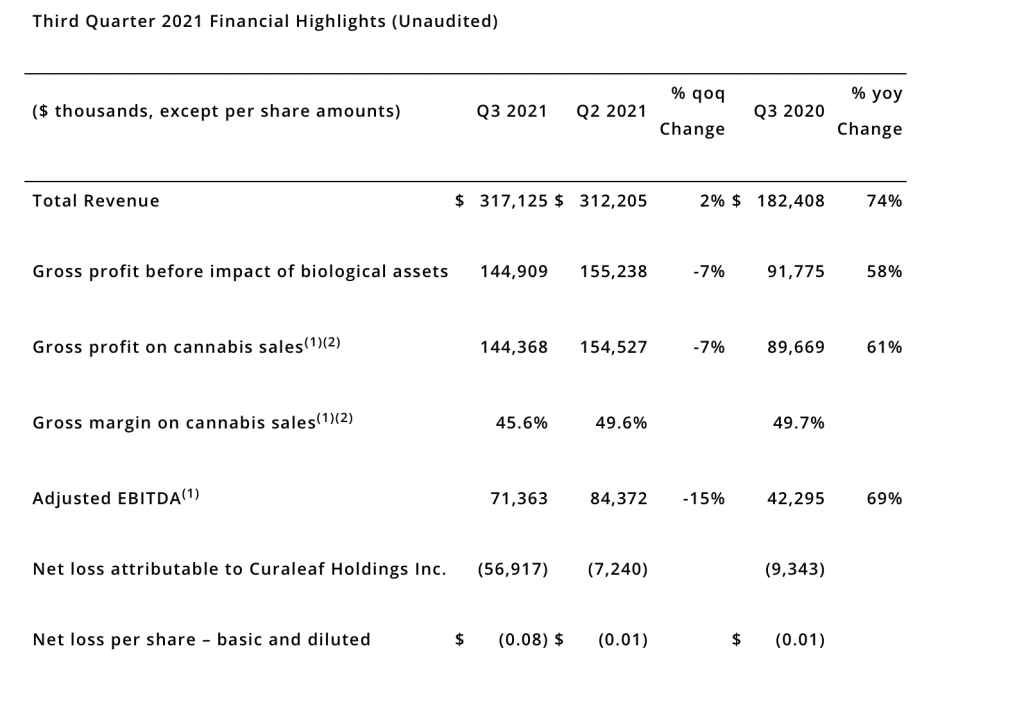

– Third quarter 2021 Revenue of $317 million, an increase of 2% sequentially and 74% YoY

– Third quarter 2021 Adjusted EBITDA(1) of $71 million, an increase of 69% YoY

– Third quarter cash flow from operations of $52 million or 16% of revenue

– Completed on October 1, 2021, the previously announced acquisition of Los Sueños Farms

– Entered into definitive agreement to acquire Tryke Companies, a vertically integrated MSO operating in Nevada, Arizona, and Utah

WAKEFIELD, Mass., Nov. 8, 2021 /PRNewswire/ — Curaleaf Holdings, Inc. (CSE: CURA) (OTCQX: CURLF) (“Curaleaf” or the “Company”), a leading international provider of consumer products in cannabis, today reported its financial and operating results for the third quarter ended September 30, 2021. All financial information is provided in U.S. dollars unless otherwise indicated.

(1) | See “Non-IFRS Financial and Performance Measures” below for more information regarding Curaleaf’s use of Non-IFRS financial measures and other reconciliations. |

| (2) | Cannabis sales excludes Management Fee Income. Gross profit and gross margin on cannabis sales both exclude the impact of biological assets. |

Earnings Call: Monday, November 8, 2021, at 5:00 P.M. ET

Conference ID # is 2599473

Replay ID # is 10160750

| U.S. Live Call: +1-888-317-6003 | U.S. Replay: +1-877-344-7529 |

| International Live Call (Toll): +1-412-317-6061 | International Replay (Toll): +1-412-317-0088 |

| Canada Live Call: +1-866-284-3684 | Canada Replay: +1-855-669-9658 |

A webcast of the call can be accessed on the investor relations section of the Curaleaf website at ir.curaleaf.com

The teleconference will be available for replay starting at approximately 7:00 P.M. ET

on November 8, 2021, and will end at 7:00 P.M. ET on November 15, 2021

Boris Jordan, Executive Chairman of Curaleaf commented, “During the third quarter we delivered record revenue of $317 million, representing 2% sequential and 74% year-over-year growth. We also generated $52 million of positive operating cash flow. While we faced some transient headwinds during the quarter, we continued to execute well against our strategic initiatives, prioritizing growth and gaining market share. As a result, we remain on track to achieve our $1.2 to $1.3 billion annual revenue guidance, albeit at the lower end of the range, representing growth of over 90%. Strategic M&A remains a key pillar our growth plan. We closed the Los Sueños Farms acquisition in October, and today announced another highly strategic deal to acquire Tryke Companies, a vertically integrated MSO which bolsters our leadership position in Nevada, Arizona, and Utah and will be immediately accretive to our margins and cash flow.”

