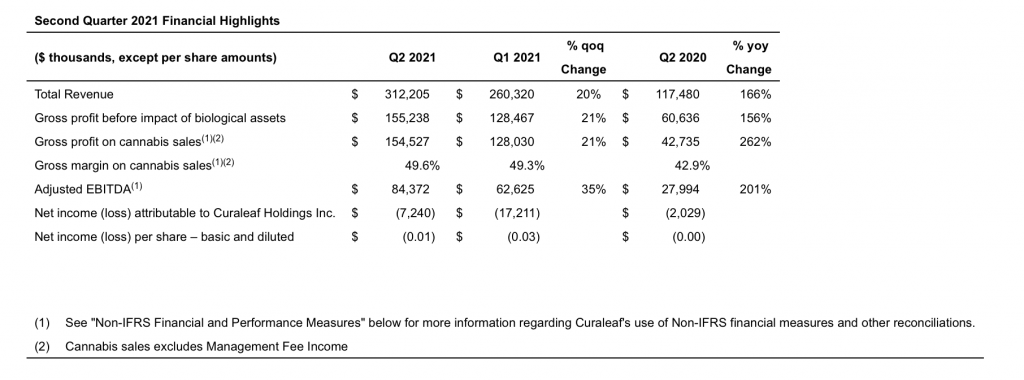

– Second quarter 2021 Revenue(1) of $312 million, up 20% sequentially and 166% YoY

– Second quarter 2021 Adjusted EBITDA margin of 28% on core U.S. operations, up 400 bps QoQ

– Second quarter 2021 Adjusted EBITDA(1) of $84 million, up 35% sequentially and 201% YoY

– Closed acquisition of EMMAC, Europe’s largest vertically integrated cannabis company

Curaleaf Holdings, Inc. (CSE: CURA) (OTCQX: CURLF) (“Curaleaf” or the “Company”), a leading international provider of consumer products in cannabis, today reported its financial and operating results for the second quarter ended June 30, 2021. All financial information is provided in U.S. dollars unless otherwise indicated.

| Earnings Call: Monday, August 9, 2021, at 5:00 P.M. ET | |

| Conference ID # is 1222509 | |

| Replay ID # is 10158196 | |

| U.S. Live Call: 1 (888) 317 6003 | U.S. Replay: 1 (877) 344 7529 |

| International Live Call (Toll): 1 (412) 317 6061 | International Replay (Toll): 1 (412) 317 0088 |

| Canadian Live Call: 1 (866) 284 3684 | Canadian Replay: 1 (855) 669 9658 |

| The teleconference will be available for replay starting at approximately 7:00 P.M. ET | |

| on August 9, 2021 and will end at 7:00 P.M. ET on August 16, 2021 |

Boris Jordan, Executive Chairman of Curaleaf commented, “July saw the introduction of the most comprehensive cannabis reform ever proposed at the Federal level. Combined with U.S. state-level liberalization and the significant investments we are making in cultivation, production and distribution, Curaleaf is creating a strong foundation for future growth. Nearer-term this includes the expansion of New York, New Jersey and Connecticut from medical to adult-use markets representing a potential new $8 billion annual addressable market opportunity. Longer-term, our acquisition of EMMAC and establishment of Curaleaf International this quarter marks our entry into Greater Europe, with a population of 750 million representing a potential market size twice that of the United States.”

Joe Bayern, Chief Executive Officer of Curaleaf stated, “Curaleaf continues to make excellent progress in terms of executing our U.S. strategy to achieve unrivaled scale and reach, and our record second quarter results reflect this. Our leading positions in cultivation and distribution are driving some of the strongest revenue growth rates in the sector, while our scale and focus on cost efficiency are delivering Adjusted EBITDA margin expansion as promised. Looking ahead, our strategic investments in innovation and technology will deliver processing advantages and consumer-focused product differentiation to fuel our growth into 2022 and the years beyond.”

Second Quarter Highlights

- Revenue reached $312 million, increasing 20% sequentially and 166% YoY.

- U.S. operations reported revenue of $307 million, 18% growth QoQ, within our guidance range.

- Gross margin reached approximately 50%, an increase of 669 basis points YoY, driven by higher yields at existing cultivation facilities and new state-of-the-art facilities coming online.

- SG&A expense reached $88 million. Excluding Curaleaf International, SG&A expense represented 26.4% of revenue, a sequential improvement of 435 basis points driven by operating efficiencies.

- Adjusted EBITDA reached $84 million, up 201% YoY, and equivalent to a margin of 27.0%. Excluding Curaleaf International, the margin expanded 400 basis points sequentially to 28.1%.

- Successfully closed the acquisition of EMMAC, Europe’s largest vertically integrated independent cannabis company, which has formed the foundation of our Curaleaf International business.

- In May, agreed to acquire Los Suenos, a 66-acre outdoor grow in Colorado.

- Brought online nearly 250 thousand square feet of flower canopy during the first half of the year, with a further 40 thousand square feet planned for the second half of 2021.

- Opened five new stores in Illinois, Pennsylvania, New Jersey, and Maine bringing total retail locations to 107.

