Acreage Holdings, Inc. (“Acreage”) (CSE: ACRG.A.U, ACRG.B.U), (OTC: ACRHF, ACRDF) a multi-state operator of cannabis cultivation and retailing facilities in the U.S., today reported financial results for the first quarter of 2021.

FIRST QUARTER RESULTS (UNAUDITED)

During the first quarter of 2021, Acreage continued to improve its financial performance and made progress against its strategic initiatives. Highlights for the quarter are summarized below.

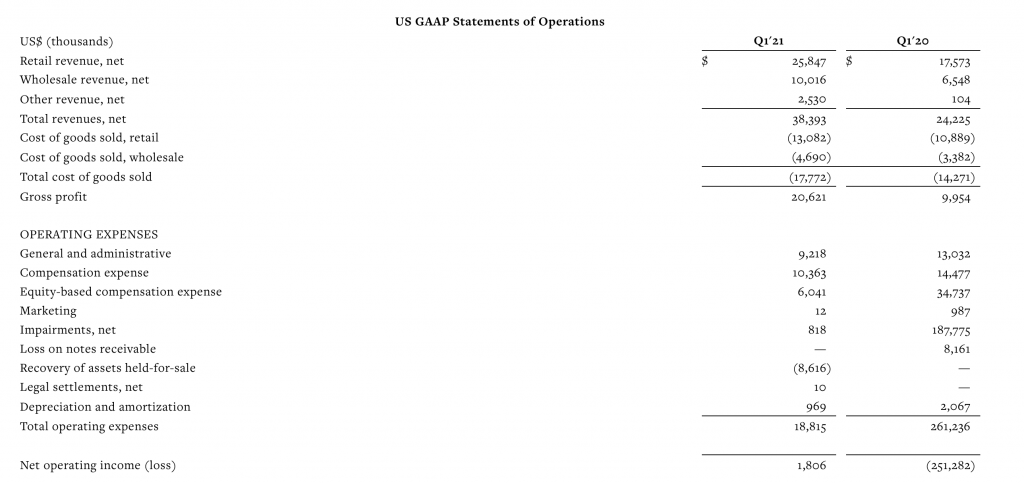

- Consolidated revenue was $38.4 million, a 58% increase compared to the same period in 2020 and a sequential increase of 22% compared to the fourth quarter of 2020.

- Company-owned same store sales growth was 16%, marking the ninth consecutive quarter of double-digit same store sales comparisons.

- Gross margin was 53.7%, an increase of 12.6 percentage points compared to the same period in 2020.

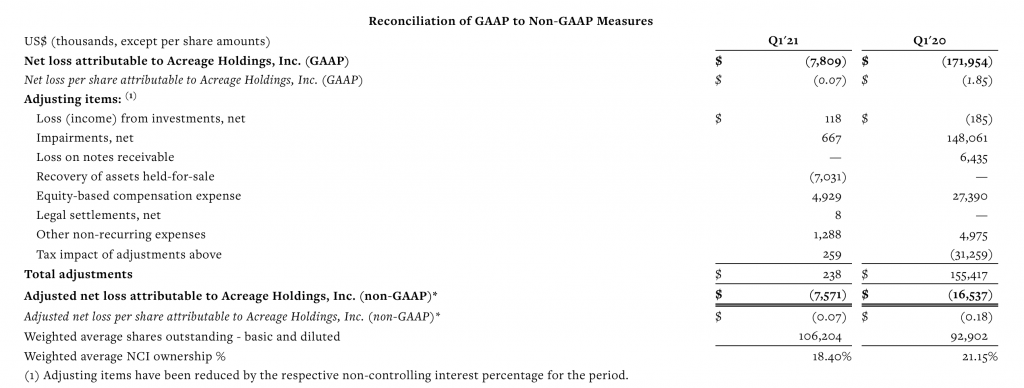

- Net loss attributable to Acreage in the first quarter of 2021 was $7.8 million, an improvement from the net loss attributable to Acreage of $172.0 million for the same period in 2020.

