BOULDER, Colo., March 25, 2021 /CNW/ – (TSX: CWEB) (OTCQX: CWBHF), Charlotte’s Web Holdings, Inc. (“Charlotte’s Web” or the “Company”), the market share leader in full spectrum cannabidiol (CBD) hemp extract wellness products and a certified B Corp, today reported financial results for the fourth quarter and year ended December 31, 2020. All amounts are expressed in United States dollars unless otherwise noted. Certain metrics, including those expressed on an adjusted basis, are non-IFRS measures, see “Non-IFRS Measures” below.

2020 12-Month Financial Highlights

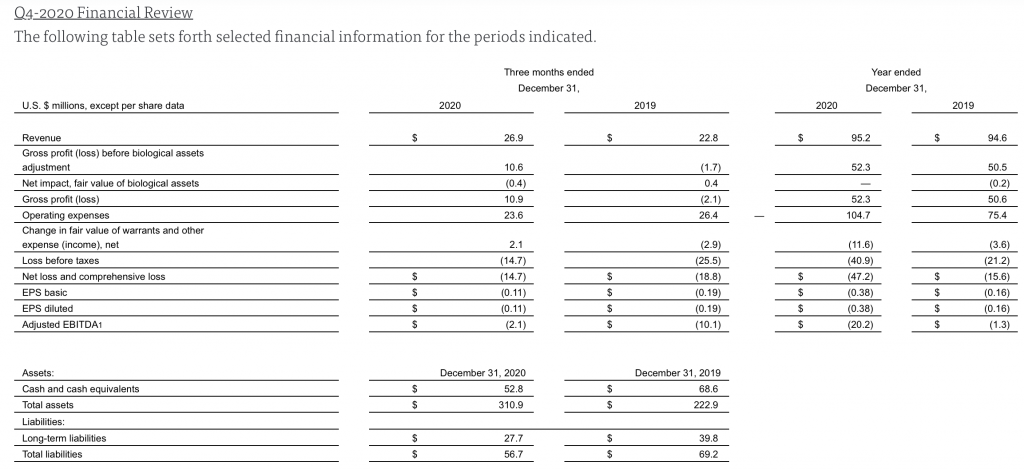

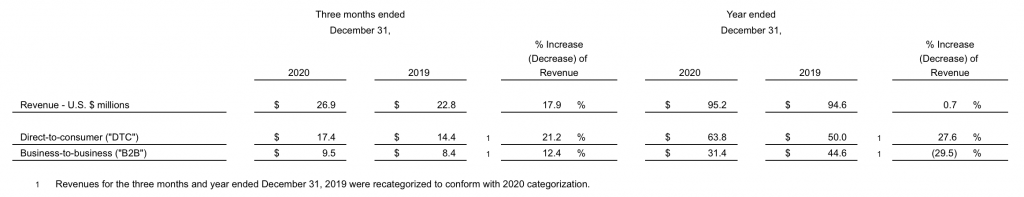

- Total net revenue increased to $95.2 million vs. $94.6 million in 2019

- Direct-to-Consumer (“DTC”) eCommerce sales grew 27.6% in 2020 contributing 67.0% of total revenue, substantially offsetting a decline of 29.5% in B2B sales impacted by the COVID-19 pandemic

- Gross profit, excluding the impact attributable to the inventory provision, of $60.3 million was 63.3% of consolidated revenue

- Adjusted EBITDA loss was $20.2 million

- $52.8 million cash and $113.6 million working capital at December 31, 2020

2020 12-Month Business Highlights

- Completed acquisition of Abacus Health to become the market share leader in CBD topicals1

- Invested $28.3 million capex including new facilities to expand capacity for production, extraction, R&D, and distribution

- Launched CW Labs R&D division to advance hemp science and clinical studies

- Secured 3 U.S. Patents for the Company’s proprietary hemp cultivars bringing total patents to 5 in 2021

- Increased distribution from 10,000 doors to more than 22,000 unique retail doors

- Sponsored a third-party liver health study to address FDA need for quantitative data

- Drove federal and state legislative actions to help develop comprehensive regulatory framework

- Earned B Corp certification

Q4-2020 Financial Highlights

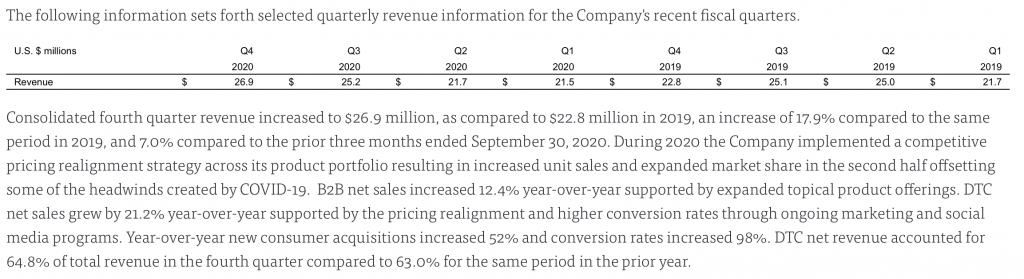

- Revenue increased 17.9% to $26.9 million vs. Q4-2019 and increased 7.0% vs. Q3-2020

