Canopy Growth Corporation (“Canopy Growth” or the “Company”) (TSX:WEED, NASDAQ:CGC) today announces its financial results for the first quarter fiscal 2022 ended June 30, 2021. All financial information in this press release is reported in Canadian dollars, unless otherwise indicated.

Highlights

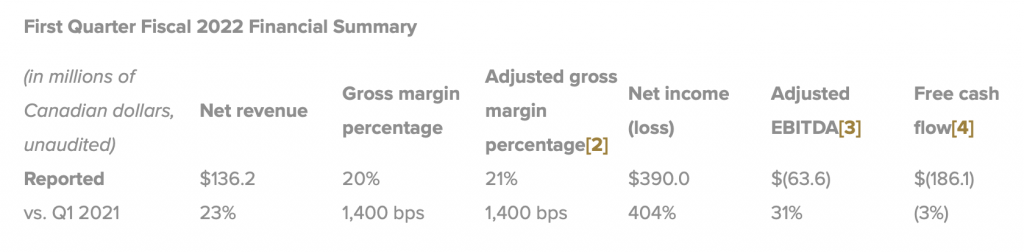

- Achieved 23% revenue growth in Q1 2022 versus Q1 2021 driven by strong double-digit growth in both cannabis and other consumer products businesses.

- Maintained #1 market share[1] in tracked Canadian recreational cannabis market amid a highly competitive landscape.

- Completed acquisition of Ace Valley and Supreme Cannabis, with commercial and operational Integration progressing smoothly.

- Led by consumer insights, a robust innovation pipeline with over 100+ SKUs across key product categories set to hit store shelves from Q2 2022 to Q4 2022.

- Momentum with cannabis reform increasing as the Company continues to build its U.S. presence through broad portfolio of innovative CBD and CPG brands.

- Remains committed to accelerating top-line growth in the second half of fiscal 2022 and achieving positive Adjusted EBITDA by end of fiscal 2022.

“With the right strategy and strong foundation in place we are confident in our ability to deliver long-term success as Canopy’s products and brands continue to demonstrate their appeal to consumers in our core markets,” said David Klein, CEO, Canopy Growth. “While we’re encouraged by regulatory advancement in the U.S., Canopy is not waiting as we continue to scale our business on both sides of the border with an exciting product pipeline planned for the coming quarters.”

“We’re continuing to drive cost savings and operational efficiencies across the company, and remain broadly on track to our target of $150-$200 million in fiscal 2022- fiscal 2023,” added Mike Lee, CFO. “We look forward to scaling our new operating model in coming months as we push forward our profitability goals in fiscal year 2022.”