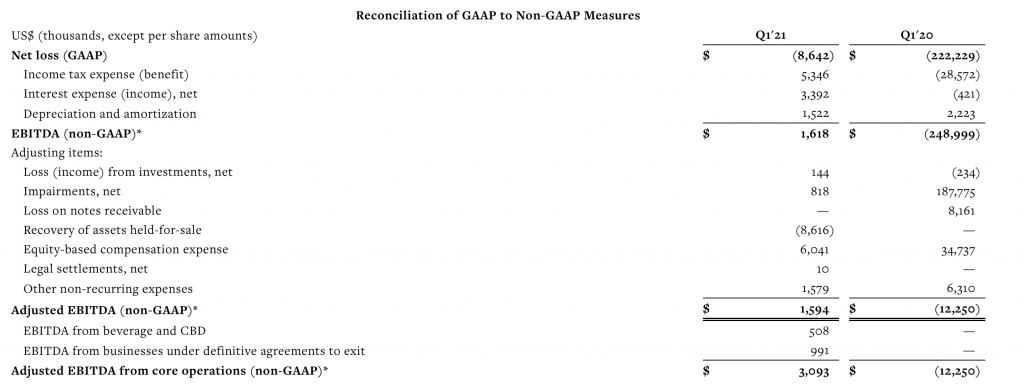

- Adjusted EBITDA* in the first quarter of 2021 was $1.6 million compared to a loss of $12.3 million in the same period in 2020. This marks the first quarter of positive adjusted EBITDA* for the company and validates management’s refocused strategic plan.

“I am very pleased with our financial performance in the first quarter as we reported positive Adjusted EBITDA for the first time in our history,” said Peter Caldini, Chief Executive Officer of Acreage. “Additionally, our revenue growth accelerated to 58% year over year, and our gross margin of 53.7% once again set a company record. This all validates our refocused strategy, and we are clear on our path to improved performance.”

Retail revenue for the first quarter of 2021 was $25.8 million, an increase of $8.3 million or 47% compared to the first quarter of 2020. The year over year growth was primarily driven by the consolidation of our New Jersey operations in June 2020 and same store sales growth of 16%. Additionally, retail revenue for the first quarter of 2021 improved sequentially by $0.8 million or 3% compared to the fourth quarter of 2020.

Wholesale revenue for the first quarter of 2021 was $10.0 million, an increase of $3.5 million or 53% compared to the first quarter of 2020. The year over year growth in wholesale revenue was primarily driven by increased capacity, coupled with maturing operations in the Company’s Pennsylvania, Massachusetts, and Illinois cultivation facilities. This resulted in higher yields and improved product mix in each of the respective markets. Additionally, wholesale revenue for the first quarter of 2021 improved sequentially by $3.6 million or 55% compared to the fourth quarter of 2020.

Total gross profit for the first quarter of 2021 was $20.6 million, an increase of $10.7 million or 107% compared to the first quarter of 2020. Both the growth in revenue and efficiencies achieved at our production facilities drove the increase in gross profit. Total gross margin was 53.7%, up 1,260 basis points compared to total gross margin of 41.1% in the first quarter of 2020.

Consolidated EBITDA* for the first quarter of 2021 was $1.6 million, which was a significant improvement compared to a consolidated EBITDA* loss of $249.0 million in the year ago comparable period. Adjusted EBITDA* for the first quarter of 2021 was $1.6 million, which was also a significant improvement to the Adjusted EBITDA* loss of $12.3 million in the first quarter of 2020 and a sequential improvement from the Adjusted EBITDA loss* of $3.5 million in the fourth quarter of 2020. This marks the first time the company has reported positive EBITDA* and positive Adjusted EBITDA*, which management believes validates its refocused strategy. Finally, Adjusted EBITDA from core operations*, which excludes markets where the Company has entered into definitive agreements to exit and start-up ventures such as beverages and CBD, was $3.1 million, indicating the Company’s core markets are still being negatively impacted by its non-core operations.