Joe Bayern, Chief Executive Officer of Curaleaf stated, “We continued to successfully execute our plan for long-term growth in the third quarter with a focus on our four pillars of competitive advantage – research & development, commercialization, national distribution, and marketing and brand building. We expanded our scale and reach by strategically growing our retail and wholesale presence and significantly increasing our cultivation capacity both organically and, more recently, through M&A. Significant investments in R&D are a cornerstone of our competitive advantage, and we continued to set ourselves apart with the introduction Cliq by Select in the third quarter, while also expanding our innovative Select Squeeze and Nano Bites products to new markets. Looking to the balance of 2021 and beyond, we will continue to execute our long-term strategy with a focus on gaining market share in a sustainable and profitable manner.”

Third Quarter Operating Highlights

- Opened two new dispensaries located in Bordentown, New Jersey and Wells, Maine bringing total retail locations to 109 as of September 30, 2021.

- Expanded the number of U.S. wholesale accounts by 6% sequentially, exceeding 2,100 active accounts as of September 30, 2021.

- On track to organically add 275,000 square feet of flower canopy by year-end 2021.

- Introduced Select Squeeze THC infused beverage enhancer in several new markets including Michigan, New Jersey, and New York.

- Launched Cliq by Select premium vape system, a unique hardware design featuring a proprietary pod and durable stainless-steel encasing in Arizona, California, Nevada, and Oregon with additional markets expected by year-end 2021.

Post-Third Quarter Operating Highlights

- Closed the previously announced acquisition of Los Sueños Farms and its related entities bringing total Curaleaf cultivation capacity to approximately 4.4 million square feet and retail locations to 111 as of November 8, 2021.

- Entered into a definitive agreement to acquire Tryke Companies, a vertically integrated MSO operating in Nevada, Arizona, and Utah. Tryke owns and operates the Reef-branded dispensaries with four highly trafficked retail stores in Nevada and two in Arizona and brings an extensive and highly complementary vertical portfolio of retail and wholesale distribution, licenses, and cultivation assets to Curaleaf. For more information, please refer to the Company’s press release at https://ir.curaleaf.com/.

