Cronos Group Inc. (NASDAQ: CRON) (TSX: CRON) (“Cronos Group” or the “Company”), today announces its 2020 fourth quarter and full-year business results.

“Our fourth quarter 2020 results are the summation of the hard work and perseverance the Company has put into this past year despite the challenges of 2020. As we look to 2021, I’m incredibly excited about the teams we have supporting our brands and the breakthrough research and development (“R&D”), innovation and exciting marketing campaigns Cronos Group plans to execute on. We are poised to build upon the growth we experienced in 2020 as we continue to push cannabinoid innovation and differentiated product offerings under our portfolio of brands,” said Kurt Schmidt, President and CEO of Cronos Group. “My goals this year will be to focus on building a winning team by fostering a collaborative, performance-driven culture; continue to focus on creating disruptive technology and innovation; grow and develop our brands and strengthen our ability to compete through R&D, strategic global infrastructure and engaging in the legislative process in key markets.”

Fourth Quarter 2020

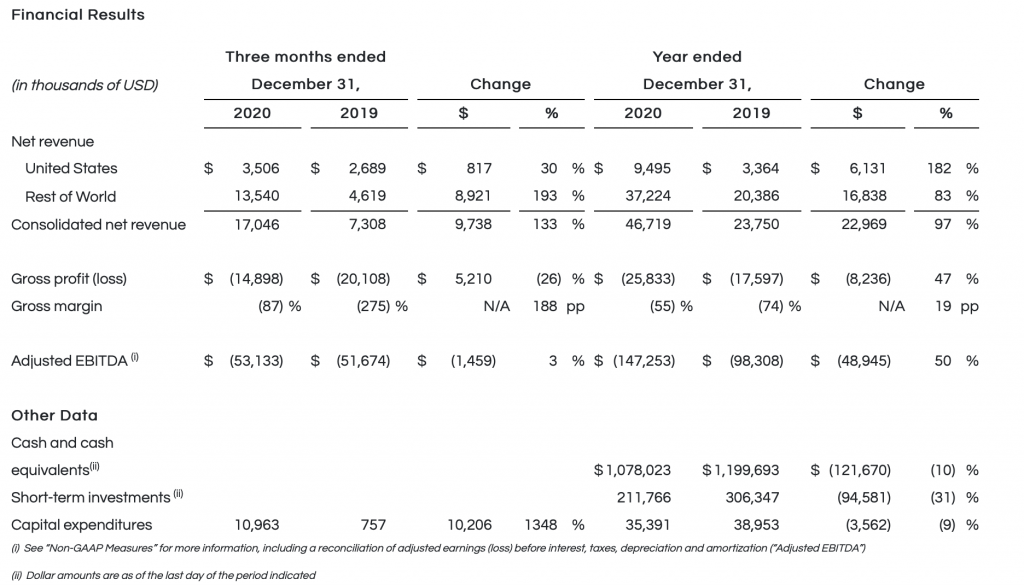

- Net revenue of $17.0 million in Q4 2020 increased by $9.7 million from Q4 2019. The increase year-over-year was primarily driven by continued growth in the adult-use market in Canada, sales in the Israeli medical market and growth in our U.S. segment. Partially offset by non-recurring wholesale revenue in the Canadian market in Q4 2019 and strategic price reductions on various adult-use cannabis products in Canada in Q4 2020.

- Gross loss of $14.9 million in Q4 2020 decreased by $5.2 million from Q4 2019. The decrease in losses year-over-year was primarily driven by a decline in inventory write-downs and increased gross profit in the U.S. segment. Offset by third party purchased flower associated with adult-use products in Canada and a decline in wholesale sales in Q4 2020 versus Q4 2019.

- The Company incurred an inventory write-down in Q4 2020 of $15.0 million on dried cannabis and cannabis extracts, primarily driven by cannabis product price compression in the Canadian market. The Company may incur further inventory write-downs due to pricing pressures in the marketplace.

- Adjusted EBITDA loss of $53.1 million in Q4 2020 increased by $1.5 million from Q4 2019. The increase in losses year-over-year was primarily driven by an increase in general and administrative expenses and an increase in R&D spending.

- Capital expenditures of $11.0 million in Q4 2020 increased by $10.2 million from Q4 2019. The increase year-over-year was primarily driven by spending at the Company’s Peace Naturals campus, Cronos Fermentation, our Israeli facility, and our new ERP system.

Full-Year 2020

- Net revenue of $46.7 million in Full-Year 2020 increased by $23.0 million from Full-Year 2019. The increase year-over-year was primarily driven by continued growth in the adult-use market in Canada, growth in our U.S. segment, which included a full-year of the Redwood business as opposed to 117 days in Full-Year 2019, and sales in the Israeli medical market. Partially offset by non-recurring wholesale revenue in the Canadian market in Full-Year 2019 and strategic price reductions on various adult-use cannabis products in Canada in Full-Year 2020.

- Gross loss of $25.8 million in Full-Year 2020 increased by $8.2 million from Full-Year 2019. The increase in losses year-over-year was primarily driven by third party purchased flower associated with adult-use products in Canada and a decline in wholesale sales in Full-Year 2020 versus Full-Year 2019. Partially offset by increased gross profit in the U.S. segment due to a full year of results from the Redwood business and a decrease in inventory write-downs in the ROW segment.

- The Company incurred an inventory write-down in Full-Year 2020 of $26.1 million, on dried cannabis and cannabis extracts, primarily driven by cannabis product price compression in the Canadian market. The Company may incur further inventory write-downs due to pricing pressures in the marketplace.

- Adjusted EBITDA loss of $147.3 million in Full-Year 2020 increased by $48.9 million from Full-Year 2019. The increase in losses year-over-year was primarily driven by an increase in gross loss, increased general and administrative expenses, higher sales and marketing costs related to brand development and R&D spending.

- Capital expenditures of $35.4 million in Full-Year 2020 decreased by $3.6 million from Full-Year 2019. The decrease year-over-year was primarily driven by a reduction in spending at the Company’s Peace Naturals campus and Cronos Israel. Partially offset by an increase in spending at Cronos Fermentation.

Business Updates

Brand Portfolio

Happy Dance™ continues its expansion by securing its first major U.S. retailer, ULTA Beauty™. The full collection of Happy Dance™ products is expected to launch online at ULTA.com and in-store in over 550 ULTA Beauty™ locations across the U.S. in the coming weeks. Happy Dance™ was co-founded by actress and New York Times best-selling author Kristen Bell and features an easy-to-use line of clean, vegan and cruelty-free U.S. hemp-derived CBD bath and body products including an All-Over Whipped Body Butter + CBD, Head-to-Toe Coconut Melt + CBD and Stress Away Bath Bomb + CBD.

During 2020, Cronos Israel received all certifications and licenses required for the cultivation, production and marketing of dried flower, pre-rolls and oils in Israel and currently has PEACE NATURALS™ dried flower and oils in market. On January 11, 2021, the PEACE NATURALS™ brand was recognized by the Israeli Marketing Association and was given the 2020 Innovation Award for its successful marketing strategy in 2020, which led to increased brand exposure. The marketing campaign gained this accolade for standing out amongst its peers by focusing on the high-quality nature of PEACE NATURALS™ products. In February 2021, Cronos Israel signed a distribution agreement with the largest pharmacy chain in Israel, Super-Pharm, which has over 250 branches in Israel. Cronos Israel continues to build distribution and brand awareness through a growing network of pharmacies.

Global Supply Chain

In 2020, Cronos Growing Company Inc. (“Cronos GrowCo”), the Company’s joint venture in Canada, fully completed construction of its production facility, including all fixtures within the greenhouse and all post-harvest activity areas. In November 2020, Cronos GrowCo obtained a cultivation license for the operations contemplated by the first phase of the project. The Company expects the facility to become operational in phases beginning in the first half of 2021.

Throughout 2020, Natuera, the Company’s joint venture in Latin America, a fully licensed operation in Colombia for hemp and cannabis derived bulk, consumer, and medicinal cannabinoid products, continued to achieve significant operational milestones. In addition to completing a number of test exports of hemp-derived CBD extract to both the U.S. and the United Kingdom for business development and R&D purposes over the course of 2020, during the fourth quarter of 2020, Natuera completed its first export of hemp-derived CBD extract to the U.S. for commercial purposes.