- Launched a long-term strategic partnership with Rolling Stone to leverage our Select brand and operating experience in Nevada.

Post Second Quarter Highlights

- Opened a medical dispensary in Wells, Maine, bringing total retail dispensaries to 108 as of today.

- Launched B. Noble pre-roll brand partnership in Maryland and Massachusetts.

Financial Results for the Second Quarter Ended June 30, 2021

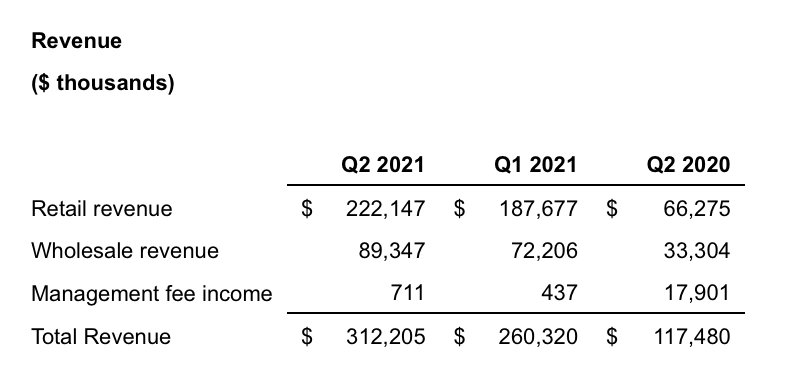

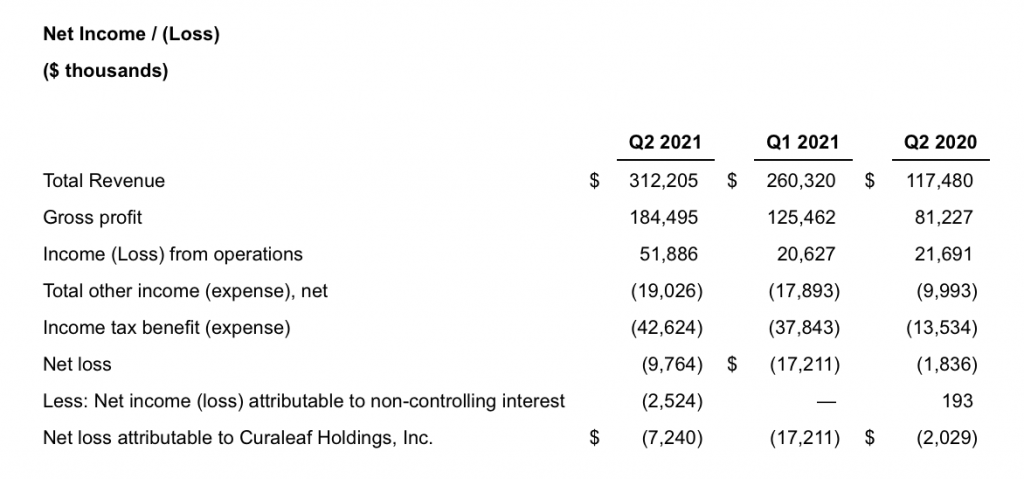

Total revenue increased by 166% year-over-year to $312 million during the second quarter of 2021, compared to $117 million in the second quarter of 2020. Excluding international operations, total revenue was $307 million.

During the second quarter we opened five new dispensaries including two in Pennsylvania, one in Illinois, a second location in New Jersey and the first adult-use store in Maine, reaching 107 dispensaries as of quarter end.

Retail revenue reached $222 million, sequential growth of 18.4% and year-over-year growth of 235%. Strong growth in our retail operation was primarily driven by new customer acquisition and an increase in repeat customers. Retail revenue represented 71% of total revenue.

Wholesale revenue grew 23.7% sequentially and 168% year-over-year to reach $89 million and represented 29% of total revenue. Strong growth in our wholesale operation was driven by the addition of new accounts and an increase in sales productivity.

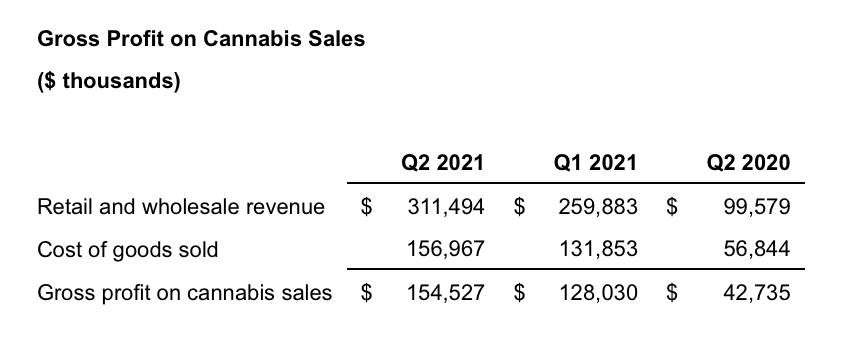

Gross profit was $155 million for the second quarter of 2021, compared to $43 million in the second quarter of 2020. Gross profit margin reached 49.6%, equivalent to a year-over-year increase of 669 basis points. The margin gain was primarily due to increased operating capacity coming online as well as efficiency gains in cultivation and processing.

