- 4Q Combined Revenue of $5.1 million, an increase of 88% YoY despite Winberry revenue not being recognized

- Record 4Q Combined Adjusted EBITDA, up $7.3 million from the previous year despite carrying some Winberry costs

- 4Q Gross Profit up $2.3 million YoY; Ended year with higher consolidated gross margin of 20%, up from 11% in 2019

- Shrank loss on biological assets to a mere 15% of total revenue down from 51% loss in 2019

- Corporate overheads were reduced YoY by $0.35 million to $3.1 million in Q4 2020

- Closed 13 M&A transactions in 2020, only one of which contributed to material consolidated revenues in 2020; however, many of the remaining are forecasted to contribute significantly in 2021, which should result in write ups of 2020 impairments

- Ended the year with $3.7 million cash on hand; currently over $10.5 million of cash with and an untapped credit line of C$15 million

- 2021 guidance higher than any previously reported consolidated revenues

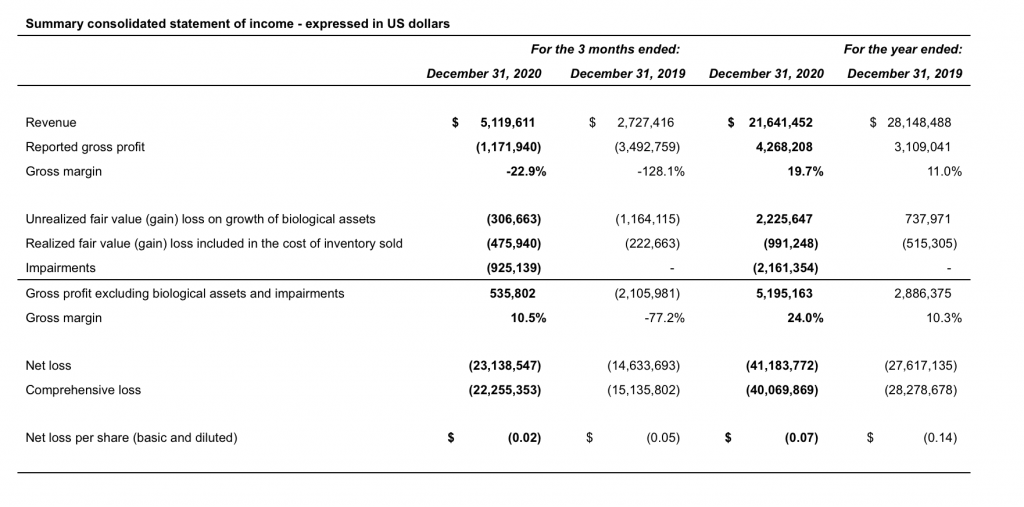

TORONTO, April 1, 2021 /CNW/ – Halo Collective Inc. (“Halo” or the “Company“) (NEO: HALO), (OTCQX: HCANF), (Germany: A9KN) today announced its financial and operational results for three and twelve months ending December 31, 2020. The Company reported revenues of $21.6 million for the year ended December 31, 2020, a 23% decrease in comparison with the previous year. Profitability, however, was up overall. Adjusted gross profit, excluding fair value gains in biological assets, impairment of inventory and non-reoccurring costs due to market circumstances, was $5.2 million (compared to $2.9 million in 2019). The adjusted gross margin in 2020 was 24% in comparison with 10% in 2019. Complete results are reported in the Company’s consolidated financial statements for the year ended December 31, 2020 (the “Consolidated Financial Statements”) and associated management discussion and analysis (the “MD&A“).

CEO and Co-Founder Kiran Sidhu commented “In 2020 we focused on strengthening our product mix, pruning superfluous and/or declining manufacturing lines and expanding our flower products and availability in Oregon and California. We identified a strong acquisition target in Herban Industries OR and their brand Winberry Farms. In 2021, Halo expects this will significantly enhance our financial performance when we begin consolidating this revenue. In 2020, we carried some of their expenses yet consolidated no revenue or margin contribution. . We believe there is room to improve our pricing with the addition of higher end cartridges, pre-rolls and edibles to our lineup, as well as improved potency levels across all product lines thanks to our recently acquired patent pending technology. In 2020 Halo sold more grams than any other year and achieved a higher gross margin, but we must maintain and increase topline growth even in the face of market changes. We are excited to present our guidance and strategic initiatives, as well as to deliver on this guidance by executing in 2021.”