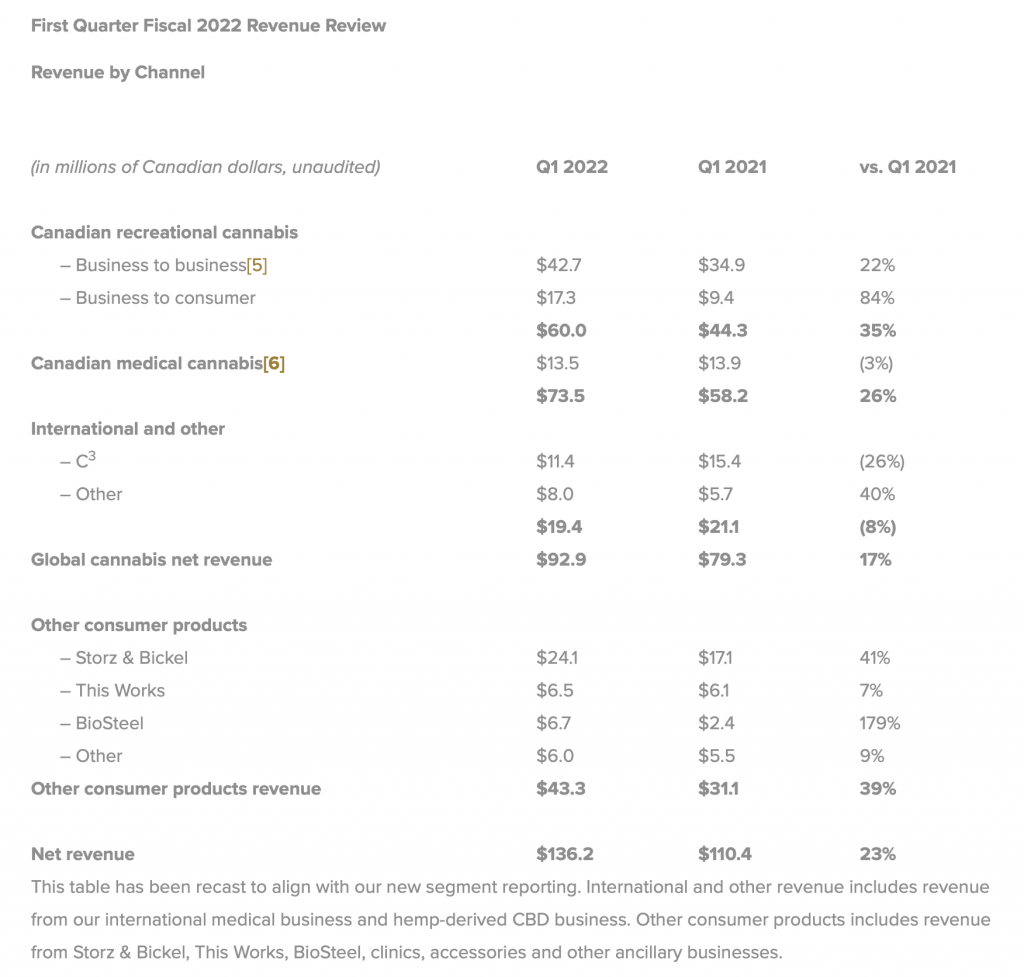

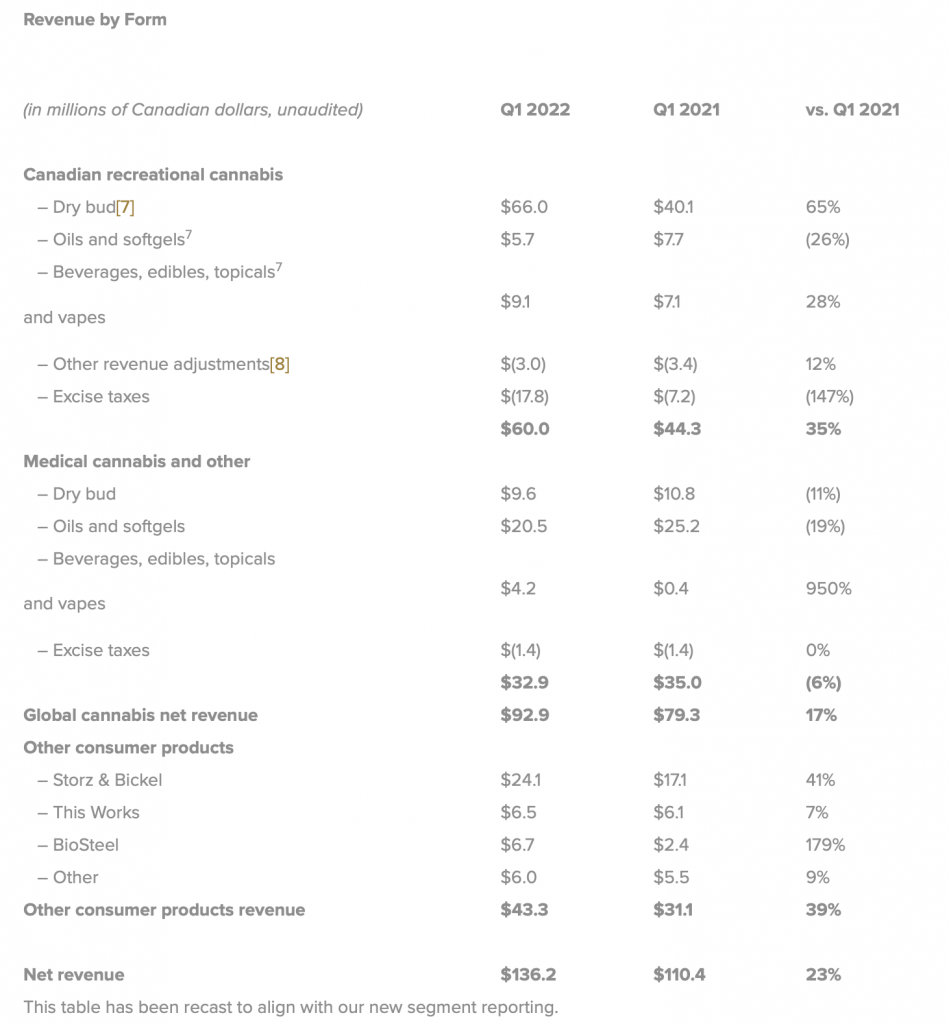

- Revenues: Net revenue of $136 million in Q1 2022 was an increase of 23% versus Q1 2021 driven by strong double-digit growth across Canadian cannabis and other consumer products, partially offset by a decline in international cannabis. Total net cannabis revenue of $93 million in Q1 2022, represented an increase of 17% over Q1 2021. Total other consumer products revenue in Q1 2022 increased 39% year-over year to $43 million. Excluding the impact from acquired businesses, net revenue increased 19% versus Q1 2021.

- Gross margin: Reported gross margin in Q1 2022 was 20% as compared to 6% in Q1 2021. Gross margin in Q1 2021 was negatively impacted by lower production output and unfavorable pack size and geographic mix in the Canadian recreational business as well as start up costs in the U.S. including building inventory and activating new production capacity along with higher third-party shipping, distribution and warehousing costs, partially offset by payroll subsidies received from the Canadian government in Q1 2022, pursuant to a COVID-19 relief program. Adjusted gross margin, excluding charges related to the flow-through of inventory step-up on business combinations, was 21% compared to 7% in Q1 2021.

- Operating expenses: Total SG&A (“SG&A”) expenses in Q1 2022 declined by 17% versus Q1 2021, driven by year-over-year reductions in General & Administrative (“G&A”) and Research and Development (“R&D”) expenses partially offset by an increase in Sales & Marketing (“S&M”) expenses. G&A expenses declined 48% year-over-year primarily due to reductions in staffing and professional fees and benefit from payroll subsidies received from the Canadian government in