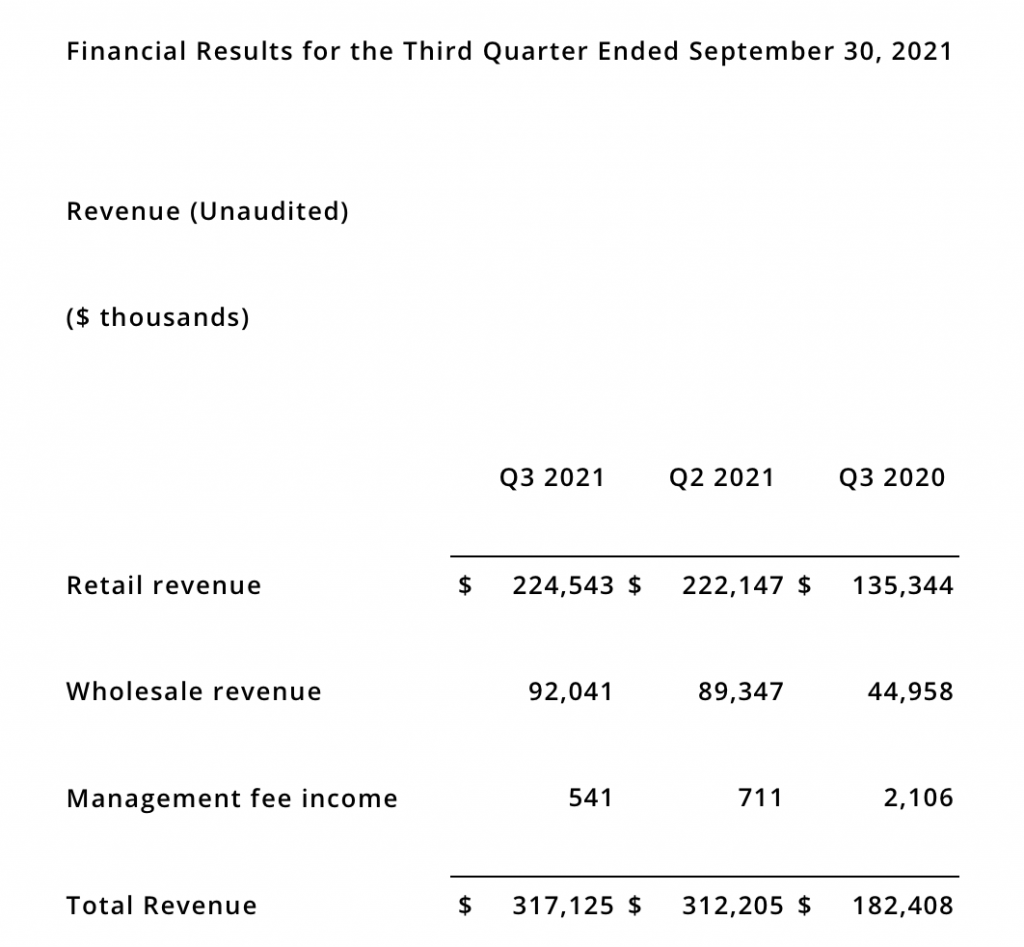

Total revenue was $317 million for the third quarter of 2021, an increase of 2% from $312 million in the second quarter of 2021 and 74% from $182 million in the third quarter of 2020.

Retail revenue reached $225 million, representing 1% sequential growth and 66% year-over-year growth. Retail revenue represented 71% of total revenue. During the third quarter the Company opened two new dispensaries including one in Bordentown, New Jersey and one in Wells, Maine, reaching 109 dispensaries as of quarter end.

Wholesale revenue grew 3% sequentially and 105% year-over-year to $92 million and represented 29% of total revenue. During the third quarter, total wholesale accounts increased approximately 6% sequentially and exceeded 2,100 accounts at quarter end.

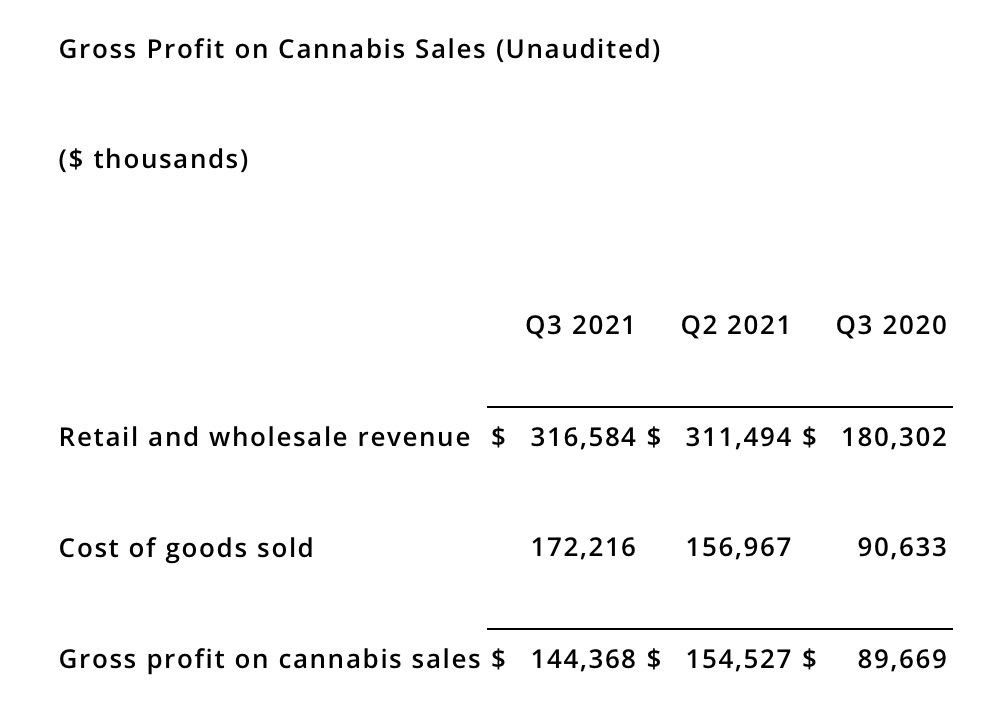

Gross profit on Cannabis Sales was $144 million for the third quarter of 2021, an increase of 61% from $90 million in the third quarter of 2020. Gross profit margin was 45.6%, compared with 49.6% in the prior quarter and 49.7% in the third quarter of 2020. The change in gross margin primarily reflects a one-time loss on inventory related to the Eureka, California facility divestiture, lower revenue growth in certain Northeast markets, and the write down of certain other inventory in the third quarter of 2021, partially offset by ongoing cultivation and process efficiencies. Excluding one-time impacts, third quarter 2021 gross margin was 47.7%.