MANAGED SERVICES AGREEMENTS (MSA) PERFORMANCE

In addition to operating corporately owned production and cultivation facilities and retail dispensaries, Acreage manages operations on behalf of several third parties. For the first quarter of 2021, these managed entities generated net sales of $16.4 million, which was an increase of $3.0 million or 22% compared to the first quarter of 2020, driven primarily by same store sales growth of 99% and somewhat offset by the transition of the New Jersey operations.

Managed entities generated EBITDA of $4.7 million for the first quarter of 2021, an increase of $5.5 million compared to an EBITDA loss of $0.8 million in the first quarter of 2020.

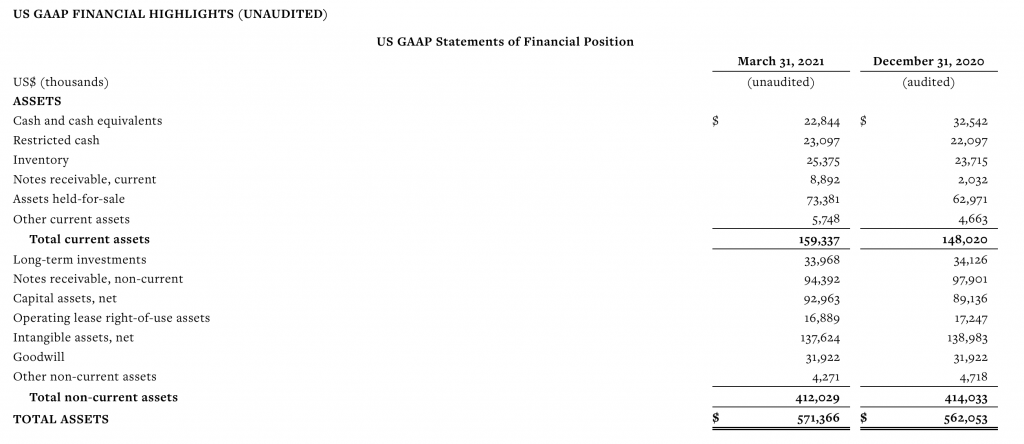

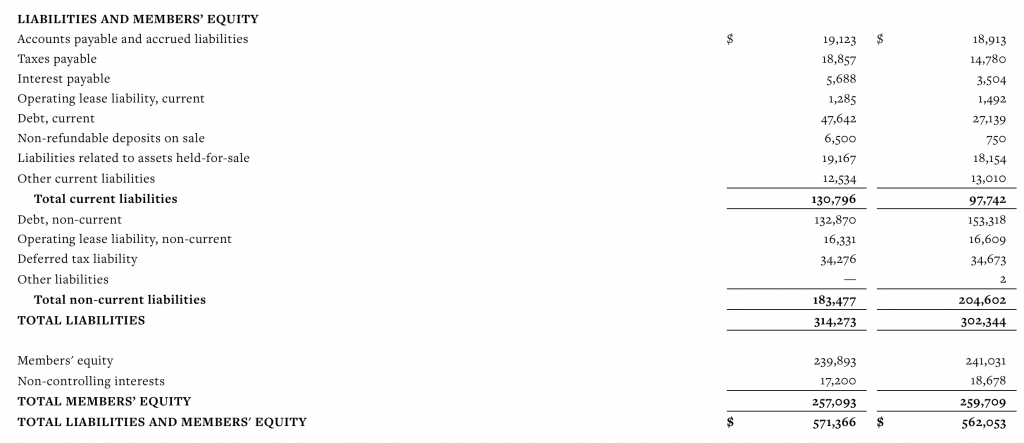

BALANCE SHEET AND LIQUIDITY

The company ended the quarter with $45.9 million in cash and restricted cash. Subsequent to the quarter end, the company closed on the previously announced sale of its Florida operations, which provided an additional $20 million to the Company’s cash balances. Additionally, during the first quarter of 2021, the company extended the maturity date related to $21 million of a $22 million term loan to June 2021 and subsequently filed a Form S-1 resale registration statement which was declared effective by the SEC, for shares underlying outstanding warrants held by our investors. The company has worked to ensure that sufficient capital is available and is consistently monitoring for advantageous opportunities.