Q1 2022, pursuant to a COVID-19 relief program. R&D expenses declined 39% year-over-year principally due to product timing and lower finished product development expenses. S&M expenses increased 34% year-over-year due largely to a return to more normal advertising and promotional spending in the first quarter of fiscal 2022; in the first quarter of fiscal 2021, the Company delayed or cancelled various product and brand marketing initiatives due to the measures established to contain the spread of COVID-19.

- Net Earnings: Net Earnings in Q1 2022 of $390 million, which is a $518 million improvement versus Q1 2021, was driven primarily by Other Income totalling $581 million during Q1 2022 primarily attributable to non-cash fair value changes of $601 million.

- Adjusted EBITDA: Adjusted EBITDA loss in Q1 2022 was $64 million, a $29 million narrower loss versus Q1 2021 driven by higher sales and lower operating expenses. Adjusted EBITDA loss in Q1 2022 was negatively impacted by a $10.1 million impairment charge related to the changes in our sourcing strategy for certain products.

- Free Cash Flow: Free Cash Flow in Q1 2022 was an outflow of $186 MM, a 3% greater outflow vs Q1 2021. Relative to Q4 2021, Free Cash Flow during the quarter was negatively impacted by the timing of certain one-time payments totalling $19 million, incremental interest payment associated with the US$750 million debt financing that occurred in Q4 2021 as well as the impact of inventory build for BioSteel’s Ready-To-Drink (“RTD”) products in the U.S.

- Cash Position: Cash and Short-term Investments amounted to $2.1 billion at June 30, 2021, representing a decrease of $0.2 billion from $2.3 billion at March 31, 2021 reflecting EBITDA losses and capital investments.