- DTC sales increased 21.2% year-over-year, contributing $17.4 million or 64.8% of Q4 revenue

- Net revenue increased quarter-over-quarter for both DTC 4.2% and B2B 12.7%

- Gross profit, excluding the impact attributable to a Q4 inventory provision, was $16.8 million, or 62.2% of consolidated revenue

- Adjusted EBITDA loss of $2.1 million vs. loss of $6.7 million in Q3-2020

Q4-2020 Business Highlights

- Increased DTC eCommerce transactions, conversion rates, subscriptions and unit volume

- Commenced Phase III extraction infrastructure and R&D expansion in new 137,000 sq ft facility to build out production capacity ahead of anticipated growth. Related Q4 capex of $5.9 million.

- Secured 5-year exclusive distribution partnership with Intercare/Canndoc in Israel as first step in international expansion strategy

- Exited 2020 as market share leader in total food/drug/mass retail (“F/D/M”), US natural specialty retail, and DTC channel

“We turned a challenging start to 2020 into a strong finish, taking multiple actions and outperforming much of the competitive set to extend our brand and market share leadership,” said Deanie Elsner, CEO of Charlotte’s Web. “We filled product and channel gaps with competitive offerings and advanced the science of hemp CBD through CW Labs and collaborative studies with top tier institutions. We have now protected our intellectual property with 5 patents awarded for our proprietary cultivars and have defended our trademarked Charlotte’s Web™ brand though a recent judgement. In 2021 we are positioning for long-term growth and shareholder value creation as we evolve towards establishing Charlotte’s Web as a leading global botanicals wellness company by expanding into cannabis wellness where federally permissible. To support our international growth we have an exclusive agreement with one of Israel’s largest medical cannabis producers, and in the U.S. we secured future optionality through a strategic option to acquire Stanley Brothers cannabis business pending US federal legalization of cannabis.”

Gross profit for the fourth quarter was 40.6% compared to (9.0)% last year. Gross profit, excluding the impact attributable to an inventory provision, was 62.2% compared to 52.0% last year.

Operating expenses were $23.6 million, a 10.4% year-over-year decrease from $26.4 million. High operating expenses reflect the Company’s investments in capacity expansion and transition to a consumer-packaged goods (“CPG”) operating company capable of supporting mass retail channel growth. In response to lower B2B retail sales growth during the pandemic, in Q4-2020 management took actions to better align operating expenses through an expense optimization program successfully achieving reductions of more than 10% of the consolidated expense run rate by the end of 2020. This was achieved despite the addition of the CW Labs R&D division and the Abacus acquisition during the year. As a percent of revenue operating expenses improved from 136%, to 113% and 88% for Q2, Q3 and Q4, respectively in 2020.

Adjusted EBITDA for the quarter was negative $2.1 million, or (7.7)% of consolidated revenue, compared to Adjusted EBITDA of negative $10.1 million, or (44.4)% of revenue, for the fourth quarter of 2019. The improved Adjusted EBITDA ratio reflects higher revenue combined with the expense optimization program.

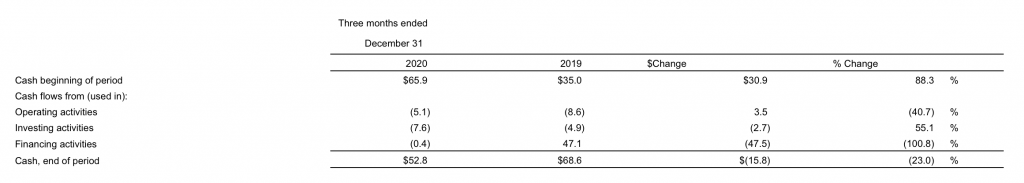

Balance Sheet and Cash Flow

The Company used $5.1 million of cash in operations during the fourth quarter of 2020 compared to $8.6 million of cash used in operations during the fourth quarter of 2019. The Company’s cash and working capital at December 31, 2020 were $52.8 million and $113.6 million, respectively, compared to $68.6 million and $116.9 million at December 31, 2019.

Consolidated Financial Statements and Management’s Discussion and Analysis

The Company’s audited consolidated financial statements and accompanying notes for the periods ended December 31, 2020 and 2019, and related management’s discussion and analysis of financial condition and results of operations (“MD&A”), are available under the Company’s profile on SEDAR at www.sedar.com and on the Investor Relations section of the Company’s website at https://investors.charlottesweb.com.

Conference Call

Management will host a conference call to discuss the Company’s fourth quarter 2020 results at 8:30a.m. ET on Thursday, March 25, 2021. To participate in the call, please dial 1-647-427-7450 or 1-888-231-8191 approximately 10 minutes before the conference call and provide conference ID 7397494. A recording of the call will be available through April 1, 2021. To listen to the rebroadcast please dial 1-416-849-0833 and provide the same conference ID.

A webcast of the call can be accessed through the investor relations section of the Charlotte’s Web website.