- Third quarter revenue of $32.0 million, up 3.8% from the previous quarter adjusting for removal of MedMen NY Inc. from continuing operations

- Total Retail Revenue increase of 8.2% quarter-over-quarter, inclusive of New York and Arizona stores

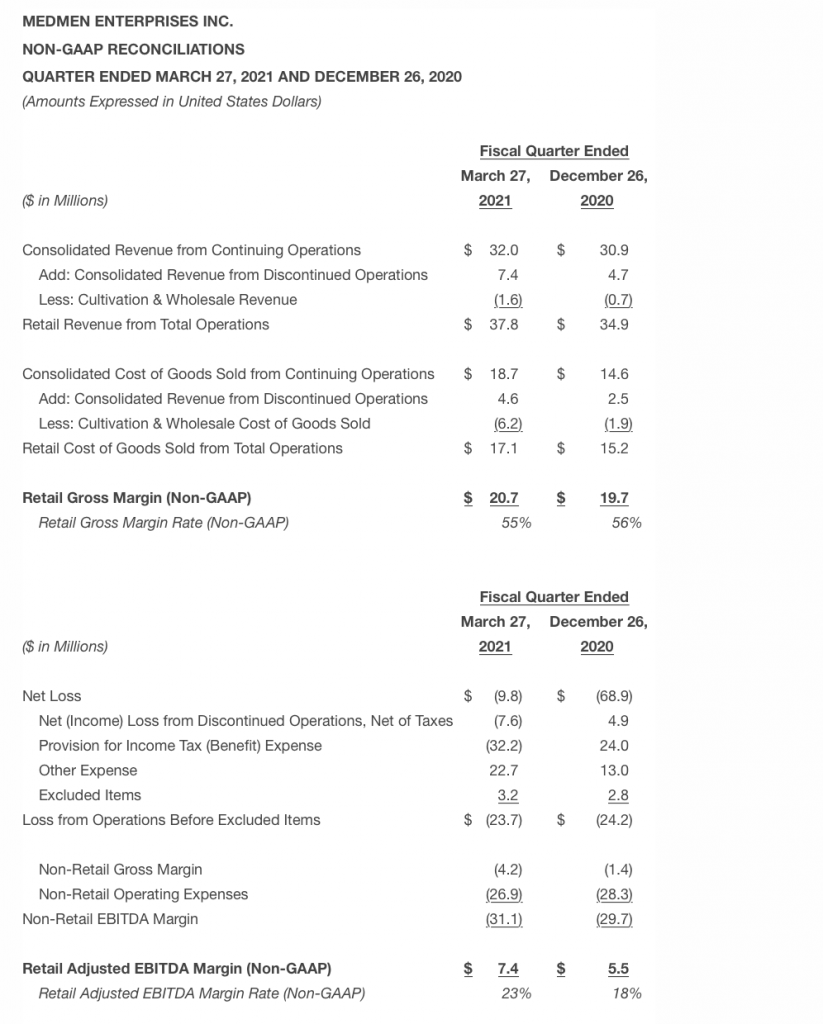

- Total Retail Adjusted EBITDA increased to $8.5 million from $6.0 million quarter-over-quarter, for a 22.5% margin, and Total Retail Adjusted EBITDA from continuing operations increased to $7.4 million from $5.5 million quarter-over-quarter for a 23.3% margin

May 11, 2021 04:30 PM Eastern Daylight Time

MedMen Enterprises Inc. (“MedMen” or the “Company”) (CSE: MMEN) (OTCQX: MMNFF), a cannabis retailer with operations across the United States, today released its consolidated financial results for its third quarter fiscal 2021 ending March 27, 2021. All financial information in this press release is reported in U.S. dollars, unless otherwise indicated.

“The past quarter was defined by the reopening of retail stores, accelerated momentum in our turnaround plan and a shift towards growth,” said Tom Lynch, Chairman and Chief Executive Officer of MedMen. “As predicted, California began to rebound strongly as capacity restrictions in California fell away, with same store sales up 2.3% quarter-over-quarter and April same store sales up 11.9% over March. Additionally, we achieved the best bottom-line result in MedMen’s history. I’m pleased with the tremendous progress we have made. MedMen’s mission is to be the best-in-class cannabis retailer, and we are positioning ourselves to achieve that goal through focus, experience, improved financials and continuing to deliver the industry’s premier in-store experience. Over the next several quarters we plan to both accelerate our growth and move closer to profitability as we leverage our national brand recognition into opening new stores in Florida, California, Massachusetts and Illinois.”

Third Quarter Financial Highlights:

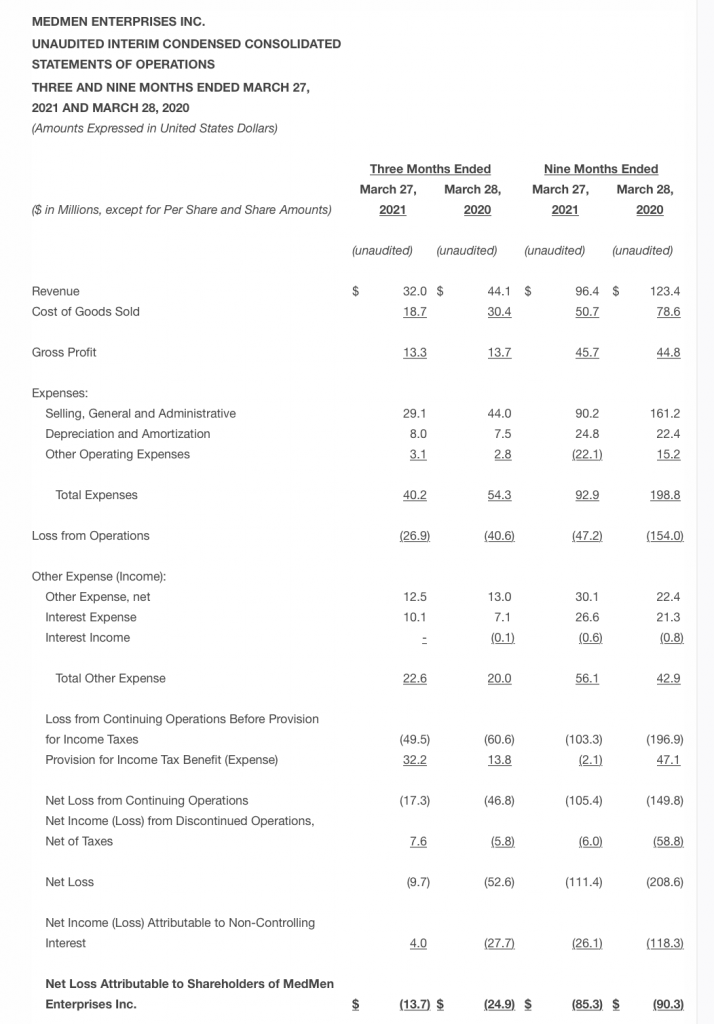

- Revenue1: Net revenue across MedMen’s continuing operations in California, Nevada, Illinois, and Florida was $31.7 million for the third quarter, up 2.8% sequentially excluding New York and Arizona.

- Total Retail Revenue1: Net revenue across MedMen’s operations in California, Nevada, Arizona, New York, Illinois, and Florida was $37.8 million, up 8.2% sequentially.

- Gross Margin2: Company-widegross margin rate was 42% in the third quarter compared to 53% in the previous quarter, driven by one-time inventory write downs totaling $1.7 million. Retail gross margin rate was 55% in the third quarter compared to 57% in the previous quarter.

- SG&A Expenses: General and administrative expenses of $29.1 million in the third quarter, a 34% decrease from the same period last year.

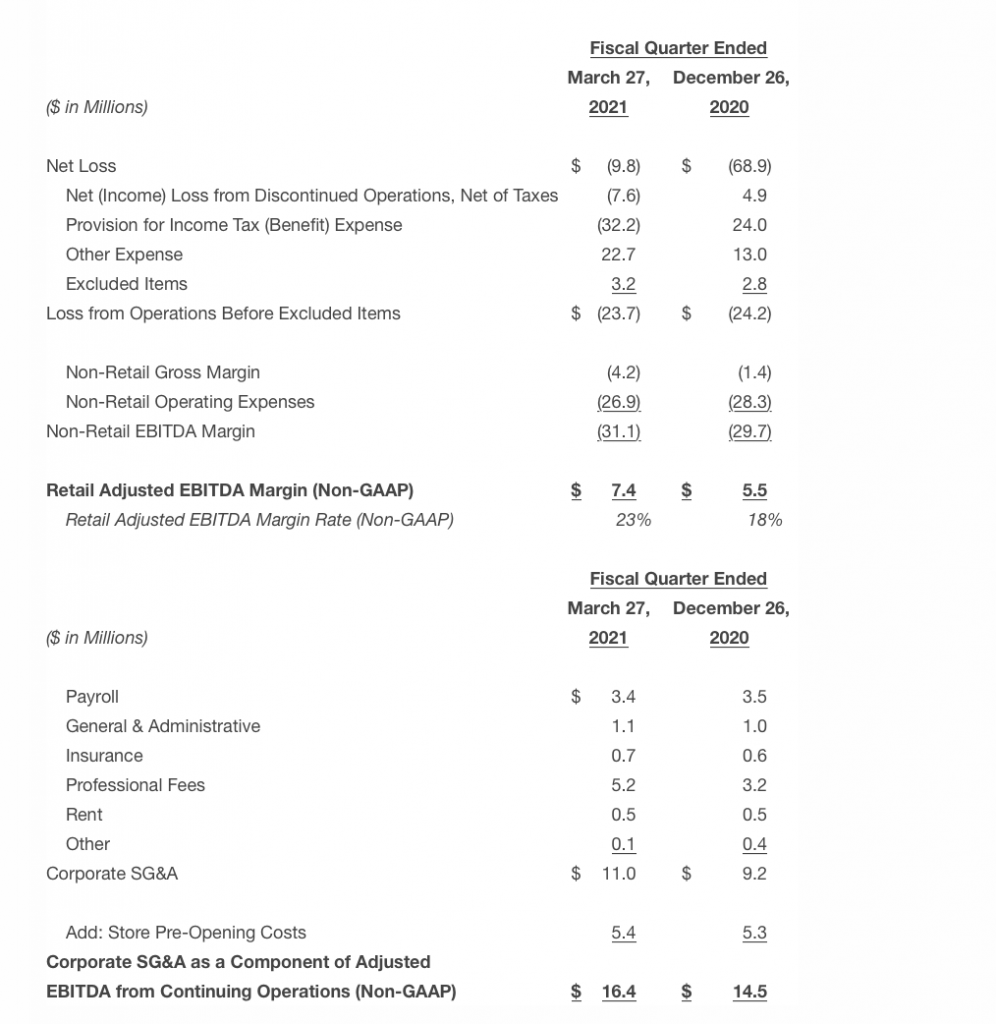

- Corporate SG&A2: Corporate SG&A excluding store pre-opening costs totaled $11.0 million in the third quarter, a 19.4% increase from the previous quarter. This result would have been roughly flat if not for the increase in litigation costs associated with former employees. The $11.0 million in the third quarter marks a 35.3% decrease from the same period last year, representing approximately $24.0 million in annualized cost savings compared to last year.

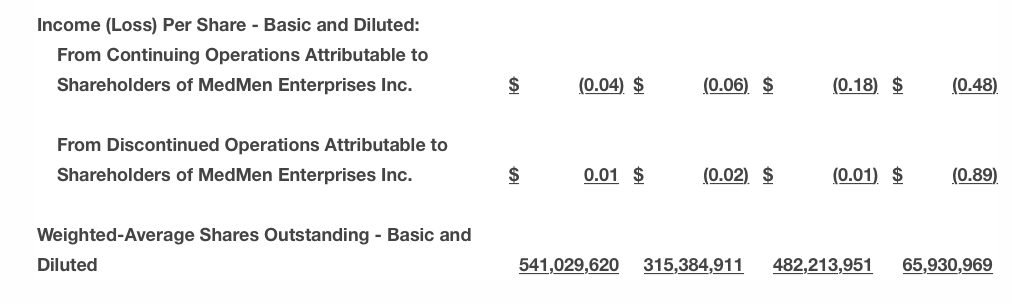

- Net Loss: Net loss was $9.7 million which included $32.2 million of tax provision benefit, compared to a net loss of $68.9 million in the previous quarter which included $24.0 million of tax provision expense. This is the best net loss result in MedMen’s history as a public company.

- Retail Adjusted EBITDA2: Retail Adjusted EBITDA from continuing operations margin was 23.3% for the third quarter.

- The Company executed definitive investment agreements to complete a majority investment in New York, subject to regulatory approval. Arizona has been classified in discontinued operations since December 2019.

- Retail gross margin, Retail revenue, Corporate SG&A and Retail Adjusted EBITDA margin are non-GAAP financial measures as described below.

