Canopy Growth Corporation (“Canopy Growth” or the “Company”) (TSX: WEED) (NASDAQ: CGC) today announces its financial results for the second quarter fiscal 2022 ended September 30, 2021. All financial information in this press release is reported in Canadian dollars, unless otherwise indicated.

Highlights

- Announced plan to acquire the #1 edibles company in North America, Wana Brands, upon U.S. THC permissibility further strengthening U.S. ecosystem.

- Delivered a robust innovative new product pipeline with over 40+ new SKUs launching globally during Q2 FY2022.

- Launched whisl, an innovative CBD vape designed for mood management, through an exclusive partnership with Circle-K in the U.S.

- Net revenue declined by 3% in Q2 FY2022 versus Q2 FY2021. Maintained market leadership position in premium flower category and increased market share in vapes and edibles during Q2 FY2022 across tracked Canadian recreational cannabis market.

- Pushing out positive Adjusted EBITDA target due to Canada supply challenges and a delayed revenue ramp in the U.S.; taking a number of actions to improve Canadian performance and remain optimistic about the mid-to long-term outlook.

“In new industries where the potential is immense, progress is rarely a straight line. With a focused strategy, a foundation for growth, and our burgeoning U.S. ecosystem, Canopy is uniquely positioned to win as the industry matures.”

David Klein, Chief Executive Officer, Canopy Growth Corporation

“Achieving profitability remains a top priority. We are focused on increasing market share in Canada, premiumizing our product mix and delivering on our cost savings commitment.”

Mike Lee, Chief Financial Officer, Canopy Growth Corporation

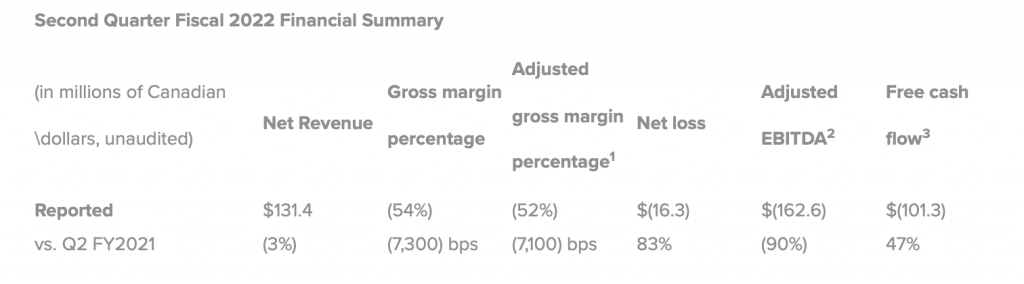

Second Quarter Fiscal 2022 Financial Summary

Revenues:

Net revenue of $131 million in Q2 FY2022 was a decline of 3% versus Q2 FY2021. Total net cannabis revenue of $95 million in Q2 FY2022, represented an increase of 1% over Q2 FY2021. Excluding the impact from acquired businesses, net revenue declined 13% and cannabis revenue declined 14% versus Q2 FY2021.

Gross margin:

Reported gross margin in Q2 FY2022 was (54%) as compared to 19% in Q2 FY2021. Excluding non-cash charges related to inventory write-downs and inventory step-up charges from acquisitions, as well as certain other non-recurring items including Canadian government payroll subsidies pursuant to a COVID-19 relief program, gross margin would have been approximately 12%. Inventory write-downs in Q2 FY22 amounted to $87 million and primarily relate to excess Canadian cannabis inventory resulting from lower sales relative to forecast as well as declines in expected near-term demand. Gross margin in Q2 FY2022 was further impacted by lower production output and price compression in the Canadian recreational business as well as higher third-party shipping, distribution and warehousing costs across North America.

Operating expenses:

Total SG&A (“SG&A”) expenses in Q2 FY2022 declined by 15% versus Q2 FY2021, driven by year-over-year reductions in General & Administrative (“G&A”) and Research and Development (“R&D”) expenses partially offset by an increase in Sales & Marketing (“S&M”) expenses. G&A expenses declined 49% year-over-year primarily due to reductions in staffing and professional fees and benefit from payroll subsidies received from the Canadian government in Q2 FY2022, pursuant to a COVID-19 relief program. R&D expenses declined 38% year-over-year principally due to project timing. S&M expenses increased 49% year-over-year primarily due a return to more normal advertising and promotions spending in Q2 FY2022, compared to the prior year, higher sponsorship fees associated with BioSteel’s partnership deals and increased advertising expenses associated with new product launches.

