Company affirms position as the largest wholesaler of branded products in the industry with $274.0 million in wholesale revenue for the year

- Record full year 2020 revenue of $476.3 million, up 271% YoY

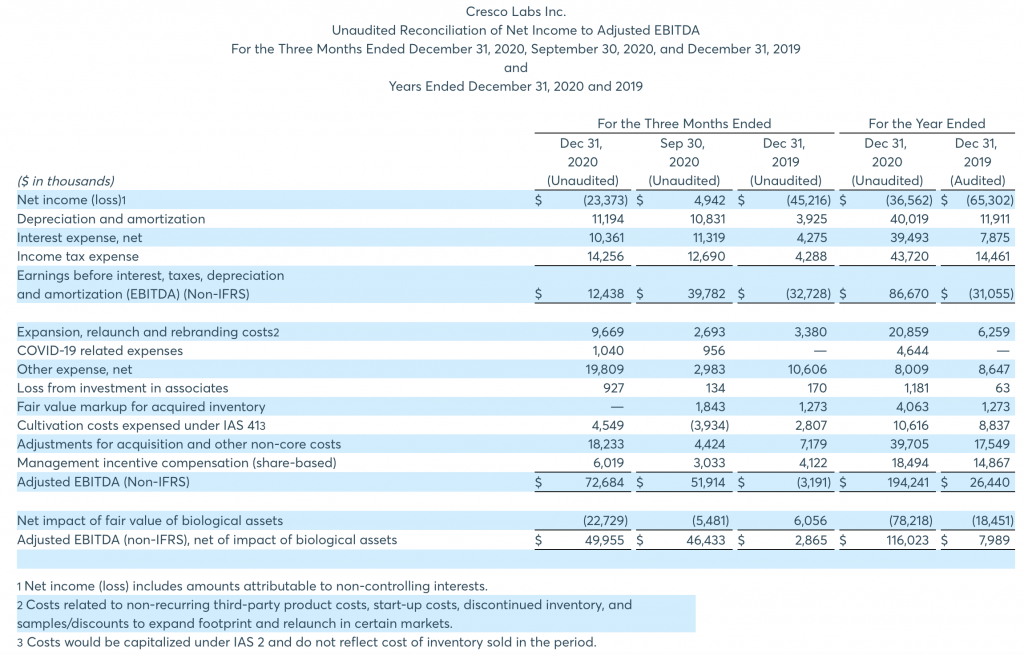

- Record full year 2020 adjusted EBITDA1 of $116.0million

- Record fourth quarter revenue of $162.3 million

- Record fourth quarter adjusted EBITDA1 of $50.0 million

- Record fourth quarter retail revenue of $68.8 million from 19 stores, an average of $3.6 million per store2

CHICAGO–(BUSINESS WIRE)– Cresco Labs Inc. (CSE: CL) (OTCQX: CRLBF) (FSE: 6CQ) (“Cresco Labs” or the “Company”), one of the largest vertically integrated multi-state cannabis operators in the United States, today released its financial results for the year ended December 31, 2020. All financial information presented in this release is in U.S. dollars, unless otherwise noted.

Management Commentary

“2020 was a remarkable year for Cresco Labs. We dedicated our resources to the most strategic markets, grew our leadership as the number one wholesaler of branded cannabis products, executed high efficiency retail, and generated substantial operating leverage as we scaled. We laid out our objectives at the beginning of the year and we executed on what we set out to accomplish, resulting in the largest year-over-year revenue growth among tier one MSOs,” said Charles Bachtell, Co-founder and CEO of Cresco Labs. “In 2021, cultivation expansions are underway and we are executing accretive M&A as we repeat our playbook in more states. Our best-in-class execution was on display in 2020 and it’s what you can expect from Cresco Labs for years to come.”

Financial Highlights

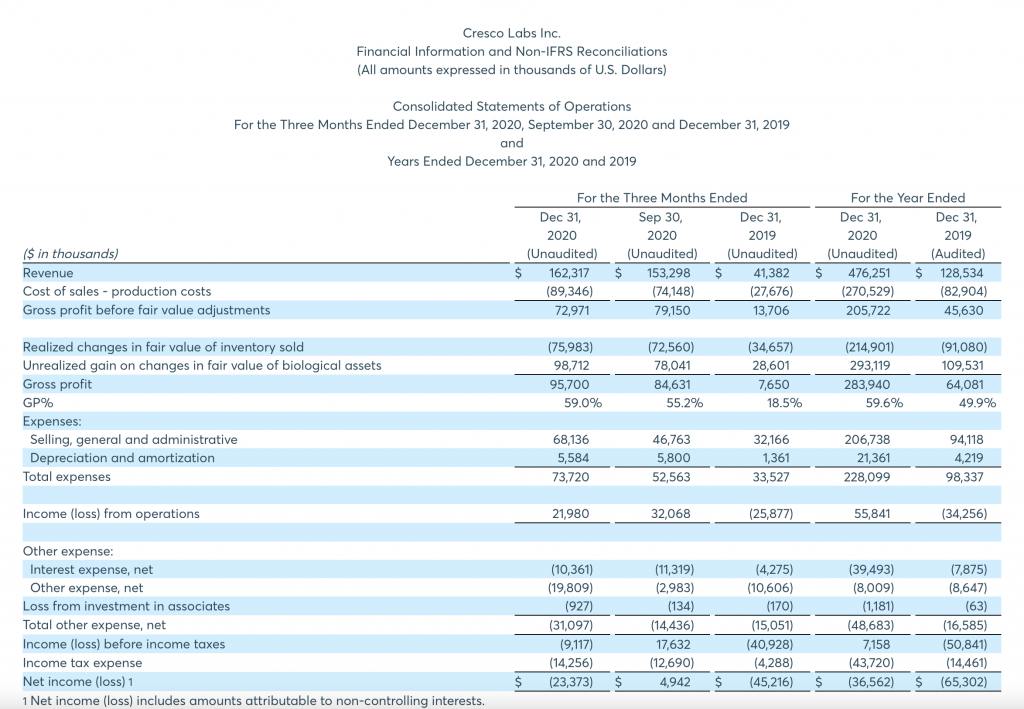

Full Year 2020 Operating Results

- Revenue was $476.3 million, an increase of $347.7 million or a 271% increase over full year 2019 revenue. Growth was driven by cultivation expansion in Illinois and Pennsylvania as well as strong sequential same-store growth.