First Quarter Fiscal 2022 Business & Operational Highlights

- Achieved another quarter of strong double-digit revenue growth year-over-year

- Canadian recreational sales grew 35% year-over-year, even as the industry was impacted by COVID lockdowns for much of the quarter.

- Canopy Growth maintained #1 market share in tracked provinces, with total market share (including Ace Valley and Supreme) of 15.2% during Q1 2022.

- In total Flower category, Canopy Growth also maintained #1 market share with 17.9% in Q1 2022.

- S. CBD business continues to build momentum driven by Martha Steward CBD which is now the #3 brand among all CBD supplements in the food, drug and convenience-store channel, according to IRI data for the 12 weeks ended July 11, 2021. In addition, distribution of Quatreau CBD beverages is ramping up in the U.S.

- Other Consumer Products brands also delivered strong growth driven by Storz & Bickel which saw sales increase by 41% year-over-year and BioSteel, which grew sales triple digits year-over-year driven by the launch of its RTD beverages.

- Canadian recreational sales grew 35% year-over-year, even as the industry was impacted by COVID lockdowns for much of the quarter.

- Led by consumer insights, already launched 50+ SKUs over past two quarters, 100+ SKUs expected to enter markets in coming quarters

- In Flower, national launch of Doja is ongoing including Ontario-exclusive Doja Legendary Larry flower, launched in Q1 2022, garnering strong consumer feedback. 7 Acres Papaya flower launched in Q1 2022. National launch of Tweed lineage strain products is also ongoing. Launch of Tweed Quickies and Ace Valley Pinners small size, single strain pre-rolled joints (0.35 g and 0.3g, respectively) in the current quarter addresses consumer preference for sharing cannabis in a group setting without having to pass a single joint around. The Company expects to bring a robust program of flower innovation to the market over the coming months including single strain genetics across key brands and new packaging.

- In Vapes, the Company strengthened its positioning in the Canadian vape market with the additional of 1.0 ml 510 cartridges and Tweed Citrus C-land all-in-one vape pens during Q1 2022. With the addition of Ace Valley and Supreme Cannabis vape products to the Company’s portfolio, Canopy Growth has captured the #3 market share for vapes in Canada. Addressing increasing consumer demand for premium vape cartridges and devices, Canopy is scheduled to bring a range of vape innovations to market over the coming quarters including premium Live Resin cartridges as well as multiple new or upgraded vape devices.

- In Beverages, in response to consumer demand for great-tasting 5mg and 10mg THC beverages, the Company has expanded its portfolio of THC beverages with Tweed Iced Tea beverages (available in lemon and raspberry flavors, both with 5 mg THC) entering market in Q1 2022 and new Tweed Fizz seltzer beverages (available in Watermelon and Mango flavors, both with 5 mg THC) shipping in the current quarter. The Company expects to double the number of THC beverages on the market over the coming months including line extensions of its popular Deep Space 10 mg THC beverages.

- In Edibles, the Company’s Twd. Strawberry gummies, launched in Q4 2021, have captured #2 market share in the total gummy category in Canada. Canopy Growth’s portfolio of gummies expanded in Q1 2022 with the launch of Ace Valley Dessert flavor gummies (Key Lime Pie and Peaches & Honey), followed by the launch of Twd. Mixed Berry as well as Ace Valley Dream CBN gummies in the current quarter. The Ace Valley Dream gummies contain the CBN minor cannabinoid which lends itself to a key consumer need state, sleep. The Company is scheduled to bring a robust portfolio of new gummy innovations to market over the coming months featuring gourmand flavours, higher THC levels and advanced “human effects”.

- Remain focused on further capitalizing on the U.S. market

- Path to cannabis reform took an important step forward with release of the draft Cannabis Administration and Opportunity Act.

- Multiple routes to market upon federal permissibility of U.S THC market already exist for the Company, including immediate path through planned acquisition of Acreage Holdings and conditional ownership of TerrAscend, which provides further optionality to increase presence.

- Leveraging balance sheet strength, the Company is actively seeking legally permitted investments in THC businesses/brands to increase exposure to U.S. THC market in advance of federal permissibility.