Net Earnings:

Net Earnings in Q2 FY2022 amounted to a loss of $16 million, which is an $80 million improvement versus Q2 FY2021, driven primarily by Other Income totaling $196 million during Q2 FY2022 mostly attributable to non-cash fair value changes of $233 million.

Adjusted EBITDA:

Adjusted EBITDA loss in Q2 FY2022 was $163 million, a $77 million wider loss versus Q2 FY2021 driven by lower sales, a decline in gross margins, partially offset by the reduction in our total selling, general and administrative expense. Adjusted EBITDA loss in Q2 FY2022, excluding non-cash inventory write-downs would have been a loss of $76 million.

Free Cash Flow:

Free Cash Flow in Q2 FY2022 was an outflow of $101 million, a 47% decrease in outflow vs Q2 FY2021. Relative to Q2 FY2021, the Free Cash Flow outflow reduction reflects the decrease in cash used for operating activities and the lower purchases of property, plant and equipment.

Cash Position:

Cash and Short-term Investments amounted to $2.0 billion at September 30, 2021, representing a decrease of $0.3 billion from $2.3 billion at March 31, 2021 reflecting EBITDA losses and capital investments.

Outlook

Pushing out positive Adjusted EBITDA target due to market share challenges in the Canadian recreational business and a slower-than-expected ramp-up of U.S. distribution for BioSteel

- The Company continues to expect revenue acceleration in the second half of FY2022 but the magnitude and pace of improvement is expected to be more modest than previously anticipated. The Company is focused on stabilizing its market share of the Canadian recreational cannabis in the second half of FY2022. Distribution expansion of BioSteel is expected to accelerate in the second half of FY2022 but shipments may depend on timing of chain authorizations and associated shelf resets.

- The Company is taking steps to improve its Canadian recreational business, with increased supply of in-demand high THC flower products and new product launches across flower, pre-roll joints, vapes, edibles and beverages expected to improve market share. Additionally, the Company recently implemented a portfolio optimization strategy that is designed to improve distribution of high-velocity and high-margin products while reducing supply chain complexity and improving service levels on priority SKUs. The portfolio optimization work, along with increased sales, is expected to lead to improved gross margin in the Canadian operations.

- The Company remains optimistic about its growth opportunities in the U.S. for both its BioSteel ready-to-drink (“RTD”) beverages and its portfolio of CBD brands. Brand awareness continues to rise, velocity is tracking in-line with expectations and feedback from distributors and retailers has been positive. BioSteel is expected to see its distribution ramp up over the balance of FY2022 and into FY2023 driven by increased listings with national and regional chain accounts.

- Implementation of the previously announced cost savings program is well underway, with the Company having realized $70 million, including $32 million in Q2 FY2022, of the $150 million to $200 million in cost savings expected by the end of the first half of FY2023. The Company is taking steps to reduce/delay discretionary spending and further tighten G&A expenses, an effort that is also expected to contribute to the Company achieving positive adjusted EBITDA.

- Further mitigating impact to Free Cash Flow through a reduced CapEx plan, with FY2022 CapEx now expected to be in the range of $100 million to $150 million.