STRATEGIC DISCUSSION

The Company continues to believe its refocused strategy is the key to continued improvements in its financial results and shareholder value. The Company remains focused on three key strategic objectives – driving profitability, strengthening the balance sheet, and accelerating growth in its core markets.

Driving Profitability: The Company’s focus on improving operational and financial results has significantly improved profitability from reporting an EBITDA loss of $249.0 million in the first quarter of 2020 to reporting positive EBITDA of $1.6 million in the first quarter of 2021. Management continues to diligently control costs, improve operational efficiencies, and accelerate organic growth in its core markets to continue to report improved profitability going forward.

Strengthening the Balance Sheet: Strengthening the balance sheet is key to both providing the Company with the necessary capital to achieve its operational plans and building shareholder confidence. The Company has worked to ensure that sufficient capital has been available when needed. Going forward, the Company will monitor the capital markets and utilize opportunities to access both debt or equity when it is necessary and advantageous to do so.

Accelerating Growth in Core Markets: Through prior acquisitions and capital expenditures, management believes Acreage is well positioned for future success in several key markets as regulations regarding the use of cannabis continue to evolve. As an example, the Company has an established footprint in key markets such as New York and New Jersey and expects to benefit in the coming months and years as a result of the recent passage of adult-use programs in these states. The Company will continue to focus its growth on its core markets where it can take advantage of and expand on the presence already established.

During the first quarter of 2021, several achievements were completed in accordance with these strategic objectives:

- The company entered into a definitive agreement to sell its Florida operations for an aggregate $60.0 million during the quarter. Subsequent to the quarter end, the company closed on its Florida divestiture. Additionally, the company agreed to sell its dispensary in Powell, OR and its cultivation and processing facility in Medford, OR.

- The company opened its third dispensary in Williamstown, New Jersey. The Company now operates the maximum number of dispensaries allowed in the state of New Jersey.

- The Company continued to aggressively push toward completion of its New Jersey cultivation facility expansions in Egg Harbor and Sewell, positioning Acreage as a market leader ahead of adult-use sales in that state. Both facilities remain on track to complete the expansion projects currently underway in early 2022, bringing total production and cultivation space to nearly 200,000 square feet.

EARNINGS CALL DETAILS

Acreage will host a conference call with management on Tuesday, May 11th at 8:30 A.M. Eastern Daylight Time. The call will be webcast and can be accessed at investors.acreageholdings.com. To listen to the live call, please go to the website at least 15 minutes early to register, download and install any necessary audio software.

*NON-GAAP MEASURES, RECONCILIATION AND DISCUSSION (UNAUDITED)

This release contains tables that reconcile our results of operations reported in accordance with accounting principles generally accepted in the United States of America (“GAAP”) to adjusted results that exclude the impact of certain items identified as affecting comparability (non-GAAP). We use EBITDA, adjusted EBITDA, adjusted EBITDA from core operations, adjusted net loss attributable to Acreage, same store sales trends, among other measures, to evaluate our actual operating performance and for planning and forecasting future periods. We believe the adjusted results presented provide relevant and useful information for investors because they clarify our actual operating performance, make it easier to compare our results with those of other companies and allow investors to review performance in the same way as our management. Since these measures are not calculated in accordance with GAAP, they should not be considered in isolation of, or as a substitute for, our reported results as indicators of our performance, and they may not be comparable to similarly named measures from other companies. The tables below reconcile our results of operations in accordance with GAAP to the adjusted results mentioned above: