- Q3 Revenue up 111% Y/Y to $96.2 Million, up 5% sequentially

- Q3 Adjusted EBITDA of $26.0 million, up 40% Y/Y and down 5% sequentially as the Company Invests in Future Growth

- US GAAP Operating Loss of $8.9 Million Included Non-Cash, One-Time Expenses, and Non-Operating Adjustments totaling $34.9 Million

- Raised $50 Million in Cash with Early Call of Outstanding Warrants and $150 Million in Offering of Additional Senior Notes

- Company Provides Q4 2021 Guidance for over 10% Sequential Revenue Growth with Adjusted EBITDA Flat Sequentially

- Proposing to Add Two Dispensaries in Chicago with Announced Agreement to Acquire Dispensary 33, Which Would Increase Illinois Retail Footprint to Five Stores

- Revising 2022 Adjusted EBITDA Target to $250-300 Million, and Maintaining 2022 Revenue Target of $800 Million to Reflect Revised Timing for Capital Projects and Recent Changes in Wholesale Market Conditions

- Acquisitions of Levia, a Leading Branded Cannabis Beverage Company, Herbal Remedies (IL) and Tahoe Hydro (NV) Expected to Close in Q1 2022, Followed by Dispensary 33 (IL) in the First Half of 2022

MIAMI, Nov. 22, 2021 (GLOBE NEWSWIRE) — Ayr Wellness Inc. (CSE: AYR.A, OTCQX: AYRWF) (“Ayr” or the “Company”), a vertically-integrated cannabis multi-state operator (MSO), is reporting financial results for the three and nine months ended September 30, 2021. Unless otherwise noted, all results are presented in U.S. dollars.

Jonathan Sandelman, CEO of Ayr Wellness, said, “We are pleased to report another great quarter of growth at Ayr, more than doubling our revenue from last year’s third quarter and up 5% sequentially in a flat cannabis market. We have been able to maintain or grow share in competitive markets with pricing discipline because, by design, we have focused on quality and consumers continue to show a willingness to pay for quality. As we’ve said again and again, we seek to be the largest scale cultivator of high-quality cannabis in the United States. First and foremost, this is because we want to produce the best product for our customers. But also, because quality serves as a mitigant to pricing pressure that can result from supply and demand imbalances. Quality matters.”

“Today we are unveiling our new corporate, retail and CPG brands which represent the next phase in the evolution of our company. These brands are designed to represent the quality of what’s inside the box. Our portfolio of power brands, which consists of Kynd premium flower, Origyn Extracts, Stix Pre-Roll Company, and (on closing) Levia, reflects the very best of cannabis and represents leading market categories for current and future consumers. We’re also unveiling a collection of core brands to offer variety in form, dose and experience. These core brands address a broader audience in those same power categories,” Mr. Sandelman continued.

“Lastly, we are unveiling our updated Ayr retail concept. We have built this retail concept very intentionally for the experience in our stores to reflect the quality of our products and our commitment to our local communities. At Ayr, we are committed to thinking long-term. We will continue to invest in our quality and our brands. We understand that brand building in this industry is still in its early stages but the reason that we’re committed to this path is because we know that great products and great brands create their own categories and consumer segments,” Mr. Sandelman concluded.

Third Quarter and Recent Highlights:

- Closed on acquisition of Garden State Dispensary, adding New Jersey to Ayr’s growing footprint with three open dispensaries and 24,000 sq. ft. of operational cultivation and production facilities, with an additional 75,000 sq. ft. of cultivation under development coming online with sales in Q2 2022

- Completed combination with PA Natures Medicine, adding three dispensaries in central Pennsylvania, including the college towns of Bloomsburg and State College

- Organic revenue growth from Massachusetts and Nevada was 18% year-over-year

- Hired over 300 new employees across all levels, deepening our bench in marketing, human resources, technology and operations professionals focused on driving scalable processes across our regional footprint

- Florida:

- Completed construction of 10 acres of hoop house cultivation on the Gainesville campus with a further 10 acres under development, adding an estimated 40,000 lbs. of annual biomass cultivation capacity commencing in 2022

- Continue to expand and improve the assortment and availability of products at retail with the launch of Secret Orchard fruit forward vapes and Sun Gems gummies

- Since closing on February 26, 2021, the Company has opened 11 retail locations, bringing total store count to 42, the second largest retail footprint in Florida

- An additional three stores are expected to open by the end of the year, with five more in Q1 2022; the Company has sited a further 15 new locations, bringing its year-end 2022 Florida dispensary target to at least 65

- Western Region:

- Retail trends in Nevada remain robust and Ayr market share continues to rise in this competitive market, reaching over 13.7% in September, according to BDSA

- Completed 20,000 sq. ft. processing facility upgrade outside of Las Vegas and expanded production in July of manufactured products such as edibles, concentrates and vapes

- Arizona retail market was seasonally soft over Q3, however wholesale revenues partially offset the retail softness as the Chandler, AZ facility came on-line, adding 10,000 sq. ft. of cultivation capacity

- Construction of 80,000 sq. ft. Phoenix cultivation expected to be completed in Q4, with revenues commencing in Q2 2022

- Northeast:

- Closed on Garden State Dispensary in New Jersey, adding three dispensaries, 24,000 sq. ft. of existing cultivation and production and over 75,000 sq. ft. of cultivation under development, making Ayr one of 12 vertical operators in the state serving over 9 million people with adult use slated to begin in H1 2022

- Pennsylvania combined retail revenues reached $1.9 million per month in September, excluding the three dispensaries added in central PA post the end of Q3

- One additional Pennsylvania Ayr Wellness store opened in November, bringing total store count to seven; eighth store expected to open later this year, followed by the ninth in early 2022

- Construction continues on Adult Use dispensaries in Greater Boston (Watertown and Boylston Street)

- Selling to 137 of Massachusetts’ 177 dispensaries

- Construction of 100,000 sq. ft. double-stacked cultivation and production facility in Milford, MA expected to be completed in early 2022

- Midwest:

- Added eighth state, Illinois, to growing footprint with the proposed acquisition of Herbal Remedies Dispensaries, today’s announcement of the agreement to acquire Dispensary 33 (see details below) and license win by affiliated company, Land of Lincoln, LLC

- Began production of vape carts, concentrates, RSO, and tinctures as well as Highly Edible gummies at processing facility in Ohio

Third Quarter Financial Highlights ($ in millions, excl. margin items)

| Q3 20201 | Q2 2021 | Q3 2021 | % Change Y/Y | % Change Q/Q | ||||||

| Revenue | $45.5 | $91.3 | $96.2 | 111.4% | 5.4% | |||||

| Adjusted Gross Profit1 | $28.6 | $53.1 | $56.6 | 97.9% | 6.6% | |||||

| Operating Income/(Loss) | $8.5 | $(24.9 | ) | $(8.9 | ) | NM | NM | |||

| Adj. EBITDA1 | $18.6 | $27.4 | $26.0 | 39.8% | -5.0% | |||||

| AEBITDA Margin1 | 40.8% | 30.0% | 27.0% | -1380bps | -300bps |

1For comparison purposes, Q3 2020 has been restated to be consistent with US GAAP. Adjusted EBITDA and Adjusted Gross Profit are non-GAAP measures. See Definition and Reconciliation of Non-GAAP Measures below. For a reconciliation of Operating Loss to Adjusted EBITDA as well as Gross Profit to Adjusted Gross Profit, see reconciliation table appended to this release.

Outlook:

Based on the results to date, management is forecasting Q4 2021 revenue growth of over 10% sequentially. Adjusted EBITDA is expected to remain roughly flat sequentially, as the Company continues its investments in branding, new markets and growth projects, and the centralized corporate resources to support growth.

The Company is revising its 2022 Adjusted EBITDA guidance to a range of $250-300 million reflecting delays in capital projects and the impact on results should recent wholesale market price volatility persist into 2022. It is reiterating its target for 2022 revenue of $800 million.

The Company’s expectations for Q4 2021 and 2022 are based on the assumptions and risks detailed in the MD&A for the period ending September 30, 2021 as filed on SEDAR.

Summary of the Dispensary 33 Acquisition:

Ayr has entered into a definitive agreement to acquire Gentle Ventures, LLC d/b/a Dispensary 33 (“Dispensary 33”), and certain of its affiliates that collectively own and operate two licensed retail dispensaries in Chicago, Illinois, one in the Andersonville neighborhood and the other in West Loop.

Purchase consideration will consist of $55 million upfront, including $12 million in cash, $3 million sellers notes and $40 million in stock. An earn-out is payable if certain EBITDA performance is achieved through Q3 2022. The acquisition is subject to customary closing conditions and regulatory approvals.

More details can be found in separate the press release dated November 22, 2021, available here.

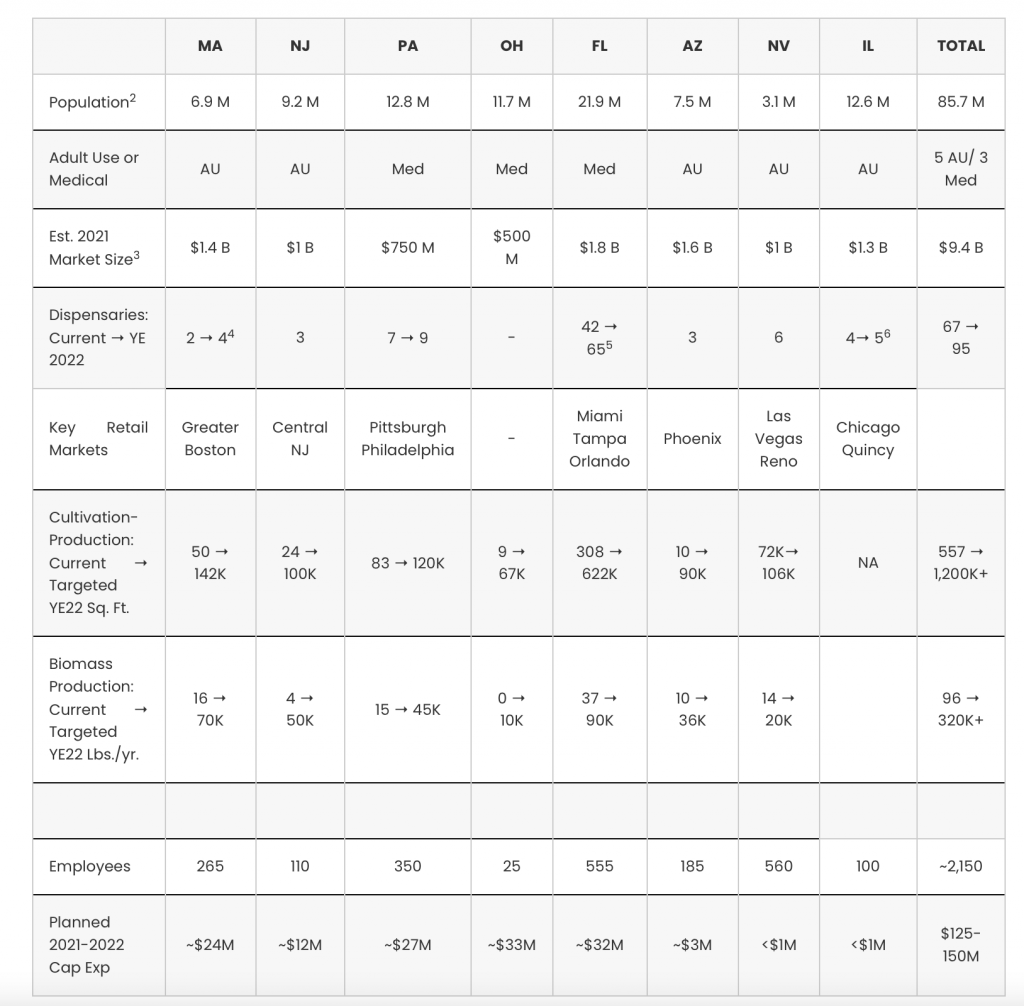

Pro-forma for the closing of pending transactions in IL and NV

2) Source: United States Census Bureau 2020

3) BDSA estimate

4) Includes two co-located Adult Use/Medical dispensaries (Somerville and Watertown), one Adult Use-only dispensary in Boston and one Medical-only dispensary in Needham

5) 42 currently open, eight under development, 15 under LOI

6) Includes dispensary 51% owned by social equity partner

Conference Call

Ayr CEO Jonathan Sandelman, Co-COOs Jason Griffith and Jennifer Drake, and CFO Brad Asher will host the conference call, followed by a question and answer period.

Conference Call Date: Monday, November 22, 2021

Time: 8:30 a.m. Eastern time

Toll-free dial-in number: (800) 319-4610

International dial-in number: (604) 638-5340

Please call the conference telephone number 5-10 minutes prior to the start time. An operator will register your name and organization. If you have any difficulty connecting with the conference call, please contact MATTIO Investor Relations at IR@mattio.com.

The conference call will be broadcast live and available for replay here.

A telephonic replay of the conference call will also be available after 11:30 a.m. Eastern time on the same day through December 21, 2021.

Toll-free replay number: (855) 669-9658

International replay number: (412) 317-0088

Replay ID: 8071

Financial Statements

Certain financial information reported in this news release is extracted from Ayr’s Unaudited Interim Consolidated Financial Statements for the three and nine months ended September 30, 2021 and 2020. Ayr files its financial statements on SEDAR and with the SEC. All financial information contained in this news release is qualified in its entirety by reference to such financial statements and MD&A.