Revenue of $14.5 million increased 53% from prior year period

Gross profit income of $3.5 million increased 151% from prior year period

Net income was $0.4 million versus a loss of $0.6 million in prior year period

Adjusted EBITDA was $1.2 million, versus a loss of $0.6 million in prior year period

Maintained a strong liquidity position, including a cash & cash equivalents balance of $7.6 million, an increase of 300% from prior year quarter

Hollister Biosciences Inc. (CSE: HOLL) (OTC: HSTRF) (FRANKFURT: HOB) (the “Company” or “Hollister”) today announced its financial results for the third quarter fiscal 2021 ended September 30, 2021. All financial information is presented in U.S. dollars unless otherwise indicated.

“We delivered another solid quarter, continuing to drive year-over-year growth. Our performance in this quarter was driven by organic growth of our core business, Venom Extracts. As we approach the end of our final quarter and the beginning of a period of transformation, our strengthened and experienced leadership team is laser focused on creating shareholder value, delivering sustainable profitable growth, keeping operating costs low, and scaling the Company for optimal global success.”

– Jake Cohen, Chief Executive Officer, Hollister

“Hollister’s third quarter results demonstrate the strength of our business and commitment to executing against our strategy. With its strong balance sheet, we believe the Company is well positioned and prepared for growth as it continues on its strategic transformation.”

– Eula Adams, Chief Financial Officer, Hollister

Third Quarter 2021 Financial Results

-- Total revenue was $14.5 million, an increase of $5 million or 53% compared to the prior year period. -- Gross profit was $3.5 million compared to $1.4 million for the prior year period. -- Net income was $0.4 million versus a loss of $0.6 million in the prior year period. -- Adjusted EBITDA was $1.2 million compared to a loss of $0.6 million in the prior year period. -- Cash and cash equivalents was $7.6 million, a 300% increase as compared to $1.9 million at June 30, 2020.

Third Quarter 2021 Business Highlights

-- On July 13th, 2021, the Company announced it was added as an index constituent in the Solactive US Marijuana Companies Index (the "Index") as part of the Index's June 2021 quarterly rebalancing and as a result is now a holding in the Horizons US Marijuana Index ETF (NEO: HMUS). -- On August 25th, 2021, the Company announced 'Hollister Brand Campus' (the "Campus") a 30-Acre Arizona Brand Campus with planned 700,000 square feet of cultivation area and an existing 28,500-square-foot processing and manufacturing facility. -- On August 31st, 2021, the Company announced two new board members, Mr. Kevin Harrington, an original "Shark" from the NBC hit TV series "Shark Tank" and Mr. Jakob Ripshtein, the former CFO of Diageo North America and President of Aphria Inc.

Recent Events

-- On October 18th, 2021, the Company announced a series of operational and strategic updates to create shareholder value, enhance governance, operations and market positioning while preparing the Company for the next phase of its growth, including: -- Appointment of: -- Jacob Cohen as Chief Executive Officer -- Eula Adams as Chief Financial Officer -- Chris Lund as Chief Commercial Officer -- Jill Karpe as Senior Vice President of Admin and Finance; -- Refocused business strategy to develop a "house of brands" focused on cannabis consumer packaged goods; -- Initiated rebranding corporate identity and name of the company; and -- Reduction of expenses and resource allocation on non-core business activities. -- On November 2nd, 2021, the Company announced it received an order from the Ontario Securities Commission granting Hollister an exemption from certain provisions governing disclosure and other matters applicable to issuers with outstanding "restricted securities". -- On November 23rd, 2021, all matters put forward before the Company's shareholders for consideration and approval, as listed in the management information circular of the Company dated October 18, 2021 (the "Circular"), were approved by the requisite majority of votes cast at the Company's Annual General and Special Shareholder Meeting. This includes the election of all six (6) Board of Director nominees listed in the Circular: Jakob Ripshtein, Jacob Cohen, Eula Adams, Lily Dash, Kevin Harrington, and Brett Mecum.

Outlook

The Company believes the outlook is strong and has developed a solid strategy supported by strong operational, financial and leadership capabilities. In January 2021, the state of Arizona enacted sales of adult-use cannabis ahead of industry expectations. The Company recognized a substantial increase in demand for its branded goods and bulk wholesale products, creating a larger volume of sales in the first half of the year as dispensaries and brands readied for inventory for the market change. During Q3 2021 and beyond the Company focused its efforts on improving sales of higher margin products and aligning supply and demand to flow with the seasonality of the Arizona and cannabis markets at large. Management reports that January through November sales are estimated to exceed $64.5 million. Management believes the previously forecasted guidance of $70 million is achievable and driven by sales of finished and bulk products in the company’s core market of Arizona. Historically, fourth quarter sales in Arizona improved versus summer months due to local population increases from seasonal residents returning and holiday visitors. The overall Arizona market demand has seen improvements in the categories that the company operates and is expected to continue.

Sales through the end of November are preliminary and are unaudited and subject to change and adjustment when the Company prepares its audited consolidated financial statements for the year ended December 31, 2021. Accordingly, investors are cautioned not to place undue reliance on the foregoing information. The preliminary results provided in this news release constitute “forward-looking information” within the meaning of applicable Canadian securities laws, are based on several assumptions and are subject to a number of risks and uncertainties. Actual results may differ materially. See “Cautionary Statement Regarding Forward-Looking Information”.