Philip Van Den Berg, CFO and Co-Founder continued, “2020 demonstrated Halo’s capability to perform on financial metrics, demonstrating the strength of our growth strategy and the potential of our expansive market portfolio. We reduced losses across the board by improving gross margin via cost of goods sold and diminishing losses on biological assets. We slashed overhead expenses and sold more grams than in previous years. While pricing compression was experienced, we expect a 180 degree about face with a 2021 outlook. In 2021, we also expect to write up several of our assets impaired in 2021 as they come online and begin operating. Our balance sheet remains strong.”

As at December 31, 2020, the Company had unrestricted cash available in the amount of $2.8 million and working capital in the amount of $18.7 million Cash used in operations in the three months ended December 31, 2020 was $6.7 million, cash used for investing was $2.5 million and cash raised from finance activities was $9.2 million. Total cash inflow was $0.1 million.

RESULTS

Three Months Ended

Revenues in the three months ended December 31, 2020 were $5.1 million , an 88% increase compared to $2.7 million in the three months ended December 31, 2019. Total sales were 2,912,963 grams (three months ended December 31, 2019: 903,907 grams), a 222.3% increase. The average mix price was $1.86 (three months ended December 31, 2019: $3.02 per gram), a 38.2% decline, explained by sales of lower priced flower ($1.35 per gram), pre-rolls ($1.78 per gram), trim ($0.15per gram) and fresh frozen ($0.09 per gram), which were 76% of total sales. This was a better-than-expected result as the fourth quarter of calendar year in Oregon is seasonally the lowest quarter.

The Company’s subsidiaries ANM Inc. (“ANM”) and Mendo Distribution and Transportation LLC (“MDT”) reported strong performances in the period under review. ANM reported revenues of $4.1 million, a 117% increase. MDT reported revenues of $1.4 million MDT’s results were not included in the three months ended December 31, 2019.

In the three months ended December 31, 2020, the Company reported a gross loss of $1.2 million (three months ended December 31, 2019: gross loss $3.5 million). Adjusted for impairments in the amount of $0.9 million and the loss on biological assets of $0.8 million , gross profits were $0.5 million (three months ended December 31, 2019: loss $0.3 million). The adjusted gross margin was positive in 2020 at 11.5% (three months ended December 31, 2019: (77.2%)).

The loss before interest, tax, depreciation & amortization (“EBITDA”) was ($8.8 million) (three months ended December 31, 2019: loss ($13.8 million)). Operating expenses decreased to $7.6 million (three months ended December 31, 2019: $10.3 million). Adjusted for non-cash items in cost of goods sold and overheads, EBITDA was a loss of ($3.7 million) for the three months ended December 31, 2020.

Twelve Months Ended

Revenue

Revenues for the year ended December 31, 2020 were $21.6 million , a 23% decline in comparison with $28.1 million in the year ended December 31, 2019. Total sales were 6,760,873 grams (year ended December 31, 2019: 3,915,541 grams), a 72.7% increase. The average mix-price was $3.20 per gram, a 55.5% decline in comparison with $7.19 per gram in the year ended December 31, 2019. Flower and pre-roll sales were 16% of total sales revenue at an average price of $1.17 in the year ended December 31, 2020. This compares with 11% of sales at an average price of $1.09 per gram in 2019. Overall, the volume product mix was 40% flower and pre-rolls, 16% cartridge oil, 5% live resin, 9% edibles, and 12% other concentrates compared to the product mix in 2019, which was 13% flower and pre-rolls, 47% cartridge oil, 13% live resin, 8% edibles, and 20% other concentrates.

