- Record 1Q Combined Revenue of $92.5 Million, an Increase of 220% YoY

- Record 1Q Combined Adjusted Gross Profit of $37.7 Million, an Increase of 316% YoY

- Record 1Q Combined Adjusted EBITDA of $10.4 Million, an increase of $20 Million YoY

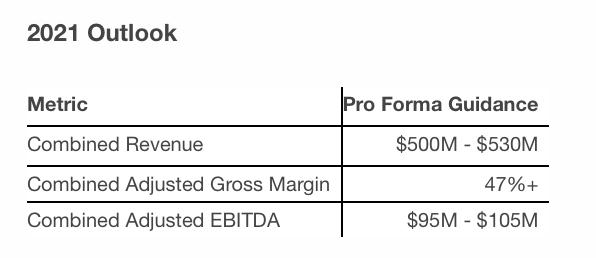

- Reaffirms 2021 Combined Revenue of $500 – $530 Million and Adjusted EBITDA Guidance of $95 – $105 Million as Green Leaf Acquisition Remains on Track for Closing at beginning of 3Q

- Raised US$140M in 1Q, Bolstering Liquidity Position in Support of Long-Term Growth Initiatives; Ended 1Q with Cash Balance of US$176M

- Closed Acquisition in April of 34-Acre Cultivation and Manufacturing Site in New York with ~1M square feet of Developed, Operational, Cost-Effective Cultivation Capacity – Affirms Leadership Position as New York’s Most Scaled Cultivator

- Launched Cannabist as National Dispensary Network Leveraging Proprietary Technology Platforms and Cohesive Retail Ecosystem to Provide a Personalized, Seamless Experience from Coast to Coast

May 17, 2021 07:00 AM Eastern Daylight Time

NEW YORK–(BUSINESS WIRE)–Columbia Care Inc. (NEO: CCHW) (CSE: CCHW) (OTCQX: CCHWF) (FSE: 3LP) (“Columbia Care” or the “Company”) today reported financial and operating results for the first quarter ended March 31, 2021. All financial information is unaudited and provided in US dollars unless otherwise indicated.

“We sustained our record 2020 momentum into the first quarter of 2021, with significant growth across both the top and bottom line,” said Nicholas Vita, CEO of Columbia Care. “Our combined revenue results reflect organic growth and further integration progress on key California and Colorado acquisitions. We continue to build scale and leverage in our existing markets, leading to positive trendlines for growth and profitability. The sequential increase in combined revenue and Adjusted EBITDA more than offset expected seasonality in Colorado and recently lifted COVID restrictions in California and was driven by substantial growth in Florida, Arizona, Illinois, and Ohio. Legacy Columbia Care same store sales increased 60 percent year over year.

“Recognizing the tremendous opportunity we have before us, we continue to deepen our state, regional and national footprint by adding scale to capitalize on additional upside in rapidly expanding medical programs and, in particular, in markets transitioning to adult-use across the country. Significant strategic investments in markets such as New York, New Jersey and Virginia will enable us to be the most efficient and scaled leaders in those markets and will cement our position as the industry leader on the east coast.

Vita continued, “We are leveraging our vertically integrated national platform and advancing our ongoing product and retail branding initiatives. Last week, we unveiled the Cannabist retail ecosystem, which is now open in Utah, a new market for Columbia Care, bringing our active market total to 15 nationwide. The Cannabist experience will be introduced across additional locations in the coming months – from San Diego to Boston – complementing the ongoing nationwide rollout of our product brands such as Seed & Strain, Triple Seven, Press, Amber and Classix.

“As we look ahead, we remain on track to close the acquisition of Green Leaf Medical (gLeaf) by the beginning of the third quarter, which will solidify our fully integrated leadership presence in Pennsylvania, Maryland, Ohio and Virginia. We have dispensaries currently in development in Missouri, New Jersey, Virginia, and West Virginia that will open in 2021, with additional locations in the commercialization pipeline, along with significant cultivation and production upgrades throughout our portfolio.”

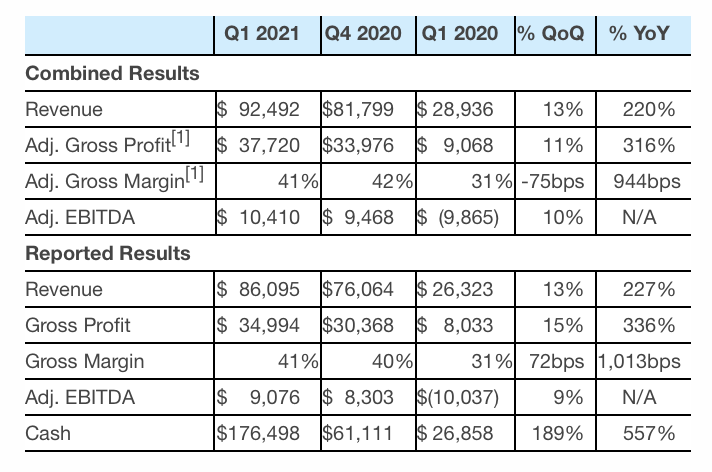

First Quarter 2021 Financial Highlights1 (in $ thousands, excl. margin items):

[1] Excludes changes in fair value of biological assets and inventory sold for all periods presented, as well as $1.4 million in Q4 2020 and $0.1 million in Q1 2021 related to the write-up of inventory acquired in The Green Solution, Project Cannabis and The Healing Center San Diego.

First quarter 2021 combined and reported results include contribution from The Healing Center San Diego (THCSD), which the company acquired on January 7, 2021.

Selected State Level Highlights:

Arizona:

- Same store sales increased approximately 70% from the same period last year, driven largely by the accelerated statewide roll-out of adult-use sales in January

- Expanding manufacturing in Tempe and upgrading cultivation facility in Chino Valley for additional wholesale and retail supply in 2H2021

- Continued focus on increasing gross margin, above 54% in 1Q, through new product offerings and supply chain management, inclusive of yield improvement, plant count and wholesale agreements

California:

- Sequential revenue growth of nearly 3x with addition of acquisitions, increasing wholesale momentum throughout 1Q

- Experienced softness across market-wide retail and wholesale revenue related to COVID-19 restrictions in January, February and early March – with noticeable uptick towards end of quarter

- Began first phase of manufacturing Project Cannabis finished goods out of De Soto facility towards the end of 1Q

- Gross margin increased 10 percentage points QoQ, driven by accretive margins from Project Cannabis and THCSD

- Top five market by Combined Revenue and Adjusted EBITDA in 1Q 2021

Colorado

- Revenue improved 27% YoY and 1Q gross margin was 42%; sequential results slowed in 1Q due to expected seasonality and decision to partially take off-line and upgrade largest indoor grow in preparation for ‘100 days of heat’ during 2Q and 3Q leading to accelerated GM and EBITDA expansion in 2Q and 2H2021

- Used market seasonality to purchase 3rd party finished goods in wholesale market to build inventory in anticipation of 2/3Q state-wide supply shortages

- Implementing cultivation improvements to increase yields and utilization of manufacturing capacity in order to drive margin improvement in 2021

- Top five market by Combined Revenue and Adjusted EBITDA in 1Q 2021

Florida:

- Revenue up 58% sequentially in 1Q 2021 and 3x YoY with significant same-store sales expansion, due to dispensary-level supply chain improvements and flower availability

- Implemented more efficient in-store processes, expanded product offerings, and updated dispensary websites across retail footprint

- Restructured production planning process resulted in a 61% quarterly improvement in cultivation yields; gross margin increased more than 2,000bps QoQ in 1Q

- Commercialization at our Alachua greenhouse complex initiated at the end of 1Q slowed GM improvement trendline; first harvest expected by end of 2Q providing significant scale to drive gross margin at accelerated pace in 2H2021

Illinois:

- Revenue up over 2x YoY, with continued robust retail sales performance and contribution from adult-use sales

- Working to secure approval to open completed Chicago dispensary expansion, which would triple the size of current retail square footage

- New product strains continue to drive foot traffic and generate positive reviews throughout the market

- Automated machinery will arrive in 2Q to drive Aurora facility utilization and reduce variable labor costs, development of infrastructure for new product launches slowed margin gains due to absorption allocations but are expected to accelerate into 2Q and 2H

Massachusetts:

- Sustained YoY revenue growth trajectory, driven by earlier than expected contributions from wholesale revenue; partially offset by supply constraints

- Adult-use sales remain on track to begin late 2Q 2021 at the co-located store in downtown Boston, the first Cannabist location in MA

- Modest sequential Gross Margin decline in 1Q due to supply chain constraints, ongoing construction and expansion activity at the Lowell cultivation and manufacturing facility in preparation for automated post-harvest equipment installation; will result in increased capacity utilization and throughput beginning in late 2Q

- Top five market by Combined Revenue and Adjusted EBITDA in 1Q 2021

New Jersey:

- Retail sales growth outperformed expectations YoY and doubled sequentially

- Significant drag on overall gross margin due to accelerated development of cultivation and manufacturing fixed assets; first significant harvest from legacy Vineland facility expected in 3Q

- Two additional dispensaries to open in 2021: Deptford in 2Q and a third by year end to match expanded cultivation capacity, bringing total to the state maximum of three; both will be Cannabist locations

- Second cultivation and production facility in Vineland providing 250,000sqft of canopy, manufacturing, and distribution space to support medical and adult-use is slated for commercialization in 4Q

New York:

- Revenue up +60% YoY, in part driven by wholesale and strong home delivery program

- Gross Margin softness reflected ongoing expansion projects in both cultivation and manufacturing

- Acquisition of Long Island cultivation facility (~1Msqft), offers the opportunity to scale with growing demand and potential for social equity partnerships

- Legislative approval of adult-use sales and expansion of medical program, including flower sales, provides significant upside; as an existing Registered Organization, we will be able to add four incremental medical dispensaries and co-locate three adult-use facilities for a total of eight

Ohio:

- Robust performance across both retail and wholesale, with same store sales up more than 3x YoY and with wholesale relationships with more than 85% of dispensaries in the state

- Commenced operations at manufacturing facility, which is now producing and selling finished goods

- Canopy expansion underway at existing cultivation facility expected to be completed by end of 3Q or mid 4Q 2021, with first material harvest in early 2022

- Top five market by Combined Revenue and Adjusted EBITDA in 1Q 2021

Pennsylvania:

- Revenue momentum continues to accelerate, up 80% YoY

- Increased operational hours in 1Q to drive revenue growth, as weather and COVID-19 restrictions impacted early months

- Adding incremental canopy, pending acquisition of gLeaf, to support 2022 growth opportunities and drive gross margin improvement

- Top five market by Combined Revenue and Adjusted EBITDA in 1Q 2021

Virginia:

- First market to be EBITDA positive in first quarter of revenue generation

- Sales increased more than 50% each month of operations; average dispensary sales of ~$165 per basket

- First harvest achieved in 1Q; developing significant cultivation expansion plan to meet expected market demand with flower entering medical program

- On track to expand Columbia Care retail footprint to six dispensaries and incremental cultivation and manufacturing capacity by year end

Columbia Care’s 2021 outlook is based on current trends and is consistent with the forecast previously provided on March 16, 2021.

Columbia Care’s pro forma 2021 outlook assumes the Company’s pending acquisition of gLeaf closes early in the third quarter but does not include any contribution from future acquisitions, nor does it assume any changes in the regulatory environment in markets where Columbia Care currently operates, such as the pending adult-use program in New Jersey, or the potential for the addition of flower sales in New York and Virginia during 4Q 2021. The outlook also excludes markets where a conversion from medical only to adult use is pending, such as New York and Virginia. See “Caution Concerning Forward-Looking Statements” below for further discussion.

Conference Call and Webcast Details

The Company will host a conference call on Monday, May 17, 2021 at 8:00 a.m. ET to discuss its financial and operating results for the first quarter of 2021.

To access the live conference call via telephone, please dial 1-877-407-8914 (US Callers) or 1-201-493-6795 (international callers). A live audio webcast of the call will also be available in the Investor Relations section of the Company’s website at https://ir.col-care.com/ or at https://78449.themediaframe.com/dataconf/productusers/colc/mediaframe/44932/indexl.html.

A replay of the audio webcast will be available in the Investor Relations section of the Company’s website approximately two hours after completion of the call and will be archived for 30 days.