Q2 2021 Net Revenue Increased 26.1% Quarter-over-Quarter to $83.4 Million

Increases 2021 Full Year Net Revenue Guidance Range to $330-$350 Million

Added Five New Dispensaries YTD, Three During Q2 2021

NEW YORK, Aug. 10, 2021 /CNW/ – Ascend Wellness Holdings, Inc. (“AWH” or the “Company”) (CSE: AAWH.U) (OTCQX: AAWH), a vertically integrated multi-state cannabis operator focused on bettering lives through cannabis, today reported its financial results for Q2 2021, which ended June 30, 2021. Financial results are reported in accordance with U.S. generally accepted accounting principles (“GAAP”) and all currency is in U.S. dollars.

Q2 2021 Financial Highlights

- Gross Revenue: Total revenue of $97.5 million increased 28.5% quarter-over-quarter and 236.2% year-over-year.

- Net Revenue: Net revenue, which excludes intercompany sale of wholesale products, increased 26.1% quarter-over-quarter to $83.4 million. Net revenue for the first six months of 2021 was $149.5 million, a 4.0% increase over the Company’s full year 2020 net revenue of $143.7 million.

- Net Loss: Net loss of $44.9 million during the second quarter of 2021, was primarily driven by a $32.0 million non-cash interest expense related to the Company’s initial public offering (“IPO”) completed in May 2021. This non-cash interest expense was largely driven by a $27.4 million charge related to the beneficial conversion feature of the historical Real Estate Preferred Units that converted in the IPO.

- Adjusted EBITDA1: Adjusted EBITDA of $20.3 million represented a 28.3% increase quarter-over-quarter. Adjusted EBITDA Margin of 24.4% represented a 43 basis point increase compared to the prior quarter.

- Balance Sheet: As of June 30, 2021, cash and cash equivalents were $104.2 million, and net debt, which equals total debt less cash and cash equivalents was $27.4 million. The Company has engaged Seaport Global to refinance the existing debt to lower the Company’s cost of capital and provide additional cash to support investment.

Management Commentary

“Our business continues to produce impressive quarter-over-quarter revenue and adjusted EBITDA growth as we scale our wholesale and retail operations across the high-quality markets where we operate,” said Abner Kurtin, Founder and CEO of AWH. “We remain focused on executing, disciplined in our approach to allocating capital, and excited about the trajectory of the Company,” Kurtin added. “As a result, we are pleased to announce that we are increasing our full year net revenue guidance range to $330 million – $350 million.”

| _________________________________ | |

| 1 | Adjusted Gross Profit, Adjusted Gross Margin and Adjusted EBITDA are a non-GAAP financial measures. Please see the “Supplemental Information (Unaudited) Regarding Non-GAAP Financial Measures” at the end of this press release for a reconciliation of non-GAAP to GAAP measures. |

Recent Business Developments

Retail Business

- During the second quarter of 2021, AWH opened three new dispensaries in Boston, Massachusetts, Rochelle Park, New Jersey, and Chicago Ridge, Illinois, which brought the Company’s total to 18 open and operating dispensaries as of June 30, 2021.

- Total retail revenue increased to $58.0 million for the second quarter of 2021, representing an increase of 27.5% quarter-over-quarter. The growth was driven by increases in transactions at existing stores and the opening of three stores during the quarter.

- Total transactions increased 39.4% quarter-over-quarter to approximately 573,000. Average value per transaction declined by 8.6% compared to the prior quarter to approximately $101 primarily due to geographic and medical versus adult-use patient mix.

| ______________________________ | |

| 2 | Certificate of Operation to be issued by the Board of Pharmacy at closing. |

Wholesale Business

- Gross wholesale revenue increased to $39.5 million, representing an increase of 30.1% quarter-over-quarter. Net wholesale revenue, after intercompany sales, increased to $25.3 million, representing an increase of 22.9% quarter-over-quarter, which continues to be driven by increased output and pricing at the Company’s cultivation facility located in Barry, Illinois.

- Pound equivalents sold increased 28.2% quarter-over-quarter and 285.3% year-over-year to approximately 11,040 pounds.

- Gross revenue per pound equivalent was approximately $3,577, which is slightly up quarter-over-quarter.

- On May 5, 2021 the Company closed on its acquisition of a cultivation license in Monroe, Ohio.

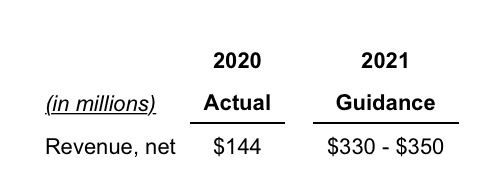

Revenue Guidance

Based on the Company’s strong Q2 2021 performance, management is increasing the 2021 full year annual revenue guidance from a range of $320 million to $340 million to a range of $330 million to $350 million. This revised range represents growth of approximately 130% to 145% year-over-year.

Q2 2021 Financial Overview

Total revenue in Q2 2021 was $97.5 million representing a 28.5% increase quarter-over-quarter and 236.2% year-over-year. Revenue growth was driven by increased cultivation and production activity, new store openings, and increased traffic at open stores. The Company continues to invest in the build-out and expansion of its cultivation and manufacturing facilities in Illinois, New Jersey, Massachusetts, and Michigan. Additionally, the Company is actively building out additional dispensaries in Massachusetts, New Jersey, and Michigan.

Q2 2021 gross profit was $34.5 million, or 41.4% of revenue, as compared to $29.7 million, or 44.9% of revenue, for the prior quarter.

Q2 2021 Adjusted Gross Profit1 was $39.6 million, or 47.5% of revenue, as compared to $32.6 million, or 49.3% of revenue, for the prior quarter. Adjusted Gross Profit1 excludes depreciation and amortization included in cost of goods sold, as well as non-cash inventory adjustments. Adjusted Gross Profit1 dollars increased 21.6% quarter-over-quarter driven by wholesale production efficiency at the Company’s Barry, Illinois cultivation facility and additional retail stores coming online, partially offset by declines in pricing at the Company’s Athol, Massachusetts cultivation facility due to the bulk sale of lower testing THC product. Adjusted Gross Profit1 margin decreased 174 basis points quarter-over-quarter to 47.5%, primarily driven by realized pricing at the Company’s Athol, Massachusetts cultivation facility.

Total general and administrative expenses for Q2 2021 were $30.6 million, or 36.7% of revenue, as compared to $25.1 million, or 38.0% of revenue, for the prior quarter.

Total other expense was $36.8 million for Q2 2021. The increase was primarily driven by a $27.4 million non-cash interest expense charge related to the beneficial conversion feature of the historical Real Estate Preferred Units recognized in conjunction with the Company’s IPO, as well as $3.6 million incremental non-cash interest recognized upon conversion of the Company’s convertible notes in conjunction with the IPO.

Net loss attributable to AWH for the second quarter of 2021 was $44.9 million, or a loss of $0.30 per basic and diluted common share, primarily driven by $32.0 million of non-cash interest expense related to the IPO, as compared to a net loss of $48.2 million, or $0.45 per basic and diluted historical common unit, for the prior quarter.

Adjusted EBITDA1, which adjusts for tax, interest, depreciation, amortization, stock-based compensation, and other items deemed one-time in nature, was $20.3 million in Q2 2021. This represents a 28.3% increase quarter-over-quarter. This increase was driven by wholesale production efficiency in Barry, Illinois and retail stores coming online, partially offset by declines in wholesale revenue at Athol, Massachusetts cultivation. Adjusted EBITDA1 Margin of 24.4% represented a 43 basis point increase compared to the prior quarter.

Balance Sheet and Liquidity

As of June 30, 2021, the Company had cash and cash equivalents of $104.2 million and total debt outstanding was $131.6 million. Net debt, which equals total debt less cash and cash equivalents was $27.4 million. The Company has engaged Seaport Global to refinance the existing debt to lower the Company’s cost of capital and provide additional cash to support investment.

Non-GAAP Financial Information

This press release includes certain non-GAAP financial measures as defined by the U.S. Securities and Exchange Commission (“SEC”). Reconciliations of these non-GAAP financial measures to the most directly comparable financial measure calculated and presented in accordance with GAAP are included in the financial schedules attached to this press release. This information should be considered as supplemental in nature and not as a substitute for, or superior to, any measure of performance prepared in accordance with GAAP.

Conference Call and Webcast

AWH will host a conference call on August 10, 2021 at 5:00 p.m. ET to discuss its financial results for the quarter ended June 30, 2021. The conference call may be accessed by dialing (888) 390-0605 with conference ID 22159427. A live audio webcast of the call will also be available on the Investor Relations section of AWH’s website at https://awholdings.com/investors/ and will be archived for replay.