| Second Quarter Fiscal 2022 Business HighlightsAmid a highly competitive Canadian recreational market, increased market share in vapes and edibles and maintained market leadership in premium flower category In Q2 FY2022, increased vape market share by 20 bps to 8.5%4 and increased edibles market share by 50 bps to 8.7%, from Q1 FY2022.Maintained #1 market share in premium flower category in Q2 FY2022 with 13.2%, down 310 bps quarter over quarter, #2 market share in the value flower category in Q2 FY2022 with 18.1%, down 540 bps sequentially.Market share softness across flower categories was driven by insufficient supply of flower with in-demand attributes, including higher THC, in the premium and mainstream categories as well heightened competition focused on single strain offerings in the value flower category.Flower products with in-demand attributes, including higher THC, have begun coming to market, with supply expected to build over 2H FY2022. U.S. business continues to gain momentum, distribution expected to ramp into spring CY2022 BioSteel RTD beverages continued to build distribution throughout Q2 FY2022, with All Commodity Volume (“ACV”) increasing to 6.5% in the latest 13-weeks ending October 3, 2021 in IRI. BioSteel has recently secured new distribution with a number of key retailers, and active discussions underway with additional national and regional chain retailers.Martha Stewart CBD remains one of the fastest growing CBD brand across all formats and is now the #3 brand among all CBD gummies in the food, drug and convenience-store channel with 12.4% market share, according to IRI data for the 4 weeks ended October 3, 2021. A range of new Martha Stewart CBD confectionary products has shipped in the current quarter.Subsequent to quarter end, Canopy announced an agreement to acquire, upon federal permissibility of THC, Wana Brands, the #1 cannabis edibles brand in North America. Wana’s leadership position and ongoing expansion across the U.S. bolsters Canopy Growth’s product, brand and geographic exposure to the U.S. cannabis market upon federal permissibility. Over 40 new SKUs shipped in Q2 FY2022 including new innovative cannabis-based mood management vape In Flower:Launched a range of premium flower SKUs in Q2 FY2022 including new DOJA Okanagan Grown Ultra Sour and Cold Creek Kush, as well as DOJA Craft limited time offerings including Cali Kush Cake and GMO Garlic Breath.Launched small format pre-rolled joints in Q2 FY2022 – Tweed Quickies, in Green Kush and Afghan Kush, and Ace Valley Pinners, in Kosher Kush, OG Mellon and Great White Shark – the first CBD dominant pre‑roll in the category.The Company expects to bring additional flower and pre-roll products to market over the coming months including new strains across all categories with DOJA 91K, Tweed Powdered Donuts, Twd. Garlic Jelly flower shipped in the current quarter. In Vapes:The Company launched the new nicotine-free, whisl CBD vaporizer in the U.S in Q2 FY2022. whisl brings cannabis-based mood management to vapes, offering three uniquely formulated options to help consumers dial in to their desired effect – focus, calm, or winding down. whisl is available on shopcanopy.com and in over 3,500 Circle-K stores across the U.S. currently. whisl is already the #3 CBD vape in the U.S. per IRI data for the 4 weeks ended October 3, 2021.Storz & Bickel released three new vaporizer updates in Q2 FY2022 including the limited-edition VOLCANO ONYX and the MIGHTY+ vaporizer featuring a fast-charging USB-C socket, pre-set Superbooster temperature and 60-second rapid heat up time.The Company is scheduled to ship premium 7Acres live-resin dab-friendly concentrates in the coming months. In Beverages:The Company further expanded its beverage portfolio with Tweed Iced Tea (available in lemon and raspberry flavours, both with 5 mg THC) entering the market in Q1 FY2022 and new Tweed Fizz seltzers (available in Watermelon and Mango flavours, both with 5 mg THC) entering the market in Q2 FY2022.The Company has expanded the popular Deep Space brand having shipped Deep Space Limon Splashdown in the current quarter. In Edibles:In Q2 FY2022, the Company launched Ace Valley Dream CBN gummies containing the minor cannabinoid CBN which lends itself to sleep. The Company also launched Ace Valley Super CBD gummies in Q2 FY2022.The Company has extended the popular Deep Space brand into the edibles category with shipments of our new Deep Space XPRESS gummies beginning in Q3 FY2022. The Deep Space XPRESS gummy contains the maximum allowable 10 mg THC per gummy and are available in the original Deep Space Cola and new Limon Splashdown flavours. In addition, new Tweed XPRESS gummies will begin to ship in Q3 FY2022.Also in Q3 FY2022, the Company has begun shipping new Martha Stewart Harvest Medley CBD Wellness Gummies, Mini CBD Peppermint Ribbons, and the Snowflake CBD Gummy Sampler. |

