DELTA 9 CANNABIS INC. (TSX: DN) (OTCQX: DLTNF) (“Delta 9” or the “Company”), is pleased to announce financial and operating results for the three-month period ending March 31, 2021.

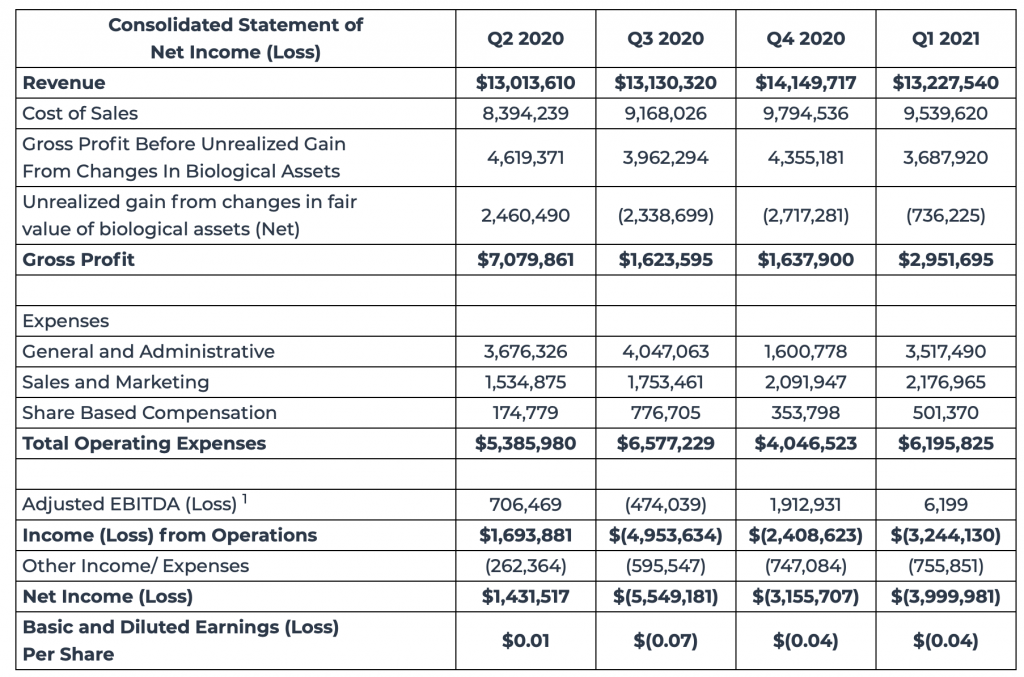

Financial Highlights for Q1, 2021:

- Net revenue of $13.2 million for the three-month period ending March 31, 2021, an increase of 12% from $11.8 million for the same quarter last year.

- Sequential net revenue decreased by 6% versus $14.1 million for the three-month period ending December 31, 2020.

- Gross profit of $3.7 million for the three-month period ending March 31, 2021, a decrease of 24% from $4.9 million for the same quarter last year.

- Sequential gross profit decreased by 16% versus $4.4 million for the three-month period ending December 31, 2020.

- Net income (loss) from operations of $(3.2) million was lower by $6.1 million from the same period last year.

- Sequential net income from operations was down 33% versus $(2.4) million for the three-month period ending December 31, 2020.

- Adjusted EBITDA was $6,199 for the three-month period ending March 31, 2021, versus an Adjusted EBITDA of $1.7 million for the three-month period ending March 31, 2020.

- Also compares with an adjusted EBITDA of $1.9 million for the three-month period ending December 31, 2020.

- The Company reported earnings per share of ($0.04) for the three-month period ending March 31, 2021.

- The Company reported a strong financial position, with working capital of $20.7 million and total assets of $75.0 million.

“Delta 9 continues to grow its three main business units by adding addition retail stores across central Canada, adding new micro cultivation partners with strategic cooperation agreements that provide for a variety of services, expanding our B2B business into the US market place and continuing to increase distribution of wholesale cannabis products across our provincial markets,” said John Arbuthnot, CEO. “In the first quarter of 2021 we have seen a degree of seasonality and industry headwinds relating to Covid lockdowns and overall weakness in the Canadian cannabis market affecting our business and impacting sequential revenue growth; however, we remain bullish that the remainder of 2021 looks to be a promising year for Delta 9.”

Q1, 2021 and subsequent Operational Highlights:

- Delta 9 announced the grand opening of three more cannabis retail stores since the beginning of 2021. Delta 9 now has 12 retail stores in total with nine in Manitoba, two in Alberta and one in Saskatchewan. The Company plans to have up to 20 Delta 9 Cannabis retail stores operating this year and has a long-term vision of opening many more Delta 9 branded retail stores across Canada. The corporate retail strategy is to offer the best selection of cannabis products at the lowest prices from the most popular cannabis manufacturers in Canada.

- Delta 9 completed its final services milestone under agreements with several micro cultivation partners: Dry Island, F1ne Cannabis Cultivation and Fourth Generation Cannabis so far this year. These micro cultivation partners entered into a strategic cooperation agreement with Delta 9 whereby Delta 9 provides services relating to the cannabis production facility design and construction, development of standard operating procedures and sanitation programs, consulting on Health Canada licensing, and other services supporting the acquisition of a Health Canada license.

- Delta 9 is a strategic partner with Oceanic Relief who has been granted a cannabis cultivation license from Health Canada for standard cannabis and processing operations. Delta 9 owns a 5% equity stake in Oceanics’ production facility operations and retail store and has a 20-year supply agreement with Oceanic and the Government of Newfoundland and Labrador.

