, among others. Curaleaf International plans to significantly increase its cultivation capacity in 2021, and to exceed 10 tons per year by 2022, in order to accommodate future growth related to the expansion of access to cannabis across the major European medical and adult-use, as well as export markets. Curaleaf International also has an operational presence and partnerships in European Union countries that are enacting new medical cannabis access programs. Curaleaf International will also serve as the platform for other possible acquisitions in Europe and adjacent areas, and for its participation in pilot adult use programs.

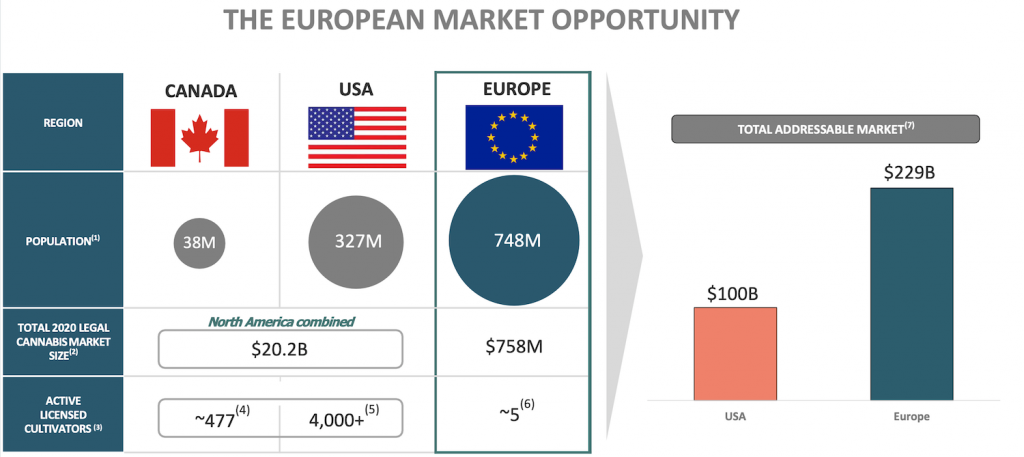

Joseph Bayern, CEO of Curaleaf, commented, “As the consumer and political liberalization trends around cannabis that are sweeping the U.S. are increasingly taking hold across Europe, our expansion into the international cannabis market presents tremendous new long-term growth opportunities for Curaleaf. With the European population of nearly 748 million1, the potential European addressable market is more than twice the size of the U.S. addressable market2. With the ability to operate our new European business across country borders, with one or two cultivation sites and one manufacturing center to serve the entire region in most cases, combined with our ability to leverage the strength of our consumer packaged goods strategies and innovations from our U.S. operations, we see enormously positive implications for our ability to quickly and efficiently scale the business across Europe.”

Following the successful completion of the transaction, Mr. Antonio Costanzo has been appointed as the new Chief Executive Officer of Curaleaf International, with the former EMMAC management team continuing to lead Curaleaf’s new European presence as well as driving local European strategy and day-to-day operations.

Antonio Costanzo, CEO of Curaleaf International, commented, “This is an important day for the European cannabis market as EMMAC transitions to Curaleaf International. I look forward to working closely with the Curaleaf team to shape the future of cannabis for our patients and customers around the world. We will retain our science-led approach to continue to deliver best in class cannabis products for Europe’s growing medical cannabis market, and will work closely to leverage the consumer packaged goods experience and innovation from the U.S. to capitalize on the emerging adult-use market as legislation allows. We are now very well positioned to realize our aggressive growth ambitions.”