- ANM

In the year ended December 31, 2020, ANM, which operates the Company’s facility in Oregon, sold about 4.7 million grams of shatter, cartridge oil, live resin, tinctures and gummies and pre-rolls, a 125% increase in comparison with over 2.1 million grams sold in the year ended December 31, 2019. The average achieved mix-price across all products was $3.41 per gram equivalent (year ended December 31, 2019: $5.19 per gram). In particular, cartridge oil and live resin were 15% of total grams sold at an average price of $9.22 per gram. The increase in sales of flower and price compression in cartridges decreased ANM’s revenue overall. - Coastal Harvest

In the year ended December 31, 2020, the Company’s subsidiary Coastal Harvest LLC (“Coastal Harvest”), which operates the Company’s facility in Cathedral City, California, sold 206k grams of bulk distillate (year ended December 31, 2019: 1.7 million grams). In the year ended December 31, 2020 sales were generated only in the third quarter compared with sales in each of four quarters in 2019. The achieved price for distillate was $3.49 (year ended December 31, 2019: $8.78 per gram). While not affecting the business globally, the price compression in bulk distillate curtailed a revenue stream the Company relied on significantly in California the prior year. - MDT

In the year ended December 31, 2020, the Company’s subsidiary MDT, which operates the Company’s facility in Ukiah, California sold 1.8 million grams of distillate, live resin, gummies, trim, fresh frozen and pre-rolls (year ended December 31, 2019: Nil) at an average price of $3.12 (year ended December 31, 2019: NA). Live resin sales were discontinued in the fourth quarter of 2020. Sales of gummies, fresh frozen, trim and pre-rolls started in the fourth quarter 2020. New sales in the fourth quarter of 2020, achieved a lower average price of $1.39 due to trim sales at $0.15 per gram and fresh frozen at $0.09 per gram.

Gross Profit

Gross profits for the Company were $4.3 million in the year ended December 31, 2020 (year ended December 31, 2019: $3.1 million). The gross margin was 20% (year ended December 31, 2019: 11.0%). The year ended December 31, 2020, included $2.2 million in inventory impairments included in COGS (year ended December 31, 2019: Nil) There was a gain of $1.2 million in the value of biological assets in the year ended December 31, 2020 (year ended December 31, 2019: $0.2 million).

Adjusted for the gain in the value of biological assets and impairments, gross profit was $5.2 million (year ended December 31, 2019: $2.9 million). The adjusted gross margin was 24% (year ended December 31, 2019: 10.3%).

In the year ended December 31, 2020, cash used in operating activities was $10.0 million (year ended December 31, 2019: $14.7 million). Cash generated from financing activities was $10.0 million (year ended December 31, 2019: $21.9 million). The cash flow from financing activities was comprised of net proceeds from issuance of the Company’s common shares in the amount of $7.9 million (year ended December 31, 2019: $24.1 million). In addition, there was an increase in loans in the amount of $3.5 million (year ended December 31, 2019: Nil). Furthermore, there were lease payments of $0.85 million (year ended December 31, 2019; $718k). An amount of $0.15 million was paid as share issuance costs (year ended December 31, 2019: $1.5 million). In the year ended December 31, 2020, cash used for investing activities was $2.7 million(year ended December 31, 2019: $1.9 million).

Corporate M&A Activity

In the year ended December 31, 2020, the Company closed fourteen mergers or acquisitions. For details, please refer to Note 14 in the Consolidated Financial Statements, which are available on SEDAR. Acquisitions included four cultivation companies; Bophelo Bioscience & Wellness (Pty) Ltd. (“Bophelo”) in Lesotho; Ukiah Ventures Inc. (“Ukiah”); Bar X Ranch in Lake County through the Company’s 50% share in Lake County Natural Health LLC; and Herban Industries OR LLC (“Winberry”). With Winberry, the Company purchased secured debt owed to Evolution Trustees Limited. On January 16, 2020, Halo Winberry Holdings, LLC, a wholly owned subsidiary of the Company, received conditional approval from the Oregon Liquor Control Commission (“OLCC”) to complete the Company’s proposed purchase of certain assets of Winberry as previously disclosed.

The Company acquired Outer Galactic Chocolates, LLC (“OGC”), holder of a Type N manufacturing license in Mendocino County.

The Company acquired a retail operation and its associated management company in LKJ11 LLC in North Hollywood and its management, Crimson & Black LLC.

The Company also acquired a 25% investment in Feel Better, LLC, doing business as FlowerShop, a wellness brand partnering with a multi-platinum selling artist.

The Company acquired two wholesale distributors; MDT in Ukiah, California, and Canmart Ltd. in the United Kingdom.