Update on COVID-19

Cronos Group’s manufacturing sites have adjusted and continue to develop in order to comply with the current COVID-19 guidelines provided by governmental authorities. In the U.S., while online sales have continued despite facing pressure, certain beauty and other retailers have temporarily closed physical boutique locations. State specific limitations on retail capacity have also reduced the ability of larger retailers to offer in-store brand education for the Company’s products. Revenue in the Rest of World segment was not materially impacted by the effects of COVID-19 during the three months or year ended December 31, 2020. However, prolonged closures of retail stores due to government mandated lockdowns as well as the changes in consumer purchasing behavior in Canada during the COVID-19 pandemic are expected to have a negative impact on the Company’s short-term revenue growth in Canada.

Fourth Quarter 2020

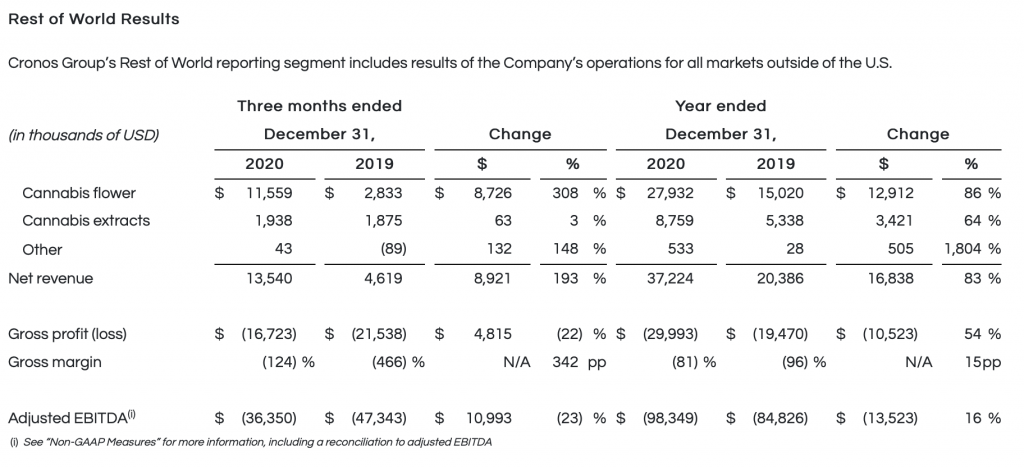

- Net revenue of $13.5 million in Q4 2020 increased by $8.9 million from Q4 2019. The increase year-over-year was primarily driven by continued growth in the adult-use market in Canada and sales in the Israeli medical market. Partially offset by non-recurring wholesale revenue in the Canadian market in Q4 2019 and strategic price reductions on various adult-use cannabis products in Canada in Q4 2020.

- Gross loss of $16.7 million in Q4 2020 decreased by $4.8 million from Q4 2019. The decrease in losses year-over-year was primarily driven by a decline in inventory write-downs. Offset by third party purchased flower associated with adult-use products in Canada and a decline in wholesale sales in Q4 2020 versus Q4 2019.

- The Company incurred an inventory write-down in Q4 2020 of $15.0 million, on dried cannabis and cannabis extracts, primarily driven by cannabis product price compression in the Canadian market. The Company may incur further inventory write-downs due to pricing pressures in the marketplace.

- Adjusted EBITDA loss of $36.4 million in Q4 2020 decreased by $11.0 million from Q4 2019. The improvement year-over-year was primarily driven by a decline in gross loss, reduced sales and marketing costs and a decline in general and administrative expenses.

Full-Year 2020

- Net revenue of $37.2 million in Full-Year 2020 increased by $16.8 million from Full-Year 2019. The increase year-over-year was primarily driven by continued growth in the adult-use market in Canada and sales in the Israeli medical market. Partially offset by non-recurring wholesale revenue in the Canadian market in Full-Year 2019 and strategic price reductions on various adult-use cannabis products in Canada in Full-Year 2020.