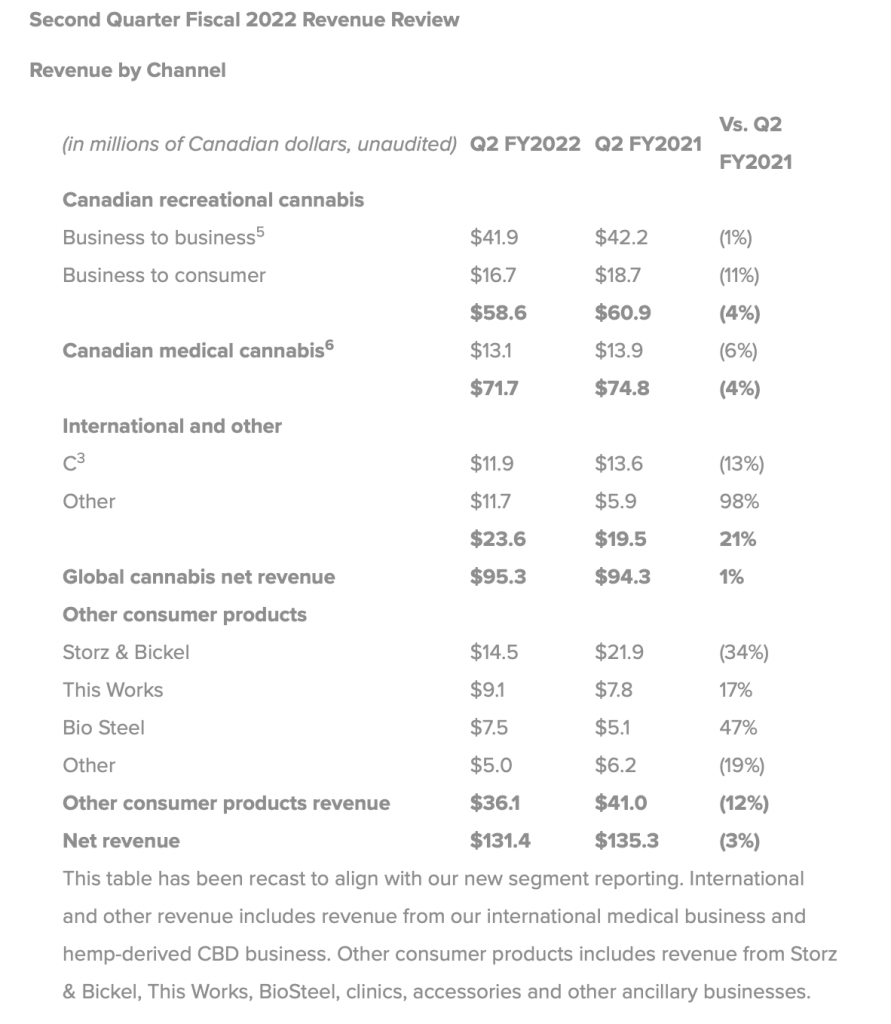

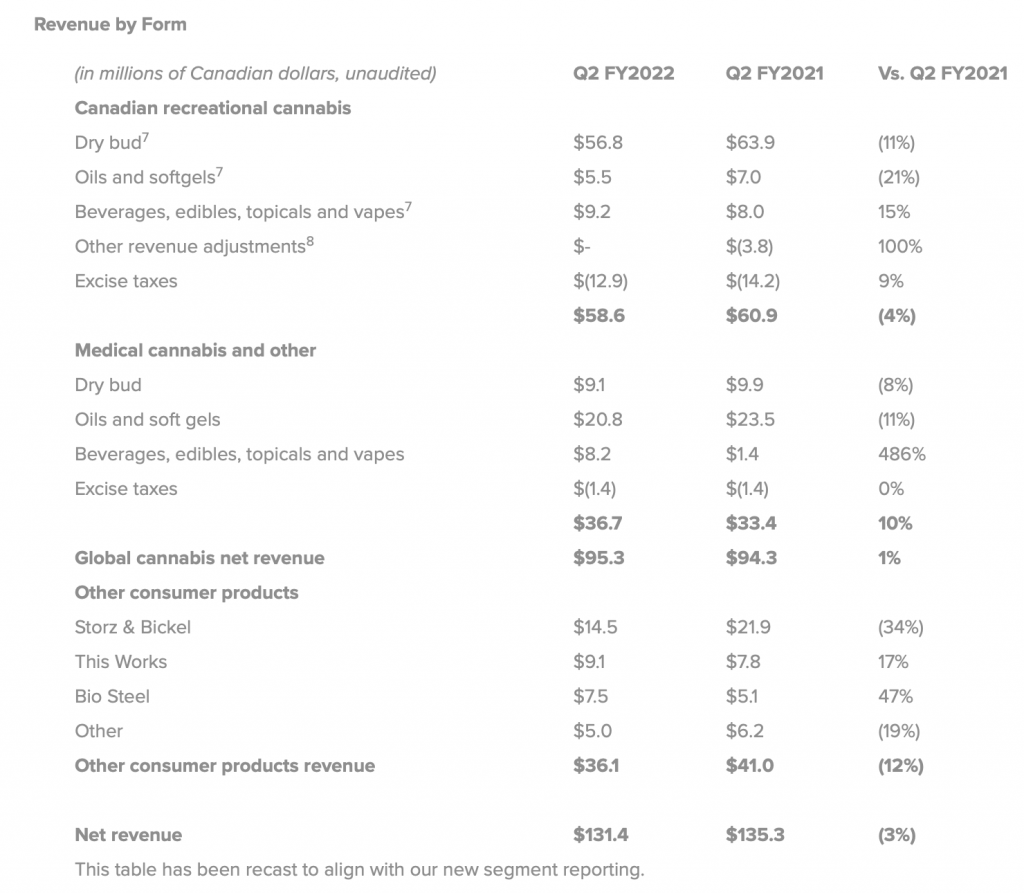

Second Quarter Fiscal 2022 Revenue Review

Canadian Cannabis

- Recreational B2B net sales in Q2 FY2022 decreased 1% over prior year period primarily due to insufficient supply of flower products with in-demand attributes and continued price compression, particularly in the value-priced dried flower category. These factors were largely offset by contribution from the acquisitions of Ace Valley and Supreme Cannabis.

- Recreational B2C net sales in Q2 FY2022 decreased 11% versus Q2 FY2021 largely driven by the rapid increase in third party retail locations across provinces.

- Medical net revenue in Q2 FY2022 decreased 6% from Q2 FY2021 driven primarily by higher average order sizes offset by a fewer number of orders.

International Cannabis

- C3 revenue in Q2 FY2022 decreased 13% year-over-year as a result of increased competition as well as the negative impact of FX, as the Canadian dollar has strengthened against the Euro compared to a year ago.

- Other revenue in Q2 FY2022 increased 98% over the prior year period primarily due to growth in U.S. CBD sales.

Other Consumer Products

- S&B vaporizer revenue in Q2 FY2022 decreased 34% over Q2 FY2021 in part due to a strong comparison during the year-ago period,as well as shipping restrictions and production shortages caused by global supply chain difficulties.

- This Works sales in Q2 FY2022 increased 17% over Q2 FY2021, driven by Amazon and third-party e-commerce sales.

- BioSteel sales in Q2 FY2022 increased 47% over Q2 FY2021 driven by the launch of RTD beverages and expanded distribution in the U.S. market.

The second quarter fiscal 2022 and second quarter fiscal 2021 financial results presented in this press release have been prepared in accordance with U.S. GAAP.

Webcast and Conference Call Information

The Company will host a conference call and audio webcast with David Klein, CEO and Mike Lee, CFO at 10:00 AM Eastern Time on November 5, 2021.

Webcast Information

A live audio webcast will be available at:

Replay Information

A replay will be accessible by webcast until 11:59 PM ET on February 3, 2022 at:

Non-GAAP Measures

Adjusted EBITDA is a non-GAAP measure used by management that is not defined by U.S. GAAP and may not be comparable to similar measures presented by other companies. Adjusted EBITDA is calculated as the reported net income (loss), adjusted to exclude income tax recovery (expense); other income (expense), net; loss on equity method investments; share-based compensation expense; depreciation and amortization expense; asset impairment and restructuring costs; restructuring costs recorded in cost of goods sold; and charges related to the flow-through of inventory step-up on business combinations, and further adjusted to remove acquisition-related costs. Asset impairments related to periodic changes to the Company’s supply chain processes are not excluded from Adjusted EBITDA given their occurrence through the normal course of core operational activities. The Adjusted EBITDA reconciliation is presented within this news release and explained in the Company’s Quarterly Report on Form 10-Q to be filed with the Securities and Exchange Commission (“SEC”).

Free Cash Flow is a non- GAAP measure used by management that is not defined by U.S. GAAP and may not be comparable to similar measures presented by other companies. This measure is calculated as net cash provided by (used in) operating activities less purchases of and deposits on property, plant and equipment. The Free Cash Flow reconciliation is presented within this news release and explained in the Company’s Quarterly Report on Form 10-Q to be filed with the SEC.

Adjusted Gross Margin and Adjusted Gross Margin Percentage are non-GAAP measures used by management that are not defined by U.S. GAAP and may not be comparable to similar measures presented by other companies. Adjusted Gross Margin is calculated as gross margin excluding restructuring and other charges recorded in cost of goods sold, and charges related to the flow-through of inventory step-up on business combinations. Adjusted Gross Margin Percentage is calculated as Adjusted Gross Margin divided by net revenue. The Adjusted Gross Margin and Adjusted Gross Margin Percentage reconciliation is presented within this news release.