iAnthus Capital Holdings, Inc. (“iAnthus” or the “Company”) (CSE: IAN) (OTC: ITHUF), which owns, operates, and partners with regulated cannabis operations across the United States, today reported its financial results for the three months ended March 31, 2021. The Company’s Quarterly Report on Form 10-Q, which includes its unaudited interim condensed consolidated financial statements for the three months ended March 31, 2021 and the related management’s discussion and analysis of financial condition and results of operations, can be accessed on the Securities and Exchange Commission’s (“SEC”) website at www.sec.gov, the Company’s SEDAR profile at www.sedar.com, and on the Company’s website at www.iAnthus.com. The Company became a U.S. reporting company effective February 5, 2021. As such, the Company’s financial statements are reported in accordance with U.S. Generally Accepted Accounting Principles (GAAP). All currency is expressed in U.S. dollars.

First Quarter 2021 Financial Highlights

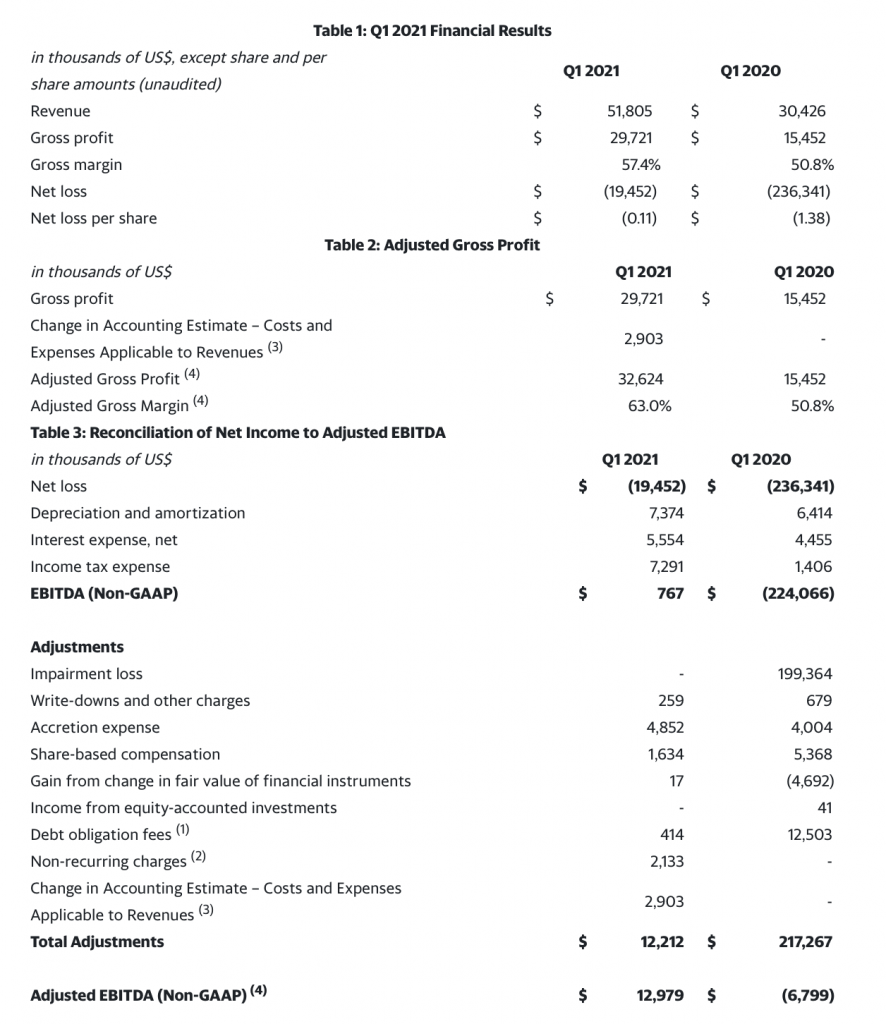

- Revenue of $51.8 million, up 70% from the same quarter in the prior year.

- Adjusted Gross Profit(4) of $32.6 million, up 111% from the same quarter in the prior year.

- Adjusted Gross Margin(4) of 63%, up 12% from the same quarter in the prior year.

- Net loss of $19.5 million, or a loss of $0.11 per share, compared to a loss of $236.3 million, or a loss of $1.38 per share, in the same quarter in the prior year.

- Adjusted EBITDA(4) of $13.0 million, up from ($6.8) million in the same quarter in the prior year. EBITDA and Adjusted EBITDA are non-GAAP measures. Reconciliation tables of EBITDA and Adjusted EBITDA are included below.

- Due to liquidity constraints experienced by the Company, the Company did not make applicable interest payments due on its 13% senior secured convertible debentures (“Secured Notes”) and its 8% convertible unsecured debentures (“Unsecured Debentures”) due during 2020. As previously disclosed, the non-payment of interest in March 2020 triggered an event of default with respect to these components of the Company’s long-term debt, which, as of March 31, 2021, consisted of principal amounts at face value of $97.5 million and $60.0 million, and accrued interest of $19.0 million and $6.0 million, on the Secured Notes and Unsecured Debentures, respectively. In addition, as a result of the default, as of March 31, 2021, the Company has accrued additional fees and interest of $14.2 million (“Exit Fees”) in excess of the aforementioned amounts that are further detailed in the Company’s financial statements.