- Delta 9 announced it began trading on the OTCQX® Best Market under the new ticker “DLTNF” effective March 16, 2021. The Company changed its symbol from “VRNDF” to align its U.S. trading symbol with its corporate name.

Summary of Quarterly Results:

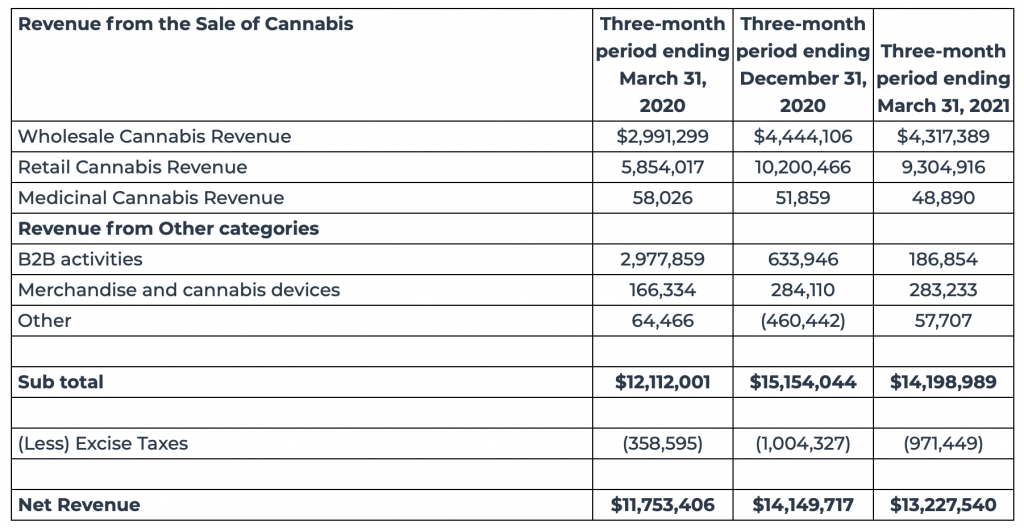

The following chart provides a breakdown of the Company’s revenue by segment:

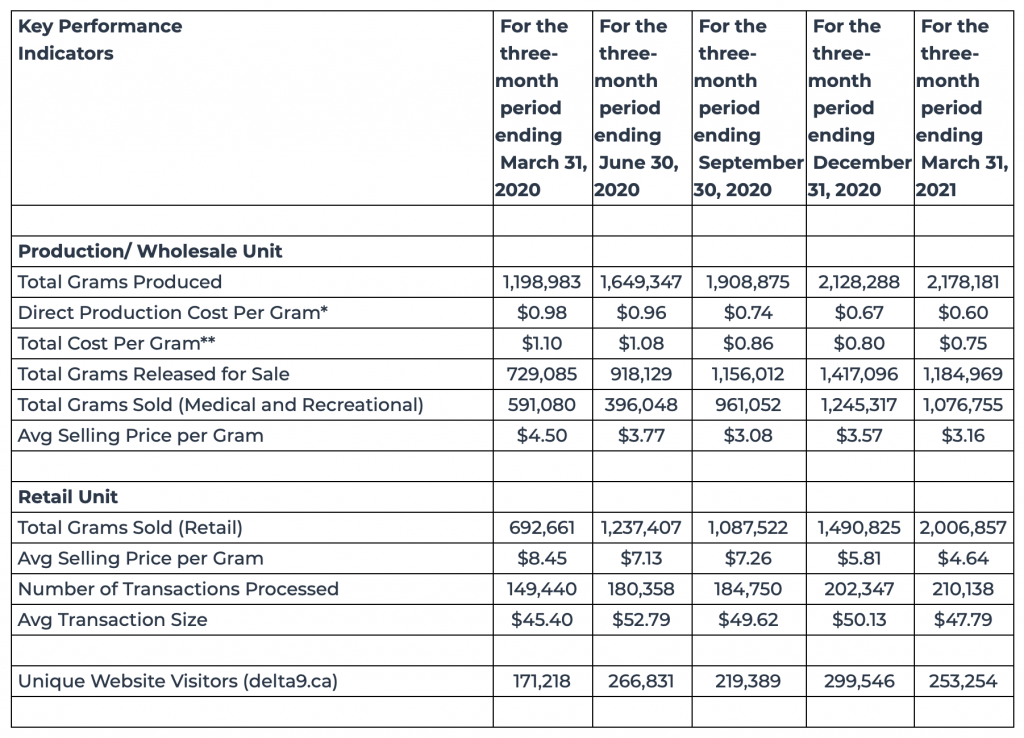

*Direct Production Cost per gram includes direct labour, nutrients, utilities, growing materials and supplies costs

**Total Cost per gram includes Direct Production Cost per gram plus processing labour, packaging, bottling, and labelling costs

A comprehensive discussion of Delta 9’s financial position and results of operations is provided in the Company’s Management Discussion & Analysis for the first quarter ended March 31, 2021 filed on SEDAR and can be found at www.sedar.com.

Q1 Results 2021 Conference Call

Delta 9 has scheduled a conference call to discuss the results for its first quarter ended March 31, 2021. The conference call will be hosted May 17, 2021 at 9:00 a.m. Eastern Time by John Arbuthnot, Chief Executive Officer, and Jim Lawson, Chief Financial Officer, followed by a question and answer period.

| Date | May 17, 2021 |

| Time | 9:00 a.m. ET |

| Dial in # | 1-888-886-7786 – Toll free North America |

| Replay information: | 1-877-674-6060 |

| Replay Password | 586812# |

Available until August 17, 2021