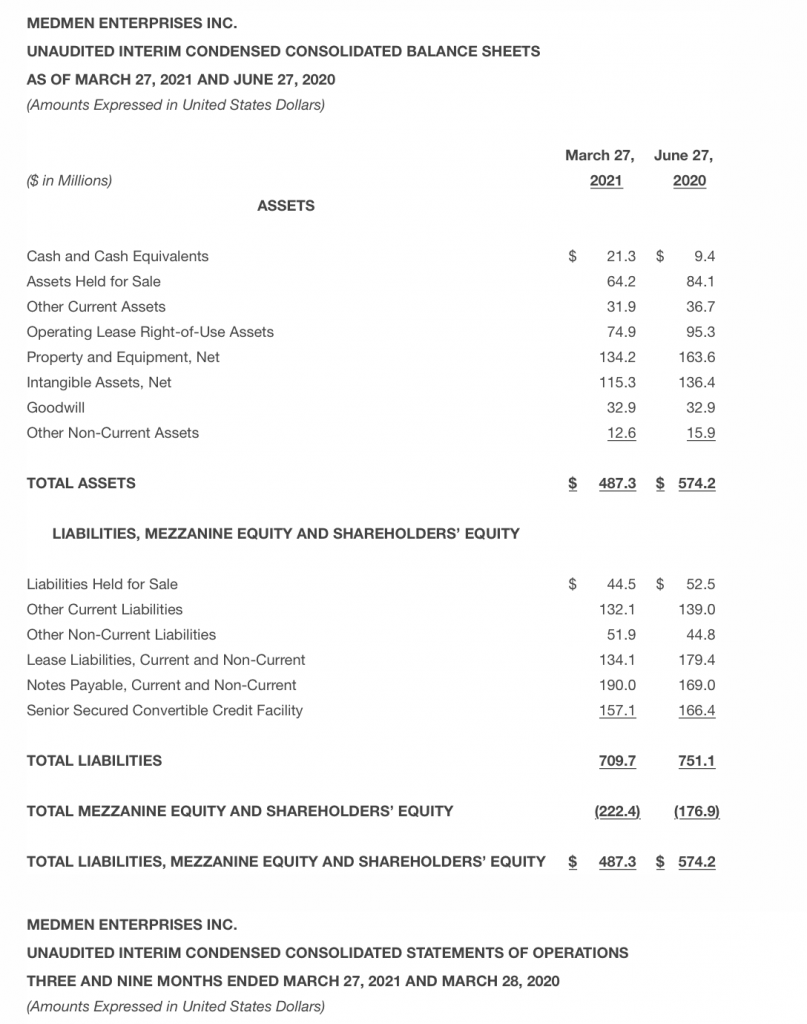

Balance Sheet:

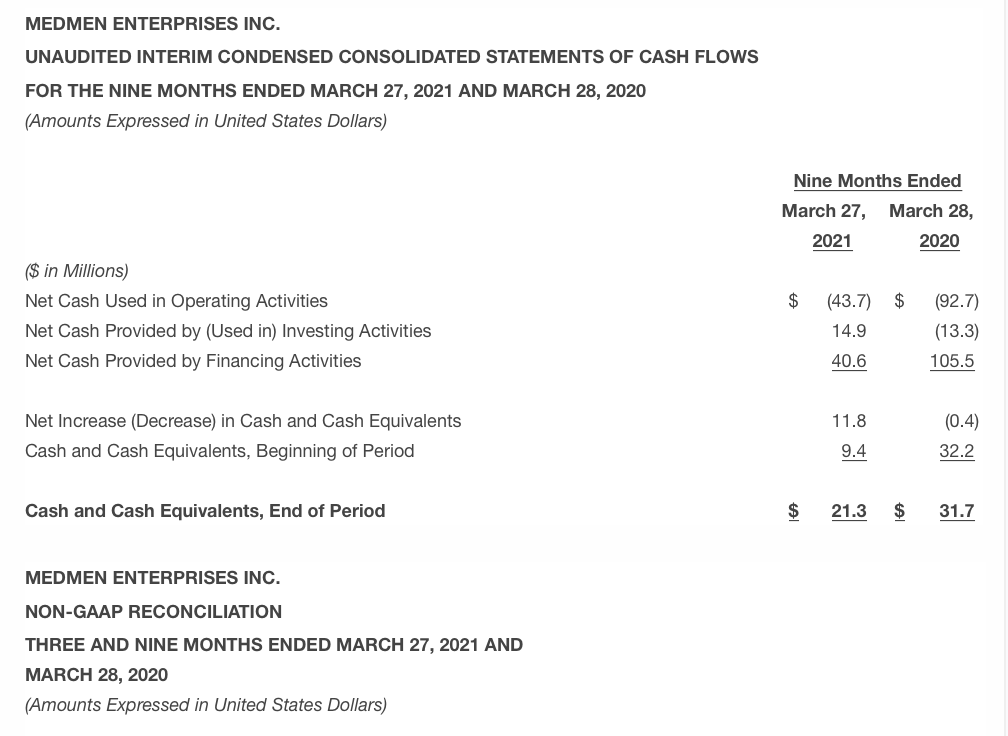

As of March 27, 2021, the Company had total assets of $487.3 million, including cash and cash equivalents of $21.3 million.

Capital Markets and Financing:

- Equity Private Placement: During the third quarter, the Company raised $18.9 million in additional gross proceeds through non-brokered private placement transactions with certain institutional investors.

- Unsecured Convertible Facility: During the third quarter, the Company raised $1 million through an unsecured convertible debenture facility with certain institutional investors.

- Senior Secured Convertible Financing: During the quarter, the Company closed on $10 million in additional gross proceeds under its senior secured convertible debt facility led by funds affiliated with Gotham Green Partners.

- Deleveraging Transaction: On February 25, 2021, the Company announced an investment, subject to regulatory approval, of up to $73.0 million in MedMen NY Inc., which will predominantly be used to pay down the Company’s senior secured lender.

Operations by Market:

- California: California retail revenue across 11 store locations totaled $20.2 million for the third quarter. California retail revenue was subject to significant capacity restrictions through the third quarter and MedMen continued its upward trajectory in revenue growth in April to $7.8 million as restrictions loosened, a gain of 11.9% over March.

- Nevada: The Company’s three locations in Nevada began to recover from a severe reduction in tourism during the second quarter, leading to an 8.1% sequential increase in revenue in the third quarter.

- Florida: The Company’s four stores in Florida reported a 12.8% revenue increase sequentially quarter over prior quarter.

- Illinois: The Company’s flagship store in Oak Park was the highest revenue store in the Company’s national portfolio. The Company secured a second location in Morton Grove with an expected opening date during calendar year 2021.

- Massachusetts: The Company expects to open its Fenway Park store in late summer 2021 and continued to progress towards opening its Newton location.

- Arizona: As a result of Arizona’s adult-use initiative and the Company’s turnaround plan, the Talking Stick store saw 80.2% sequential quarter over prior quarter growth to $2.2 million for the third quarter, as well as 124% sequential growth in its wholesale sales.

- New York: The Company announced a definitive investment agreement in New York where, subject to regulatory approval, MedMen will no longer hold a controlling interest in its New York operations. Currently MedMen operates four medical dispensaries in the state.

Non-GAAP Financial Information:

This press release includes certain non-GAAP financial measures as defined by the SEC. Management believes that these non-GAAP financial measures assess the Company’s ongoing business in a manner that allows for meaningful comparisons and analysis of trends in the business, as they facilitate comparing financial results across accounting periods and to those of peer companies. These non-GAAP financial measures exclude certain material non-cash items and certain other adjustments the Company believes are not reflective of its ongoing operations and performance Management uses non-GAAP financial measures, in addition to GAAP financial measures, to understand and compare operating results across accounting periods, for financial and operational decision-making, for planning and forecasting purposes and to evaluate the Company’s financial performance. Management believes that these non-GAAP financial measures enhance investors’ understanding of the Company’s financial and operating performance from period to period and enable investors to evaluate the Company’s operating results and future prospects in the same manner as management. Reconciliations of these non-GAAP financial measures to the most directly comparable financial measure calculated and presented in accordance with GAAP are included in the financial schedules attached to this press release. This information should be considered as supplemental in nature and not as a substitute for, or superior to, any measure of performance prepared in accordance with GAAP.

Definitions:

Retail Gross Margin Rate: Retail Gross Margin (Non-GAAP) divided by Retail Revenue (Non-GAAP). Retail Gross Margin Rate (Non-GAAP) is reconciled to consolidated gross margin rate as follows: consolidated revenue less non-retail revenue reduced by consolidated cost of goods sold less non-retail cost of goods sold, divided by consolidated revenue less non-retail revenue. Retail Revenue (Non-GAAP) is consolidated revenue less non-retail revenue, such as cultivation and manufacturing revenue. These non-GAAP measures provide a standalone basis of the Company’s performance as a cannabis retailer in the U.S. considering the Company’s long-term viability is correlated with cash flows provided by or used in retail operations.

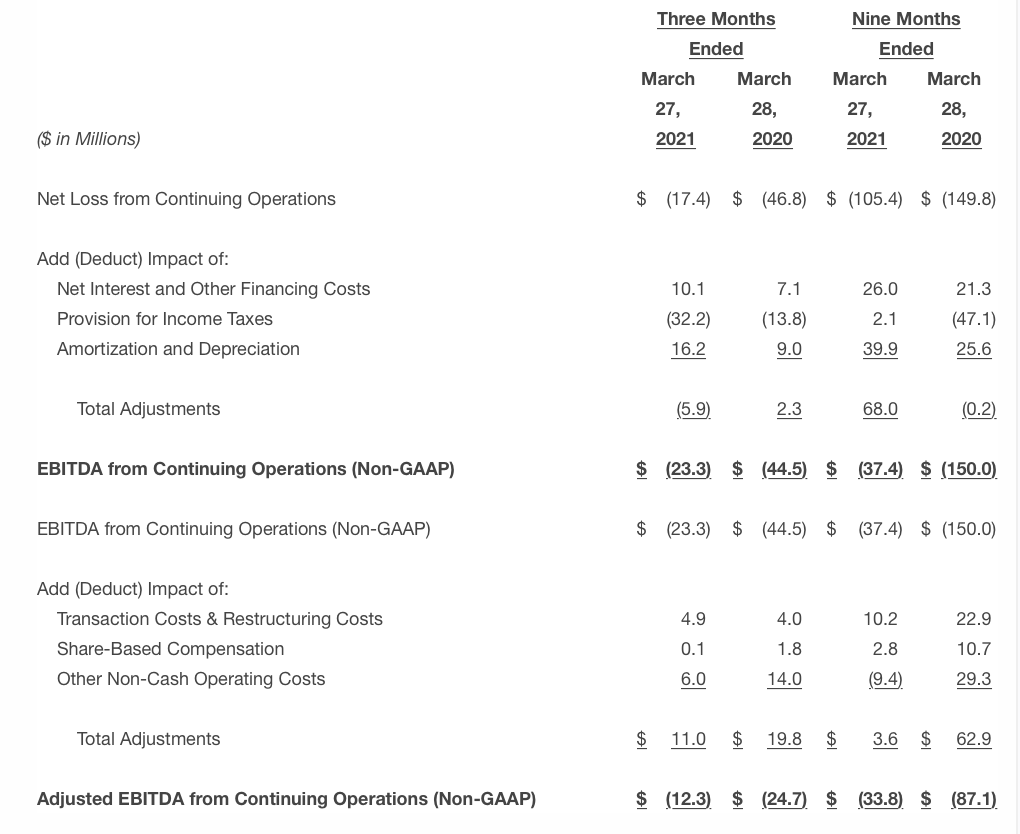

EBITDA from Continuing Operations: Net Loss from Continuing Operations (GAAP) adjusted for interest and financing costs, income taxes, depreciation, and amortization. This non-GAAP measure represents the Company’s current operating profitability and ability to generate cash flow.

Retail Adjusted EBITDA: Retail Gross Margin (Non-GAAP) less direct store operating expenses, including rent, payroll, security, insurance, office supplies and payment processing fees, local cannabis and excise taxes, distribution expenses, and inventory adjustments. This non-GAAP measure provides a standalone basis of the Company’s performance as a cannabis retailer in the U.S. considering the Company’s long-term viability is correlated with cash flows provided by or used in retail operations.

Adjusted EBITDA from Continuing Operations: EBITDA from Continuing Operations (Non-GAAP) adjusted for transaction costs, restructuring costs, share-based compensation, and other non-cash operating costs, such as changes in fair value of derivative liabilities and unrealized changes in fair value of investments. This non-GAAP measure represents the Company’s current operating profitability and ability to generate cash flow excluding non-recurring, irregular or one-time expenditures in order improve comparability.

Corporate SG&A: Selling, general and administrative expenses related to the Company’s corporate functions. This non-GAAP measure represents scalable expenditures that are not directly correlated with the Company’s retail operations.

Webcast and Calling Information:

At 5:00 PM Eastern, MedMen will host a conference call and audio webcast with Chief Executive Officer, Tom Lynch, Chief Financial Officer, Reece Fulgham, and Chief Operating Officer, Tim Bossidy, to discuss the results in further detail.

A live audio webcast of the call will be available on the Events and Presentations section of MedMen’s website at: https://investors.medmen.com/events-and-presentations/default.aspx and will be archived for replay.

The call may also be accessed by calling in as follows:

Toll Free Dial-In Number: (844) 559-7829

International Dial-In Number: (647) 689-5387

Conference ID: 4282344