During the year ended December 31, 2020, the Company acquired four ancillary businesses, including software, hardware devices and process technology assets. Including two operations that were acquired in 2019, the Company currently has a technology portfolio comprising six operations that are not exposed to 280E taxation. As announced on March 31, 2021 six technology companies will be spun off in a new entity and distributed to investors. The new entity, Halo Tek, Inc., is expected to be listed on a recognized North American stock exchange in the next six months.

2021 OUTLOOK

Three months ending March 31, 2021

On January 16, 2020, Halo Winberry, completed the purchase of certain assets of Herban OR. This enhanced Halo Collective’s revenues for the three months ending March 31, 2021. Total revenues for the three months ending March 31, 2021, are projected at approximately $9 million.

Year ending December 31, 2021

Management projects revenues of $75 million for the year ending December 31, 2021. Gross profits are projected at $27 million with a gross margin of 35%. EBITDA is projected at a loss of $1 million for the year ending December 31, 2021. Management projects positive EBITDA in the three months ending December 31, 2021. This guidance for the year ending December 31, 2021 includes the following milestones:

- Closing the acquisition of three operating stores in Alberta, Canada from High Tide Inc. in April 2021;

- Launch of Flowershop product and stores in California in May 2021;

- Opening the North Hollywood store in June 2021;

- Opening the two additional LA stores in West Hollywood and Westwood that were acquired on February 6, 2021, in June 2021;

- Revenues from harvesting at Bophelo in Lesotho, South Africa;

- Revenues from the acquisition of Nature’s Best Resources, LLC which the Company signed an agreement to acquire on March 26, 2021;

- Revenue contribution from Coastal Harvest, which was not in operation for most of 2020;

- Acceleration of MDT’s revenues following a new distribution and sales agreement with NMC Organization Inc, dba Greenstone Distribution (“Greenstone”); and,

- Closing down the joint venture with Just Quality LLC in Nevada to reduce operating expenses.

A more in-depth discussion of the strategic business unit (“SBU”) strategic approach to support the guidance follows below.

SBU Discussion

California

Hush™ branded products in California have seen increased sales velocity and growth as a result of the Company’s new relationship with Greenstone Distribution (“Greenstone, a distributor based out of Southern California with a statewide footprint. In March 2021, the Company shifted away from an in-house direct sales force to a contracted distributor and sales force which is intended to both increase revenues and decrease cost. Greenstone Distribution sales of Hush™ branded products to dispensaries in a partial month (March) are estimated to be $518k and for a full month are pacing towards $765k. In addition to wholesale sales via Greenstone, the Company supplies white label products directly from Mendocino Transportation and Distribution (“MDT”) in Mendocino County and are estimated to be approximately $240kin March 2021. All three revenue streams are on an upward trajectory when compared to January 2021.

The Company has recently reduced fixed costs in California by $18,000 per month and expects over $400k of cost savings in the remainder of 2021 so far. The Company has achieved these reductions while increasing sales, by eliminating its direct sales force and leveraging Greenstone’s as well as by streamlining operations in Cathedral City.

In addition, the Company has acquired a six-acre site with a 30,000 square foot structure in Mendocino County , i.e. UVI, which is currently in the design phase for a 500-light, flowering indoor canopy partnered with Terp Hogz, dba Zkittlez, in an initial buildout. The three dispensary licenses in Los Angeles are expected to be entitled by the City of Los Angelesin the 2nd quarter of 2021.

While not reflected in the guidance, the Company also notes that the 50% owned parcel in Lake County has applied for local and state entitlements under Bar X. The Company owns 44% of the Bar X parent company, Triangle Canna Corp. This operation plans to grow one harvest of full-term plants in Q3 2021 once the licenses are approved. This represents potential upside to the guidance previously discussed.

Oregon

Hush™ and Winberry Farms branded products in Oregon have seen increased sales velocity and growth as a result of the Company’s combined in-house sales forces. In January 2021, the Company moved CRO Dustin Jessup and VP of Sales & Marketing Colby Huling into leadership roles and under their management the Company has both increased revenues and decreased costs. With the ability to add more variety to the menus of both teams, and a focus on flower, the combined sales of Hush™ and Winberry Farms sales teams to dispensaries in March are estimated to be $2.9 million. When compared to Q1 2020, the synergies are even more evident with total combined sales growing from $6.5 million in 2020 to $8.2 million in 2021, a 26% increase year over year on a similar basis.