For the second quarter of 2021, net loss attributable to Curaleaf Holdings, Inc. was $7 million, compared to a net loss of $17 million in the first quarter of 2021. The net result this quarter was impacted by higher stock-based compensation and one-time charges related to the acquisition of EMMAC (now Curaleaf International) as well as earnings dilution from the consolidation of EMMAC, which contributed with a net loss of approximately $8 million.

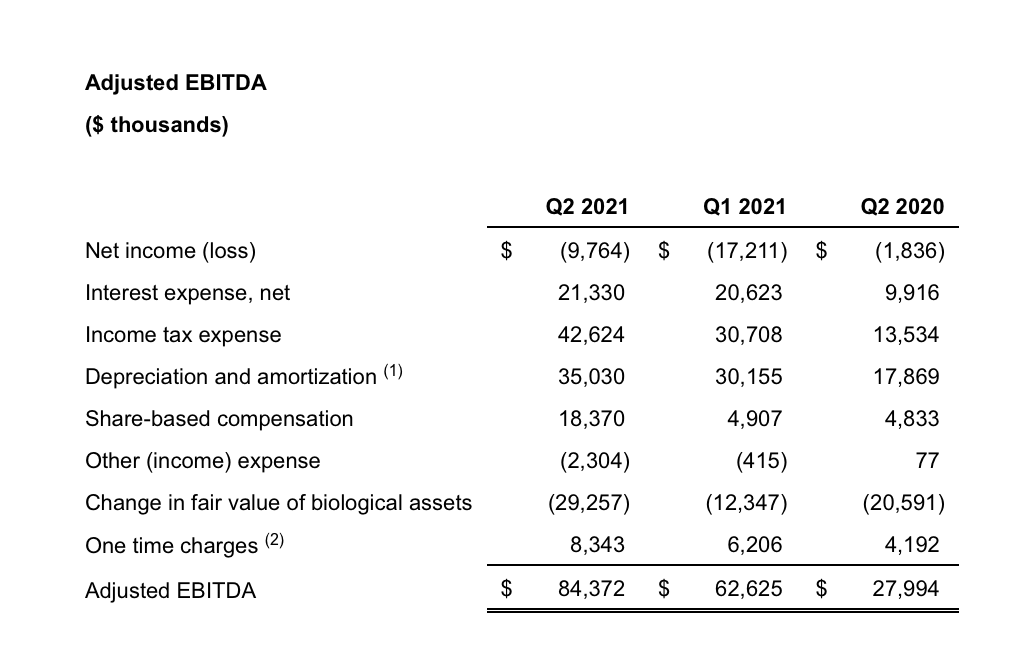

| (1) | Depreciation and amortization expense in Q2 2021, Q1 2021, and Q2 2020 include amounts charged to cost of goods sold on the statement of profits and losses. |

| (2) | One time charges in Q2 2021 include expenses related to the acquisition of EMMAC. |

Adjusted EBITDA was a record $84 million for the second quarter of 2021, compared to $28 million for the second quarter of 2020. The year-over-year increase was primarily driven by strong revenue growth and increased operating leverage. Adjusted EBITDA margin expanded 320 basis points year-over-year to reach 27.0%. Excluding Curaleaf International, the margin expanded 400 basis points sequentially and 423 basis points year-over-year to 28.1%.

Balance Sheet and Liquidity

As of June 30, 2021, the Company had $334 million of cash and $338 million of outstanding debt net of unamortized debt discounts.

Capital Expenditures

During the second quarter of 2021, Curaleaf invested $41.9 million net in capital expenditures, focused on cultivation, processing, and selective retail expansion in strategic markets.

Shares Outstanding

As of June 30, 2021 and March 31, 2021, our weighted average shares outstanding amounted to 701,668,932 and 682,041,420 shares, respectively.

As of June 30, 2021 and March 31, 2021, our issued and outstanding SVS and MVS shares amounted to 703,260,526 and 686,409,852 shares, respectively.

Non-IFRS Financial and Performance Measures

In this press release Curaleaf refers to certain non-IFRS financial measures such as “Gross Profit on Cannabis Sales” and “Adjusted EBITDA”. These measures do not have any standardized meaning prescribed by IFRS and may not be comparable to similar measures presented by other issuers. The Company defines “Gross Profit on Cannabis Sales” as retail and wholesale revenues less cost of goods sold. “Adjusted EBITDA” is defined by Curaleaf as earnings before interest, taxes, depreciation and amortization less share-based compensation expense and one-time charges related to business development, acquisition, financing and reorganization costs. Curaleaf considers these measures to be an important indicator of the financial strength and performance of our business. We believe the adjusted results presented provide relevant and useful information for investors because they clarify our actual operating performance, make it easier to compare our results with those of other companies and allow investors to review performance in the same way as our management. Since these measures are not calculated in accordance with IFRS, they should not be considered in isolation of, or as a substitute for, our reported results as indicators of our performance, and they may not be comparable to similarly named measures from other companies. The following tables provide a reconciliation of each of the non-IFRS measures to its closest IFRS measure.