High Tide Inc. (“High Tide” or the “Company”) (TSXV: HITI) (OTCQB: HITIF) (FRA:2LY), a retail-focused cannabis corporation enhanced by the manufacturing and distribution of consumption accessories, filed its financial results for the first fiscal quarter of 2021 ending January 31, 2021, the highlights of which are included in this news release. The full set of Condensed Interim Consolidated Financial Statements and Management’s Discussion and Analysis can be viewed by visiting High Tide’s website at www.hightideinc.com, its profile page on SEDAR at www.sedar.com.

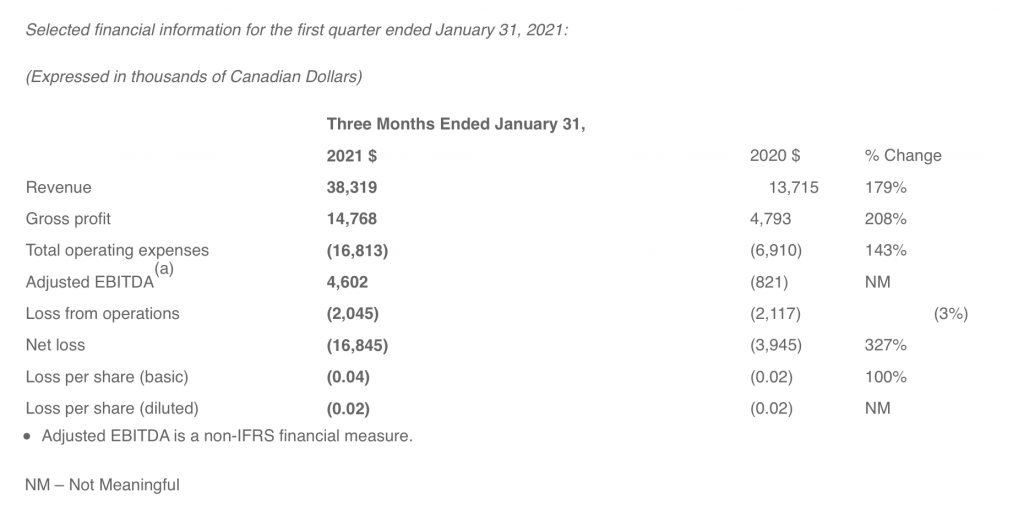

First Quarter 2021 – Financial Highlights:

- Revenue increased by 179% to $38.3 million in the first quarter of 2021 compared to $13.7 million in the same quarter last year. The first quarter of 2021 financial results incorporate the acquisition of META Growth Corp. on November 18, 2020.

- Gross profit increased by 208% to $14.8 million in the first quarter of 2021 compared to $4.8 million in the same quarter last year.

- Gross profit margin in the first quarter of 2021 was 39% compared to 35% in the same quarter last year.

