Greenrose Acquisition Corp. (NASDAQ: GNRSU, GNRS, GNRSW)(Greenrose), a special purpose acquisition company targeting companies in the cannabis industry, has entered into a definitive agreements to acquire four cannabis companies(The Platform). The companies are Shango Holdings Inc.(Shango), Futureworks LLC (d/b/a The Health Center), Theraplant, LLC, and True Harvest, LLC.

Prior to closing the transaction, Greenrose will be renamed The Greenrose Holding Company Inc. and is expected to transition its listing from the Nasdaq Capital Market totheOTCQX® BestMarket. Additionally, Greenrose intends to list on the NEO exchange after the close of the transaction.

GreenroseInvestment Highlights

- Establishes a Footprint in High Growth Limited License Markets. Through these acquisitions, Greenrose will establish itself in highly profitable, high-growth limited license markets such as Arizona, Nevada, and the medical market of Connecticut.

- Vertically Integrated Operations in Established Recreational Markets. In the established markets of Colorado, Oregon, and California, Greenrose will pursue a high-risk adjusted return business strategy of consolidating a group of highly fragmented, profitable markets.

- Well Capitalized and Cash Flow Positive. Upon closing, the transaction will be immediately Adjusted EBITDA and cash flow positive with ample liquidity to execute Greenrose’sstrategic growth objectives.

- Rapid GrowthProfile. The Platform’sestimated pro forma revenue and Adjusted EBITDA1 in 2020 were $83 million and $32 million, respectively, and are projected to grow to $158 million and $56 million in 2021 and $230 million and $90 million in 2022. This represents a 66% and 68% compounded annual growth rate on pro forma revenue and Adjusted EBITDA, respectively.

- Compelling M&A Pipeline. The cannabis market is enjoying strong growth, but attractively priced assets remain available due to capital constraints and companies with non-core assets. Greenrose intends to identify additional complementary companies and select premier retail assets. Through these and other opportunities, Greenrose seeks to both expand further within the state in which the Platform companies currently operate and enter new states.

- Comprehensive Management Team. Greenrose will complement the strong team of cultivation, product development, and retail managers within the Platform with its own executives, who possess significant corporate-level operational, financial, legal, and public company experience.

The companies we are bringing to market fully align with Greenrose’s core objectives,” said MickeyHarley, CEO and Director of Greenrose. “We are targeting strategic assets in several key states that present opportunities for further consolidation as we seek to deepen our presence, particularly in the West. Additionally, we are entering high growth, limited license markets, and newly recreational markets. The Platform provides significant revenue, Adjusted EBITDA, and cash flow right out of the gate, which we expect will help us drive our growth strategy.

“Across the Platform, we are targeting acquisitions with the highest quality retail alignment and superior cultivation capabilities, selling the most reputable products in their respective markets at premium prices. On a state-by-state level, we plan to build upon high growth, limited license markets like Nevada, as well as newly recreational and limited license markets like Arizona and Michigan. In emerging medical markets with recreational potential like Connecticut, where our company is generating strong cash flow, we are excited about this growth potential as the market evolves. In established but highly fragmented markets like California, Colorado, and Oregon, the goal will be to take advantage of the consolidation opportunities those markets offer, recognizing the favorable risk-reward dynamics of such markets vis-à-vis the newer, limited license markets. We also anticipate evaluating select distressed and undervalued assets.”

Paul Otto Wimer, Greenrose President, commented: “Our collective executive management team has extensive M&A experience and has multi-decade experience in business leadership, operational management, and corporate finance. We expect the potential pipeline of longer-term opportunities to expand now that recreational legalization has become more widespread following the 2020 election. As we develop and expand our Platform, we plan to leverage the experience of our combined management team and our scale to accelerate growth.”

Transaction Terms & Financing

Under the terms of the agreement, Greenrose will acquire the Platform for approximately $210 million, consisting of approximately $170 million in cash, $15 million in stock, and $25 million in debt, representing an attractive 2021 revenue and Adjusted EBITDA multiple of 1.3x and 3.8x, respectively. In addition, a maximum of $110 million in earnouts could be paid out through 2024, consisting of $75 million in stock and $35 million in debt.