The acquisition of Herban Industries OR, LLC bring more than just the Winberry brand to the table. In addition to Winberry Farms products, the company distributes and sells several other category leading brands which complement the portfolio of owned brands and expand the reach of the distribution operation to serve more than 80% of all dispensaries statewide.

With expanded product selection, differentiation in value proposition for cartridge and live resin offerings, and consistent availability, combined sales for Oregon are expected to exceed $36.2 million in 2021.

Distribution costs are expected to shrink now that Eugene has been designated a hub, third party storage and delivery was reduced, and excess staff were cut. Total impact was a cost savings of approximately $30,000 per month. Further cost reduction will be achieved by migrating production of existing outsourced production in house which will reduce costs by 51%. In addition, the Company expects to realize additional efficiencies and cost savings with the implementation of a new cartridge filling machine, which will reduce labor costs by 67%, and a new automated pre-roll machine with the capacity to manufacture 120,000 pre-rolls per week.

Other potential opportunities to grow margin include sales of higher priced SKU’s such as Nature’s Best rosin which retails for $52 per gram on average in Oregon.

Evans Creek Farms has implemented changes to their cultivation approach to improve the quality of their flower. They will be utilizing new industry techniques that have been known to increase the yield of the crops and improve the quality of the flower the crops they produce. Halo has invested in cutting edge watering systems and fertigation systems to deliver high quality organic nutrients to the crop. The Company is adjusting its style of planting to provide more space between plants to create less shading on the flower canopy thus giving all the flower more light which will result in increased yields and more resin development on the flower. It is expected that in 2021 the crop will produce higher quality flower which will increase the value and sales of all the flower produced on the farms. In addition, over the 4 years of operations, the Company has learned to be more efficient which will result in reduced labor costs at harvest time thus increasing overall profitability.

International

Bophelo

Due to the Covid pandemic the lock down negatively affected operations in Lesotho. Bophelo was unable to obtain its Good Agricultural and Collection Practices (“GACP”) certification in 2020 in order to sell its harvested materials. In addition, progress on completing the build out of its Phase 1 cultivation slowed as materials could not ship in and out of the country and travel was halted. Recently, Bophelo completed its first sale of flower to another local cannabis licensee and this is expected to open up other opportunities in 2021. The license-to-license market in Africa is estimated to be $7.1 billion USD by 20231. The Company is in the process of forecasting potential sales and expects to provide direction in Q2. At minimum the Company expects an additional $1 million topline revenue could be added to 2021 year end results.

| _________________ |

| 1Source: Grandview Market Research |

Alberta Dispensaries

Halo’s previously announced proposed acquisition from High Tide Inc. of three licensed cannabis retailers in the province of Alberta, Canada is expected to be approved by the Alberta Liquor and Gaming Commission and completed in April 2021. Upon closing, Halo will assume ownership of retail stores in Camrose, Morinville, and Medicine Hat, Alberta and which are expected to generate $3.3 million in topline revenue in 2021.

Other Improvements

Cost Reductions – 2020 already saw significant reductions in OPEX including G&A (down 22% from 2019); Professional (down 26% from 2019); loss on settlements and contingencies (down 75%), and IR/PR (down 45% from 2019). The Company believes further improvements can be made on G&A and Professional in 2021. In particular several corporate staff roles as well as implementation of a legal billing system when implemented will lead to $1 million annual savings alone.

Non-IFRS Financial Measures

EBITDA is a non-IFRS financial measure that the Company uses to assess its operating performance and does not have any standardized meaning prescribed by IFRS. EBITDA is defined as net earnings (loss) before net finance costs, income tax expense (benefit) and depreciation and amortization expense. EBITDA is provided to assist management and investors in determining the Company’s operating performance. The Company also believes that securities analysts, investors and other interested parties frequently use this non-IFRS measure in the evaluation of companies, many of which present similar metrics when reporting their results. As other companies may calculate this non-IFRS measure differently than the Company, this metric may not be comparable to similarly titled measures reported by other companies. For a reconciliation of EBITDA please refer to “Non-IFRS Measures” in the MD&A.