The Company will continue optimizing its platform in Arizona through improved same-store sales, loyalty, and expanding its product portfolio and market penetration. The recently announced Campus project is progressing and once production has commenced it is expected to provide the Company with substantially reduced direct material costs, resulting in improved gross margin. The Campus also has ample space to expand production of higher margin finished products.

As previously announced, the Company is moving forward, implementing its “house of brands” cannabis consumer packaged goods strategy which includes manufacturing and distribution of owned and partner branded cannabis products in chosen markets. Additionally, the Company is planning to rationalize its existing brand and product portfolio, dedicating efforts towards new, highly targeted brand partnerships and the acquisition or development of owned brands.

On the corporate development front, the process to rebrand the Company and to align it with its refined strategy has commenced. Campaigns to improve awareness and broaden the shareholder base are being developed.

The Company has placed certain non-core assets including its California operations in a care and maintenance program to reduce expenses and improve overall financial and operational performance.

In addition to operational, financial, governance and strategy improvements, the Company has also been dedicating efforts to enter new markets with its existing brands.

USE OF NON-IFRS FINANCIAL MEASURES

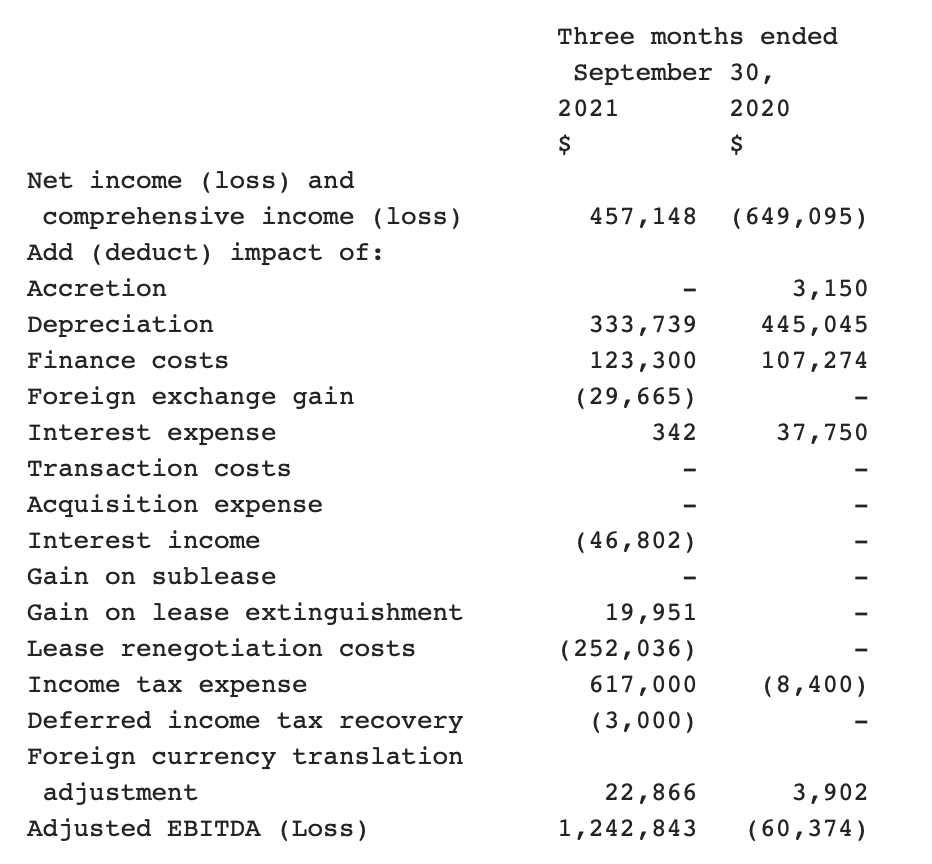

This press release includes certain non-IFRS financial measures. Reconciliations of these non-IFRS financial measures to the most directly comparable financial measure calculated and presented in accordance with IFRS are included below. This information should be considered as supplemental in nature and not as a substitute for, or superior to, any measure of performance prepared in accordance with IFRS. The Company’s management team uses adjusted EBITDA to evaluate operating performance and trends and to make planning decisions. The Company’s management team believes adjusted EBITDA helps identify underlying trends in the business that could otherwise be masked by the effect of the items that are excluded. Accordingly, the Company believes that adjusted EBITDA provides useful information to investors and others in understanding and evaluating the operating results, enhancing the overall understanding of past performance and future prospects, and allowing for greater transparency with respect to key financial metrics used by management in its financial and operational decision-making.

2021-11-30 00:21:00 GMT Hollister Biosciences Announces Third Quarter -2-

The table below reconciles net income (loss) and comprehensive income (loss) to Adjusted EBITDA (Loss for the three and nine months ended September 30, 2021 and 2020:

The live audio earnings conference call may be accessed online and by phone using the link: https://www.renmarkfinancial.com/events/third-quarter-2021-results-cse-holl-2021-11-30-160000. Investors may pre-register for the call by navigating to the same link provided. The conference call will be archived for replay and accessible at https://hollisterbiosciences.co/investors/.