Greenrose intends to commence an offering (the “Offering”) of $150 million in equity and debt securities in a private offering and to use the net proceeds of such offering for the acquisition of the Platform and general corporate purposes. The interest rate and maturity of any debt securities and the terms of any equity offered will be determined at the time of sale. The Offering will be made only to persons reasonably believed to be accredited or otherwise qualified investors under the Securities Act of 1933, as amended (the “Securities Act”). Any securities sold by Greenrose in the Offering are not expected to be registered under the Securities Act and may not be resold absent registration or unless an exemption from such registration is available. This disclosure is made pursuant to Rule 135c of the Securities Act, and does not constitute an offer to sell securities in the Offering, nor a solicitation for an offer to buy securities in the Offering.

Assuming no redemptions by Greenrose’s public stockholders in connection with the acquisitions, the combined company, post-business combination, and post-proposed Offering, will have an estimated $140 million in cash with $75 million in debt. Cash available is anticipated to consist of Greenrose’s approximately $173 million of cash in trust (before any redemptions) and an additional $150 million in gross proceeds from the Offering. In connection with the Offering, Greenrose has received a non-binding term sheet for $80 million, consisting of $40 million debt and $40 million equity.

The net proceeds raised from the transaction will primarily be used to support working capital and fund expansion through additional acquisitions. Giving effect to the anticipated acquisition of the Platform, Greenroseis expected to generate revenue and Adjusted EBITDA of approximately $158 million and $56 million, respectively, in 2021, exclusive of additional M&A activity that Greenrose may undertake.

The board of directorsof Greenroseand the governing bodies of each of the Platformcompanies have unanimously approved the proposed transactions,and they areexpected to close in the second or third quarter of 2021, subject to regulatory and stockholder/equity holderapprovals, as well asother customary closing conditions.