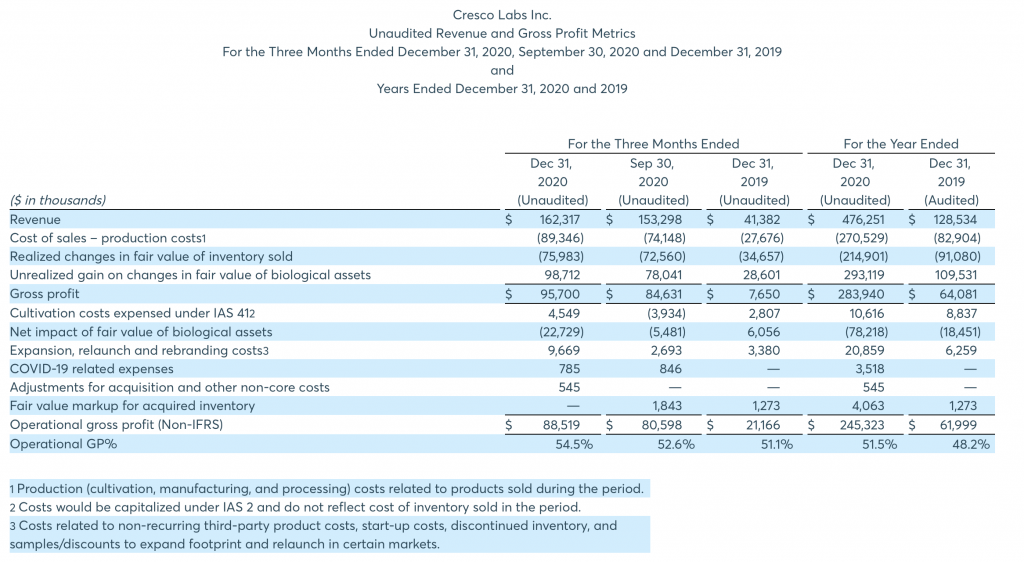

- Operational Gross Profit1 as a Percentage of Revenue was 51.5% as compared to 48.2% for full year 2019.

- Adjusted EBITDA1was $116.0 million, an increase of $108.0 million over full year 2019 Adjusted EBITDA.

Fourth Quarter 2020 Operating Results

- Revenue for the fourth quarter of 2020 was $162.3 million, an increase of $9.0 million or a 6% increase over the third quarter of 2020. Second half 2020 revenue grew 96% over first half of 2020 revenue.

- Operational Gross Profit1 as a Percentage of Revenue was 55% for the fourth quarter of 2020 as compared to 53% for the third quarter of 2020.

- Adjusted EBITDA1was $50.0million, an increase of 8% over the third quarter of 2020.

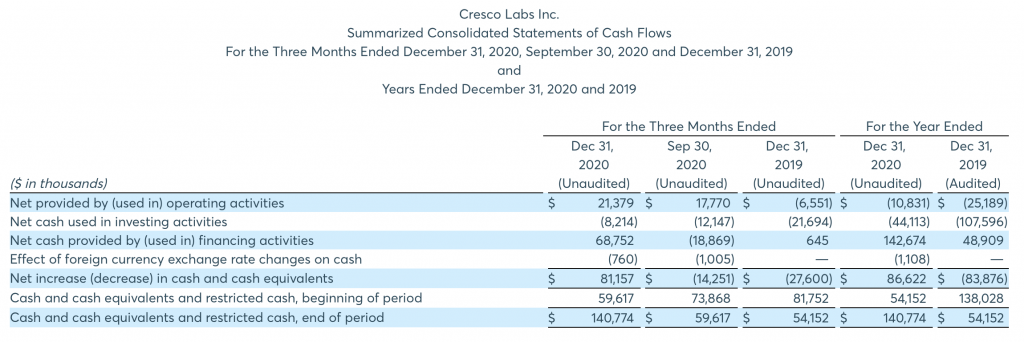

- Net Cash Provided by Operating Activities was $21.4 million for the fourth quarter of 2020, compared to $17.8 million provided in the third quarter of 2020.

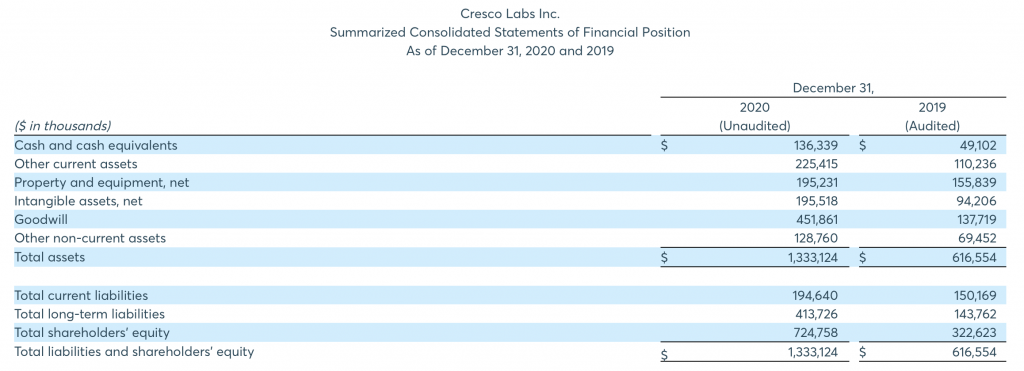

Balance Sheet and Liquidity

- As of December 31, 2020, current assets were $361.8 million, including cash and cash equivalents of $136.3 million. The Company had working capital of $167.1 million and total debt, net of issuance costs of $184.5 million.