- As disclosed in the Company’s filings with the applicable Canadian securities regulators and the SEC, the Company entered into a restructuring support agreement dated July 10, 2020 (the “Restructuring Support Agreement”) with the holders of its Secured Notes (the “Secured Lenders”) and a majority of the holders of its Unsecured Debentures (the “Consenting Unsecured Debentureholders”) to effectuate a proposed recapitalization transaction (the “Recapitalization Transaction”) to be implemented by way of a court-approved plan of arrangement (“Plan of Arrangement”) under the Business Corporations Act (British Columbia). If consummated, the Company intends to issue up to an aggregate of 6,072,579,699 common shares upon the extinguishment of (i) $22.5 million of Secured Notes (including the Exit Fees), (ii) $40.0 million of Unsecured Debentures, including interest accrued thereon, and (iii) interest accrued on the interim financing in the amount of $14.7 million provided by the Secured Lenders. The Recapitalization Transaction remains subject to the receipt of all necessary regulatory approvals and approval by the Canadian Securities Exchange. The financial highlights herein do not give effect to the consummation of the Recapitalization Transaction.

| (1) | Reflects accrued interest on the Exit Fees. |

| (2) | Includes one-time, non-recurring costs related to the Company’s Recapitalization Transaction and costs related to non-recurring legal proceedings. |

| (3) | In January 2021, the Company completed an assessment of the yield per gram that is used as an input to value the Company’s inventory. The timing of this review was based on a combination of factors accumulating over time that provided the Company with updated information to make a better estimate on the yield of its products. These factors included enhanced data gathering of crop production and yields into inventory. The assessment resulted in a revision of the Company’s production yield estimates that are used to value ending inventory. This change in accounting estimate was effective on January 1, 2021. |

| (4) | See “Non-GAAP Financial Information” below for more information regarding the Company’s use of non-GAAP financial measures. |

Operational Highlights

- On January 21, 2021, the Company, through its wholly-owned subsidiary, McCrory’s Sunny Hill Nursery, LLC, which does business under the name “GrowHealthy”, opened its 17th Florida-based dispensary in Sarasota.

- On April 1, 2021, the Company launched adult-use sales in Arizona at its four Health For Life branded dispensaries.

- In April 2021, the Company’s wholly-owned subsidiary, Cannatech Medicinals, Inc., received its final cultivation license for its Fall River, Massachusetts cultivation facility.

- In the first quarter of 2021, the Company introduced Last Resort™ brand pre-ground flower, available for purchase via the Company’s wholly-owned subsidiaries in both Florida and Massachusetts.

- In February 2021, the Company’s wholly-owned subsidiary, iAnthus New Jersey, LLC (“iAnthus NJ”), issued senior secured bridge notes in the aggregate principal amount of $11.0 million. The net proceeds from such notes will be used primarily for the continued construction and improvements of certain New Jerseycultivation, manufacturing and dispensary facilities leased and/or owned by iAnthus NJ.

Update on the Recapitalization Transaction

On September 14, 2020, the Company’s securityholders voted in support of the Recapitalization Transaction, and on October 5, 2020, the Supreme Court of British Columbia (the “Court”) approved the Plan of Arrangement, which approval was upheld on appeal on January 29, 2021.

Securityholder approval and Court approval were two of the primary conditions for closing the Recapitalization Transaction, both of which conditions have been satisfied. The closing of the Recapitalization Transaction remains subject to certain closing conditions as set forth in the Restructuring Support Agreement, a copy of which is available under the Company’s SEDAR profile at www.sedar.com and the SEC’s website at www.sec.gov. Specifically, certain of the transactions contemplated by the Recapitalization Transaction have triggered the requirement for an approval by state-level regulators in certain U.S. states with jurisdiction over the licensed cannabis operations of entities owned, in whole or in part or controlled directly or indirectly, by iAnthus in such states.

On February 23, 2021, the Nevada Cannabis Compliance Board approved the proposed change of ownership and control of the Company’s wholly-owned subsidiary, GreenMart of Nevada NLV, LLC, contemplated by the Recapitalization Transaction. Similar state-level regulatory approvals are being sought in Florida, Massachusetts, Maryland, New York, New Jersey, and Vermont.

Non-GAAP Financial Information

This release includes certain non-GAAP financial measures as defined by the SEC. Reconciliations of these non-GAAP financial measures to the most directly comparable financial measure calculated and presented in accordance with GAAP are included in the tables above. This information should be considered as supplemental in nature and not as a substitute for, or superior to, any measure of performance prepared in accordance with GAAP.

In evaluating our business, we consider and use EBITDA as a supplemental measure of operating performance. We define EBITDA as earnings before interest, taxes, depreciation and amortization. We present EBITDA because we believe it is frequently used by securities analysts, investors and other interested parties as a measure of financial performance. We define Adjusted EBITDA as EBITDA before stock-based compensation, accretion expense, write-downs and impairments, gains and losses from changes in fair values of financial instruments, income or losses from equity-accounted investments, changes in accounting policy or estimates, non-recurring costs related to the Company’s Recapitalization Transaction, and litigation costs related to ongoing legal proceedings.

The terms EBITDA and Adjusted EBITDA are not defined under GAAP, and are not a measure of operating income, operating performance or liquidity presented in accordance with GAAP. EBITDA and Adjusted EBITDA have limitations as an analytical tool, and when assessing the Company’s operating performance, investors should not consider EBITDA or Adjusted EBITDA in isolation, or as a substitute for net income (loss) or other consolidated income statement data prepared in accordance with GAAP. Among other things, EBITDA and Adjusted EBITDA do not reflect the Company’s actual cash expenditures. Other companies may calculate similar measures differently than us, limiting their usefulness as comparative tools. We compensate for these limitations by relying on GAAP results and using EBITDA and Adjusted EBITDA only as supplemental.