- Achieving profitability and improving cashflow remain the Company’s top priority

- Implementation of supply chain optimization is well underway, with the Company having realized $38 million, including $32 million in Q1 2022, of the $150 million to $200 million in cost savings expected by the end of the first half of FY 2023.

- Adjusted EBITDA performance improved, despite price/mix headwinds in our cannabis business, driven by strong operating expense discipline.

- The Company remains committed to achieving positive Adjusted EBITDA by the end of FY 2022 driven by accelerating top-line growth, cost savings initiatives and improved price/mix.

Canadian Cannabis

- Recreational B2B net sales in Q1 2022 increased 22% over prior year period due primarily to growth in the retail store network in Canada and growth in value flower.

- Recreational B2C net sales in Q1 2022 increased 84% versus Q1 2021 due primarily to growth in flower sales, the availability of vape, beverage and edible products and a higher number of corporate owned stores. The number of corporate owned stores increased over the comparison period by 12 to 34. Same store sales increased 65% year-over-year when normalized for days closed due to COVID-19.

- Canadian medical net revenue in Q1 2022 decreased 3% from Q1 2021 driven primarily by a lower number of orders partially offset by higher average order size.

International Cannabis

- C3 revenue in Q1 2022 declined 26% year-over-year due to COVID-19 restrictions that limited sales activities and increased competition.

- Other revenue in Q1 2022 increased 39% over the prior year period due primarily to growth in U.S. CBD sales.

Other Consumer Products

- S&B vaporizer revenue in Q1 2022 increased 41% over Q1 2021, benefitting from strengthened distribution in the U.S. and strong consumer demand across all key product lines including Mighty, Volcano Classic and Hybrid and Crafty+.

- This Works sales in Q1 2022 increased 7% over Q1 2021, driven by Amazon and third-party e-commerce sales.

- BioSteel sales in Q1 2022 increased 179% over Q1 2021 driven by the launch of RTD beverages and expanded distribution in the U.S. market.

The first quarter fiscal 2022 and first quarter fiscal 2021 financial results presented in this press release have been prepared in accordance with U.S. GAAP.

Webcast and Conference Call Information

The Company will host a conference call and audio webcast with David Klein, CEO and Mike Lee, CFO at 10:00 AM Eastern Time on August 6, 2021.

Webcast Information

A live audio webcast will be available at:

Replay Information

A replay will be accessible by webcast until 11:59 PM ET on November 4, 2021 at:

Non-GAAP Measures

Adjusted EBITDA is a non-GAAP measure used by management that is not defined by U.S. GAAP and may not be comparable to similar measures presented by other companies. Adjusted EBITDA is calculated as the reported net income (loss), adjusted to exclude income tax recovery (expense); other income (expense), net; loss on equity method investments; share-based compensation expense; depreciation and amortization expense; asset impairment and restructuring costs; restructuring costs recorded in cost of goods sold; and charges related to the flow-through of inventory step-up on business combinations, and further adjusted to remove acquisition-related costs. Asset impairments related to periodic changes to the Company’s supply chain processes are not excluded from Adjusted EBITDA given their occurrence through the normal course of core operational activities. The Adjusted EBITDA reconciliation is presented within this news release and explained in the Company’s Quarterly Report on Form 10-Q to be filed with the SEC.

Free Cash Flow is a non- GAAP measure used by management that is not defined by U.S. GAAP and may not be comparable to similar measures presented by other companies. This measure is calculated as net cash provided by (used in) operating activities less purchases of and deposits on property, plant and equipment. The Free Cash Flow reconciliation is presented within this news release and explained in the Company’s Quarterly Report on Form 10-Q to be filed with the SEC.

Adjusted Gross Margin and Adjusted Gross Margin Percentage are non-GAAP measures used by management that are not defined by U.S. GAAP and may not be comparable to similar measures presented by other companies. Adjusted Gross Margin is calculated as gross margin excluding restructuring and other charges recorded in cost of goods sold, and charges related to the flow-through of inventory step-up on business combinations. Adjusted Gross Margin Percentage is calculated as Adjusted Gross Margin divided by net revenue. The Adjusted Gross Margin and Adjusted Gross Margin Percentage reconciliation is presented within this news release.