- Total shares on a fully converted basis were 384,801,220 as of December 31, 2020.

Summary of Cresco Labs’ 2020 Social Equity and Education Development Program

Please click here to view our 2020 annual SEED Report.

Capital Markets and Financing

- On December 14, 2020, the Company closed an agreement with lenders to extend maturity of senior secured term loan to 2023 and increased the facility to $200 million.

- Subsequent to year end, on January 14, 2021, the Company entered into a definitive agreement with Bluma Wellness Inc. (CSE: BWEL.U) (OTCQX:BMWLF), a vertically integrated operator in Florida.

- On January 14, 2021, the Company announced the commencement of a best efforts overnight marketed offering (the “Offering”) of Subordinate Voting Shares of the Company. On January 15, 2021, the Company closed the Offering for total gross proceeds of approximately $125.0 million.

- On February 16, 2021, the Company closed its acquisition of four Ohio dispensaries previously operated by Verdant Creations, LLC and its affiliates.

- Lastly, on March 18, 2021, the Company entered into a definitive agreement to acquire all of the issued and outstanding equity interests in Cultivate Licensing LLC and BL Real Estate LLC, a vertically integrated Massachusetts operator.

Conference Call and Webcast

The Company will host a conference call and webcast to discuss its financial results and provide investors with key business highlights on Thursday, March 25, 2021, at 8:30am Eastern Time (7:30am Central Time). The conference call may be accessed via webcast or by dialing 1-855-979-6654 (US), 1-833-294-2546 (CA), 0800-640-6441 (UK), or 44-20-3936-2999 (Int’l) and providing conference ID 885607. Archived access to the webcast will be available for one year on the Cresco Labs’ investor relations website.

Consolidated Financial Statements

The financial information reported in this press release is based on unaudited management prepared financial statements for the year ended December 31, 2020. The Company expects to file its audited consolidated financial statements on SEDAR by March 26, 2021. Accordingly, such financial information may be subject to change. All financial information contained in this press release is qualified in its entirety with reference to such financial statements. While the Company does not expect there to be any material changes between the information contained in this press release and the consolidated financial statements it files on SEDAR, to the extent that the financial information contained in this press release is inconsistent with the information contained in the Company’s financial statements, the financial information contained in this press release shall be deemed to be modified or superseded by the Company’s filed financial statements. The making of a modifying or superseding statement shall not be deemed an admission for any purposes that the modified or superseded statement, when made, constituted a misrepresentation for purposes of applicable securities laws. Further, the reader should refer to the additional disclosures in the Company’s audited financial statements for the year ended December 31, 2019, previously filed on SEDAR.

Cresco Labs references certain non-IFRS financial measures throughout this press release, which may not be comparable to similar measures presented by other issuers. Please see the “Non-IFRS Financial Measures” section at the end of this press release for more detailed information.

Non-IFRS Financial Measures

Operational gross profit, EBITDA and Adjusted EBITDA, net of impact of biological assets, are non-IFRS measures and do not have standardized definitions under IFRS. The Company has provided these non-IFRS financial measures, which are not calculated or presented in accordance with IFRS, as supplemental information and in addition to the financial measures that are calculated and presented in accordance with IFRS and may not be comparable to similar measures presented by other issuers. These supplemental non-IFRS financial measures are presented because management has evaluated the financial results both including and excluding the adjusted items and believes that the supplemental non-IFRS financial measures presented provide additional perspective and insights when analyzing the core operating performance of the business. These supplemental non-IFRS financial measures should not be considered superior to, as a substitute for or as an alternative to, and should only be considered in conjunction with, the IFRS financial measures presented herein. Accordingly, the Company has included below reconciliations of the supplemental non-IFRS financial measures to the most directly comparable financial measures calculated and presented in accordance with IFRS.