Innovative Industrial Properties, Inc. (IIP), the first and only real estate company on the New York Stock Exchange (NYSE: IIPR) focused on the regulated U.S. cannabis industry, announced today its operating, investment and capital markets activity from July 1, 2021 through today.

Operating Activity

As of October 1, 2021, IIP owned 75 properties located in Arizona, California, Colorado, Florida, Illinois, Maryland, Massachusetts, Michigan, Minnesota, Missouri, Nevada, New Jersey, New York, North Dakota, Ohio, Pennsylvania, Texas, Virginia and Washington, representing a total of approximately 7.3 million rentable square feet (including approximately 2.7 million rentable square feet under development/redevelopment), which were 100% leased with a weighted-average remaining lease term of approximately 16.7 years. As of October 1, 2021, IIP had invested an aggregate of approximately $1.4 billion (consisting of purchase price and construction funding and improvements reimbursed to tenants, but excluding transaction costs) and had committed an additional approximately $417.5 million to reimburse certain tenants and sellers for completion of construction and improvements at IIP’s properties, which does not include an $18.5 million loan from IIP to a developer for construction of a regulated cannabis cultivation and processing facility in California.

Investment Activity

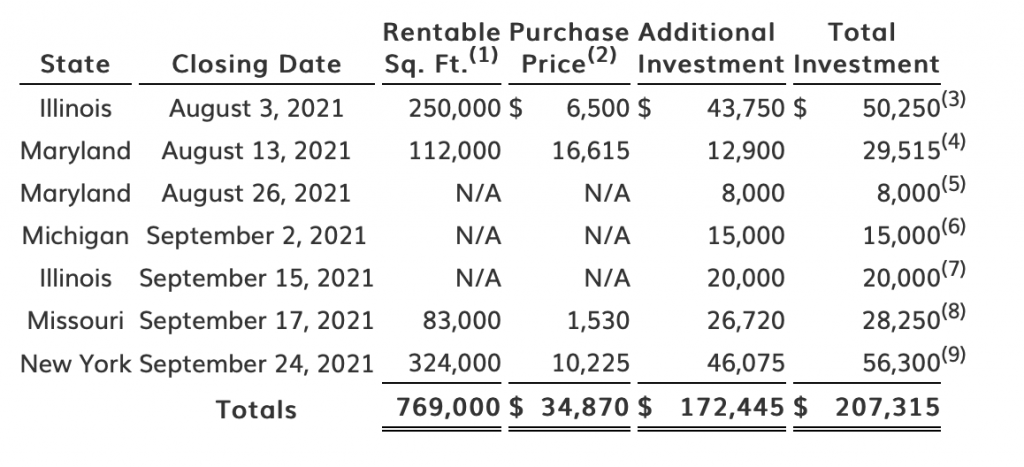

From July 1, 2021 through today, IIP made four acquisitions (including three new properties and additional land expansion at an existing property) for properties located in Illinois, Maryland, Missouri and New York, and executed three lease amendments to provide additional improvement allowances at properties located in Illinois, Marylandand Michigan. In these transactions, IIP established a new tenant relationship with Calyx Peak, Inc., while expanding existing relationships with 4Front Ventures Corp., Ascend Wellness Holdings, Inc., Goodness Growth Holdings, Inc. (f/k/a Vireo Health International, Inc.), Green Peak Industries LLC (Skymint), Harvest Health & Recreation Inc. and Holistic Industries, Inc. Additional detail regarding each transaction is set forth below:

(1) | Includes expected rentable square feet at completion of construction for certain properties. | |

| (2) | Excludes transaction costs. | |

| (3) | The tenant is expected to construct a 250,000 square foot industrial facility, for which IIP agreed to provide reimbursement of up to $43.75 million. | |

| (4) | The tenant is expected to complete improvements at the property, for which IIP agreed to provide reimbursement of up to $12.9 million. | |

| (5) | The amount relates to a lease amendment which provided an additional improvement allowance under a lease at one of IIP’s Maryland properties of $8.0 million, and also resulted in a corresponding adjustment to the base rent for the lease at the property. | |

| (6) | The amount relates to a lease amendment which increased the improvement allowance under a lease at one of IIP’s Michigan properties by $15.0 million to a total of $29.45 million, and also resulted in a corresponding adjustment to the base rent for the lease at the property. | |

| (7) | The amount relates to a lease amendment which increased the improvement allowance under a lease at one of IIP’s Illinois properties by $20.0 million to a total of $52.0 million, and also resulted in a corresponding adjustment to the base rent for the lease at the property. | |

| (8) | The tenant is expected to construct an 83,000 square foot industrial facility, for which IIP agreed to provide reimbursement of up to approximately $26.72 million. | |

| (9) | The amounts relate to the acquisition of additional land adjacent to an existing property and a lease amendment which provided an allowance to fund construction of a new building and resulted in a corresponding adjustment to the base rent for the lease at the property. The tenant is expected to construct approximately 324,000 square feet of industrial space, for which IIP agreed to provide reimbursement of up to approximately $46.1 million. |

Capital Markets Activity

IIP did not conduct any capital raising activities during the period from July 1, 2021 through today.