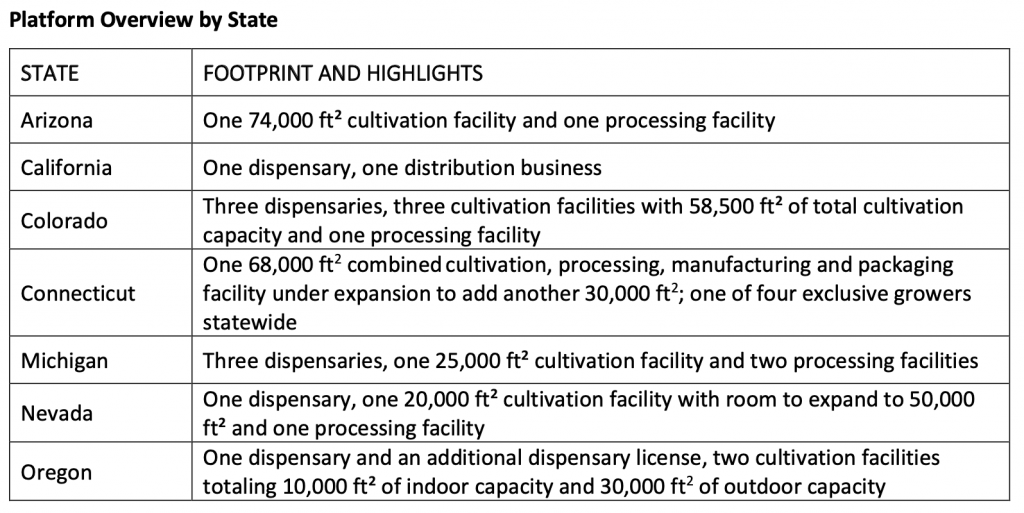

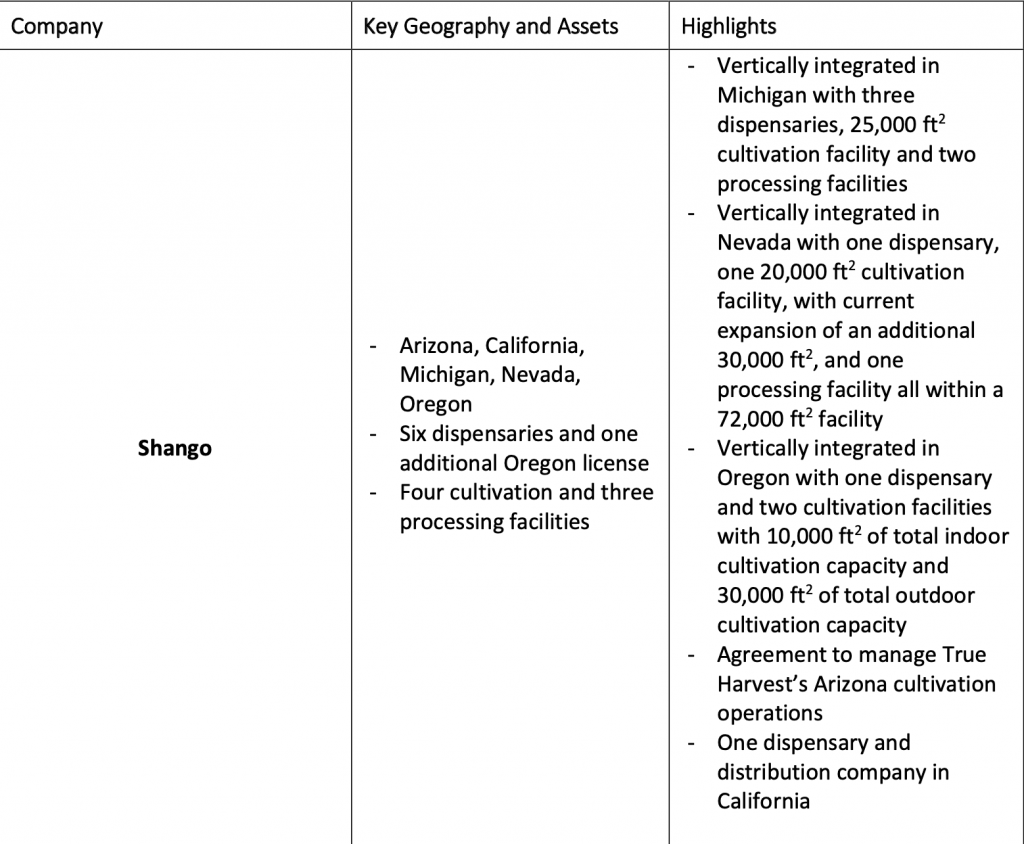

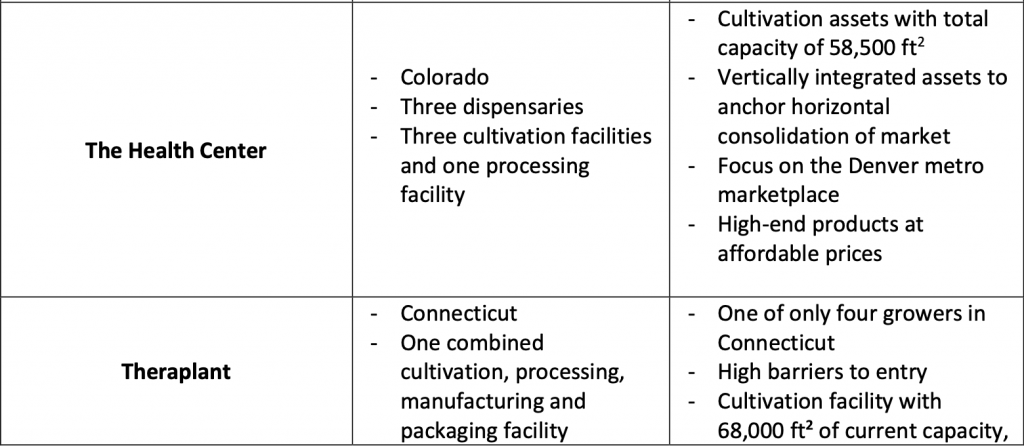

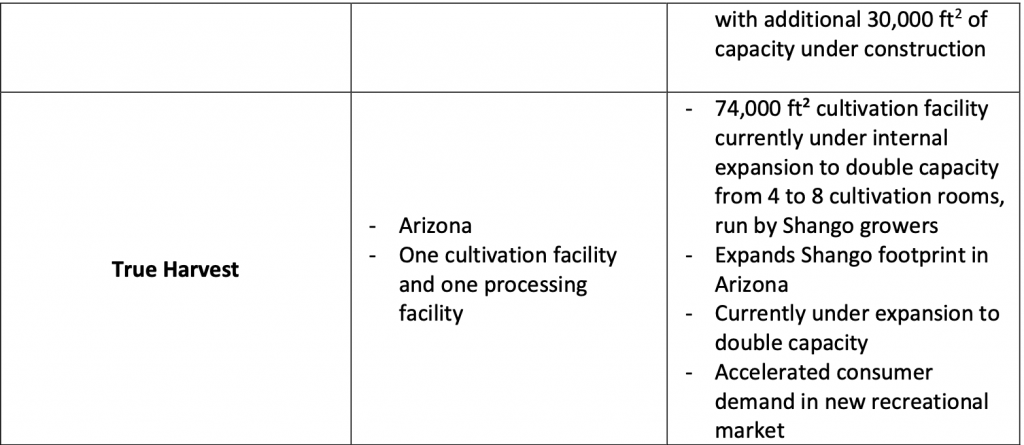

The tables below provide a synopsis of the assets, offerings and geographic footprint of each of the Platform companies.

Advisors

Imperial Capital, LLC is acting as capital markets advisor to Greenrose. Tarter Krinsky & Drogin LLP is acting as legal advisor to Greenrose. Gateway Group is serving as communications advisor to Greenrose.

Webinar

Greenrosehas made available a video webinar to discuss the proposed transaction. To watch the video, click here and use the password: GNRS2021!

The presentation accompanying the webinar can also be accessed via Greenrose’s website at: greenrosecorp.com.

About Greenrose

Greenrose Acquisition Corp. is a blank check company organized for the purpose of effecting a merger, share exchange, asset acquisition, stock purchase, recapitalization, reorganization, or other similar business combination with one or more businesses or entities. Following the transactions forming the Platform, Greenrose will be a vertically integrated, multistate operator cannabis company. For more information, visit greenrosecorp.com.

About Shango

Shango is an established vertically integrated cannabis brand offering a full range of award-winning products, including flower, extracts, and cannabis-infused edibles, in California, Oregon, Michigan, and Nevada, with additional cultivation and distribution operations in Arizona and California, respectively. The Shango brand has multiple full-service recreational and medical cannabis dispensaries in Oregon and Nevada, as well as a medical cannabis provisioning center in Michigan. A recognized leader in the cannabis industry, Shango sets the standards for product quality, consistency, and business conduct. Shango is committed to cannabis education and is a fierce advocate of the safe and responsible use of cannabis products. For more information, go to www.goshango.com.

About The Health Center

The Health Center is a vertically integrated cannabis company operating in the Colorado market. Boasting upwards of 40 varieties of award-winning strains at any given time, the THC team prides itself on offering the best variety, potency, and effectiveness of any cannabis in the region. In addition to their cultivation business, THC operates as a manufacturer of infused products through“MIPs” operations and three retail stores. For more information, please visit www.thchealth.com.

About Theraplant

Locally owned and operated, Theraplant was Connecticut’s first state-licensed medical marijuana producer and in October 2014becamethe first producer to distribute medical cannabis in the Connecticut market. Theraplantdesignspremium cannabis genetics to offer a wide variety of compositions to meet the needs of the state’s medical cannabis cardholders for all approved treatment conditions. Theraplant continually leads the market in making quality medical cannabis affordable to the greatest range of patients. For more information, visit www.theraplant.com.

About True Harvest

True Harvest is a premium craft cannabis producer operating one of the largest indoor cannabis facilities in Arizona. True Harvest is passionate about growing the finest cannabis and preserving the health and well-being of its medical patients, employees, and community. The True Harvest team takes personal pride in delivering meticulous plant care and exceptional cannabis experiences, with cultivation operations based in Arizona.