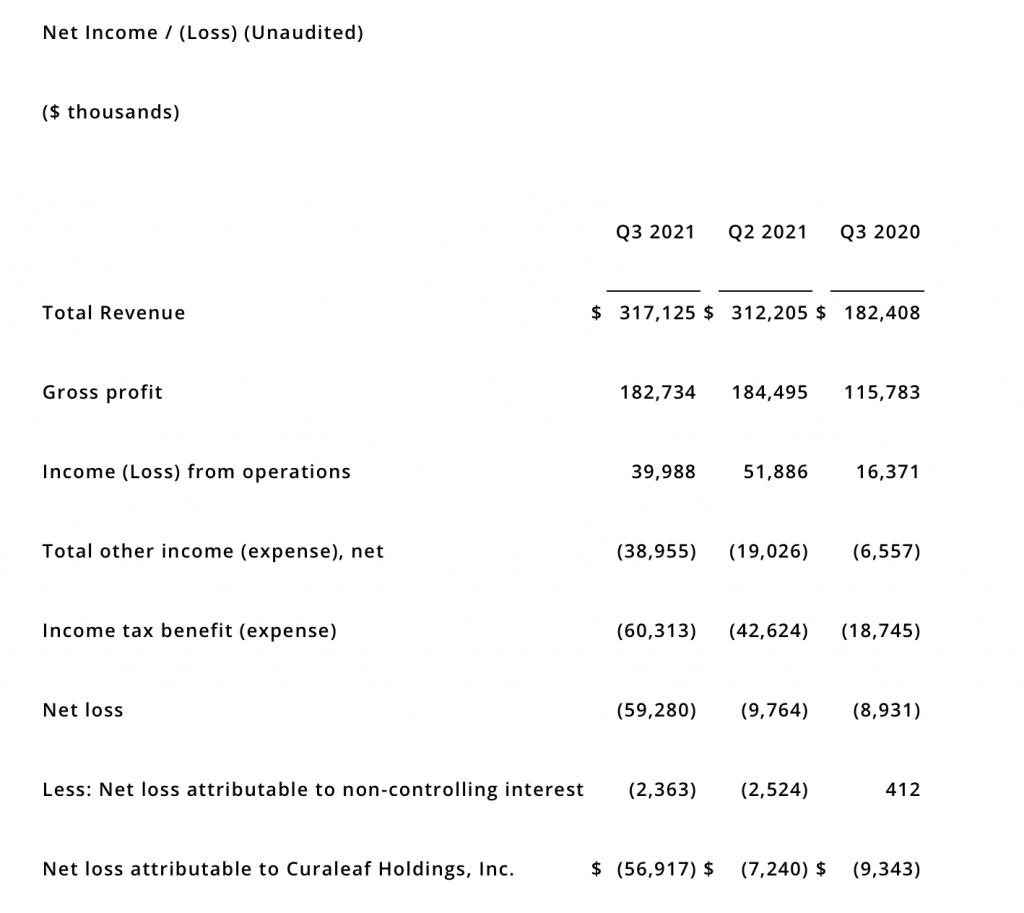

Adjusted EBITDA was $71 million for the third quarter of 2021, an increase of 69% from $42 million in the third quarter of 2020. The year-over-year increase was mainly driven by revenue growth. Adjusted EBITDA margin was 22.5%, compared with 27.0% in the prior quarter and 23.2% in the third quarter of 2020, with the change primarily reflecting lower gross margin and higher SG&A expense related to increased headcount in support of new store openings, higher travel costs, and marketing in support of new product rollouts.

Balance Sheet and Cash Flow

As of September 30, 2021, the Company had $317 million of cash and $342 million of outstanding debt net of unamortized debt discounts.

During the third quarter of 2021, Curaleaf invested $44 million net in capital expenditures, focused on cultivation, processing, and selective retail expansion in strategic markets.

Shares Outstanding

As of September 30, 2021, and June 30, 2021, the Company’s weighted average shares outstanding amounted to 703,545,262 and 701,668,932 shares, respectively.

As of September 30, 2021, and June 30, 2021, Company’s issued and outstanding SVS plus MVS shares amounted to 704,818,302 and 703,260,526 shares, respectively.