- Gross loss of $30.0 million in Full-Year 2020 increased by $10.5 million from Full-Year 2019. The increase in losses year-over-year was primarily driven by third party purchased flower associated with adult-use products in Canada and a decline in wholesale sales in Full-Year 2020 versus Full-Year 2019. The Company anticipates that gross margin will continue to fluctuate as price and mix change from quarter-to-quarter.

- The Company incurred an inventory write-down in Full-Year 2020 of $26.1 million, on dried cannabis and cannabis extracts, primarily driven by cannabis product price compression in the Canadian market. The Company may incur further inventory write-downs due to pricing pressures in the marketplace.

- Adjusted EBITDA loss of $98.3 million in Full-Year 2020 increased by $13.5 million from Full-Year 2019. The increase in losses year-over-year was primarily driven by an increase in gross loss, increased R&D spending, increased general and administrative expenses, and higher sales and marketing costs related to brand development.

Fourth Quarter 2020

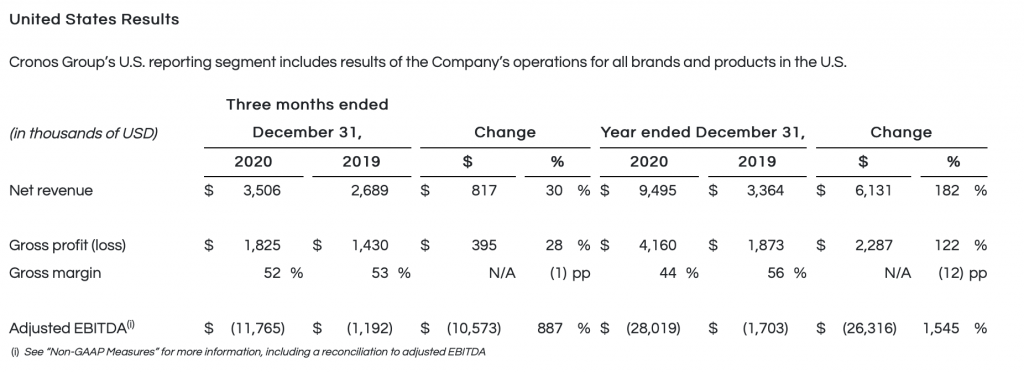

- Net revenue of $3.5 million in Q4 2020 increased by $0.8 million from Q4 2019. The increase year-over-year was primarily driven by growth in existing product lines and introductions of new hemp-derived CBD products.

- Gross profit of $1.8 million in Q4 2020 increased by $0.4 million from Q4 2019.

- Adjusted EBITDA loss of $11.8 million in Q4 2020 increased by $10.6 million from Q4 2019. The increase in losses year-over-year was primarily driven by higher sales and marketing costs related to brand development and increased general and administrative expenses.

Full-Year 2020

- Net revenue of $9.5 million in Full-Year 2020 increased by $6.1 million from Full-Year 2019. The increase year-over-year was primarily driven by a full-year of the Redwood business as opposed to 117 days in Full-Year 2019 and the growth in existing product lines and introductions of new hemp-derived CBD products. A significant amount of the U.S. Segment’s FY 2020 revenue was earned during the fourth quarter as a result of increased sales in the direct-to-consumer channel driven by holiday sales.

- Gross profit of $4.2 million in Full-Year 2020 increased by $2.3 million from Full-Year 2019.

- Adjusted EBITDA loss of $28.0 million in Full-Year 2020 increased by $26.3 million from Full-Year 2019. The increase in losses year-over-year was primarily driven by higher sales and marketing costs related to brand development and increased general and administrative expenses.

Conference Call

The Company will host a conference call and live audio webcast on Friday, February 26, 2021 at 8:30 a.m. EST to discuss 2020 fourth quarter and full-year business results and outlook. The call will last approximately one hour. An audio replay of the call will be archived on the Company’s website for replay. Instructions for the conference call are provided below:

- Live audio webcast: https://ir.thecronosgroup.com/events-presentations

- Toll Free from the U.S. and Canada dial-in: (866) 795-2258

- International dial-in: (409) 937-8902

- Conference ID: 1192729