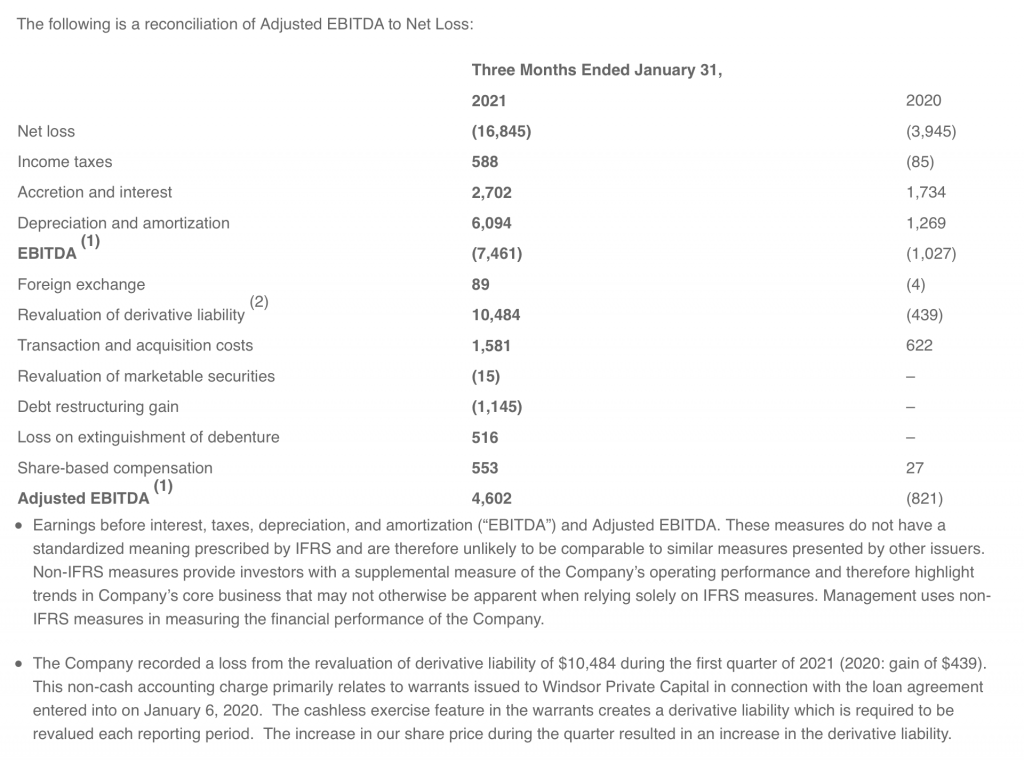

- Adjusted EBITDA(1) for the first quarter of 2021 was $4.6 million compared to negative $0.8 million for same quarter last year.

- Geographically in the first quarter of 2021, $34.2 million of revenue was earned in Canada, $3.9 million in the United States and $0.2 million internationally.

- Segment-wise in the first quarter of 2021, $36.8 million of revenue was generated by Retail, $1.5 million by Wholesale, and an immaterial amount by Corporate.

- Cash on hand as at January 31, 2021 totaled $16.6 million compared to $7.5 million as at October 31, 2020. The Company’s cash balance has subsequently increased to approximately $33 million as of today.

Fiscal First Quarter 2021 – Operational Highlights:

- The Company completed the acquisition of META Growth Crop. and became the leading Canadian cannabis retailer by annualized revenue.

- The Company’s common shares moved up to the TSX Venture Exchange.

- The Company extended the maturity date on a $10.0 million credit facility with Windsor Capital to December 31, 2021 with a subsequent one-year extension to December 31, 2022 and a reduction of interest rate from 11.5% to 10.0%.

- The Company entered into a loan agreement for $6.75 million maturing on December 31, 2024 of an undrawn balance on a $20.0 million credit facility obtained through the acquisition of META Growth Corp. Additionally, the Company extended maturity of META’s existing debt to December 31, 2024 and a reduction of all-inclusive interest rate from 12.5% to 10.0%. As of the date of this press release, the $6.75 million facility remains undrawn.

- Approximately $7.4 million of debt converted into the Company’s common shares.

- The Company opened three cannabis retail locations under the Canna Cabana and META banners: one in Guelph, Ontario, one in Toronto, Ontario, and one in Calgary, Alberta.

Subsequent Events:

- The Company closed an oversubscribed bought deal equity financing for gross proceeds of $23 million.

- After the first quarter of 2021, approximately $23 million of debt converted into the Company’s common shares.

- The Company announced filing of Form 40-F with the U.S. Securities and Exchange Commission fulfilling a significant milestone for the NASDAQ listing.

- The Company completed the acquisition of Smoke Cartel, Inc. (OTCQB: SMKC) for US$8.0 million.

- Between February 1, 2021 and the date of this press release, the Company opened nine cannabis retail locations: seven in Alberta and two in Ontario.

- Through the COVID-19 pandemic, all retail branded locations have remained operational, despite the complex conditions facing the retail industry across Canada. The Company has been nimble and adapted to frequently changing regulations – often at a municipal level – including launching delivery services to continue serving customers.

Outlook

With the transaction of META having closed, the Company has solidified its leadership position in Canada. High Tide remains focused on the Ontario market. While pandemic restrictions caused a delay in construction in much of the province, the Company is encouraged by the Alcohol and Gaming Commission of Ontario’s decision on February 16, 2021 to increase the pace of Retail Store Authorizations it issues from 20 to 30 a week. The Company expects to reach 30 open stores in the province by September 30, 2021, the date on which the cap for any one retailer can own is set to increase from 30 to 75.

While competition is increasing in the Alberta cannabis market, the Company has still been able to find pockets of areas where it believes it can profitably open new stores. With the slowdown in construction in Ontario, the Company has increased the pace of buildouts in Alberta and expects more locations to open in the province next month.

The Company has been actively following developments in the U.S. cannabis sector, and while it appears that further liberalisation regarding the federal regulatory and legislative environment is possible, our immediate strategy does not rely on regulatory change. Despite this, we remain just one transaction away from entering the bricks and mortar retail market in the U.S. when federally permissible. High Tide believes it is very well positioned to take advantage of the growing ancillary and hemp derived CBD markets and estimates its current revenue run rate in the U.S., pro forma for the Smoke Cartel acquisition, to be over $25 million today. The Company is in discussions with various parties across the federally permissible ecosystem in the U.S. which could help further expand its operations – and believes that its current financial health and application to list its shares on the Nasdaq may help accelerate its growth.