InMed Pharmaceuticals Inc. (“InMed” or the “Company”) (NASDAQ:INM), a clinical-stage company developing pharmaceutical-based drug candidates and leading the way in the clinical development of cannabinol (“CBN”), today reported financial results for the third quarter of fiscal year 2021 (“3Q21”) which ended March 31, 2021.

The Company will be hosting a conference call to present the 3Q21 results, as follows:

Conference Call & Webcast*:

Thursday, May 13, 2021 at 8:00 AM Pacific Time, 11:00 AM Eastern Time

US/CANADA Participant Toll-Free Dial-In Number: +1 (855) 605-1745

US/CANADA Participant International Dial-In Number: +1 (914) 987-7959

Conference ID: 3186833

Webcast: https://edge.media-server.com/mmc/p/ajuejmko

(*Webcast replay available for 90 days)

The Company’s 10-Q including financial statements and related MD&A for the third quarter ending March 31, 2021 are available at www.inmedpharma.com, www.sedar.com and at www.sec.gov.

“In the third quarter of fiscal 2021, significant progress was made in InMed’s INM-755 therapeutic program and IntegraSyn manufacturing approach, resulting in the announcement of important milestones shortly after the quarter’s end,” said InMed President and Chief Executive Officer, Eric A. Adams. “The submission of Clinical Trial Applications in several countries, seeking permission to begin a Phase 2 safety and efficacy clinical trial in Epidermolysis Bullosa patients and the achievement of a commercially viable yield using the IntegraSyn™ manufacturing approach bring us one step closer to delivering new therapeutic alternatives to patients who may benefit from cannabinoid-based pharmaceutical drugs. In addition to our R&D advances this past quarter, we continue to explore business development opportunities as a potential avenue to build the Company and accelerate our programs.”

Research & Development Update:

INM-755 for the Treatment of Epidermolysis Bullosa (“EB”):

- On April 28, 2021, InMed announced that it had filed Clinical Trial Applications (“CTAs”) in Austria, Israel and Serbia as part of a Phase 2 clinical trial of INM-755 (cannabinol) cream in Epidermolysis Bullosa (“EB”). Since then, additional CTAs for 755-201-EB (the ‘201 study) have been submitted to National Competent Authorities (“NCAs”) and Ethics Committees (“ECs”) in France and Germany. We also expect to file CTAs in Greece and Italy in the coming weeks. Responses from the NCAs and ECs are expected throughout July and August 2021; timing will vary slightly by country due to differences in local procedures. The ‘201 study is designed to enroll up to 20 patients, conservatively within 10-12 months, and will take place at 10 pre-qualified clinical sites in the above-mentioned countries. All four subtypes of inherited EB, being EB Simplex, Dystrophic EB, Junctional EB, and Kindler Syndrome, are eligible for this study in which InMed will evaluate the safety of INM-755 (cannabinol) cream and its preliminary efficacy in treating symptoms and healing wounds over a 28-day period. The study will use a within-patient, double-blind design whereby matched index areas will be randomized to INM-755 (cannabinol) cream or vehicle cream as a control.

IntegraSyn™:

- On April 26, 2021, InMed announced that its IntegraSyn™ cannabinoid manufacturing approach had achieved a level of 2g/L cannabinoid yield, a milestone that signals commercial viability and supports advancement to large-scale production in the coming months. Having achieved a 2g/L yield level, InMed will now focus on manufacturing scale-up to larger batch sizes while continuing process and enzyme optimization, targeting increased cannabinoid yield and further reducing the overall cost of goods. In parallel, the Company continues to prepare the manufacturing process to be Good Manufacturing Practice (GMP)-ready for pharmaceutical quality production. The next stage of large-scale production is to produce a batch with a target output of one kilogram of the selected cannabinoid in 2H2021 via a GMP-ready process.

Financing Activity and Results of Operations (expressed in US Dollars):

- On February 5, 2021, the Company announced that it had entered into definitive agreements with certain institutional investors to raise aggregate gross proceeds of approximately $4.5 million and on February 16, 2021, the Company announced that it had closed the private placement. Under the terms of the private placement, an aggregate of 1,050,000 units were purchased, each unit comprised of one common share and 0.66 of a warrant to purchase one common share, at a placement price of $4.25 per unit. The warrants have an exercise price of $4.85, are exercisable six months following issuance, and have a term of five and one half years following issuance. After the placement agent fees and estimated offering expenses payable by the Company, the Company received net proceeds of approximately $4.0 million.

- On April 27, 2021, InMed announced that, based on the strong trading data on the Nasdaq, it had provided written notice to the Toronto Stock Exchange (the “TSX”) regarding the voluntary delisting of its common shares. InMed’s common shares will continue to be listed and tradable on the Nasdaq under “INM”. The Company believes that the trading volume of its shares on the TSX no longer justified the expense and administrative efforts associated with maintaining this dual listing. InMed’s common shares were delisted from the TSX at the close of trading on May 7, 2021.

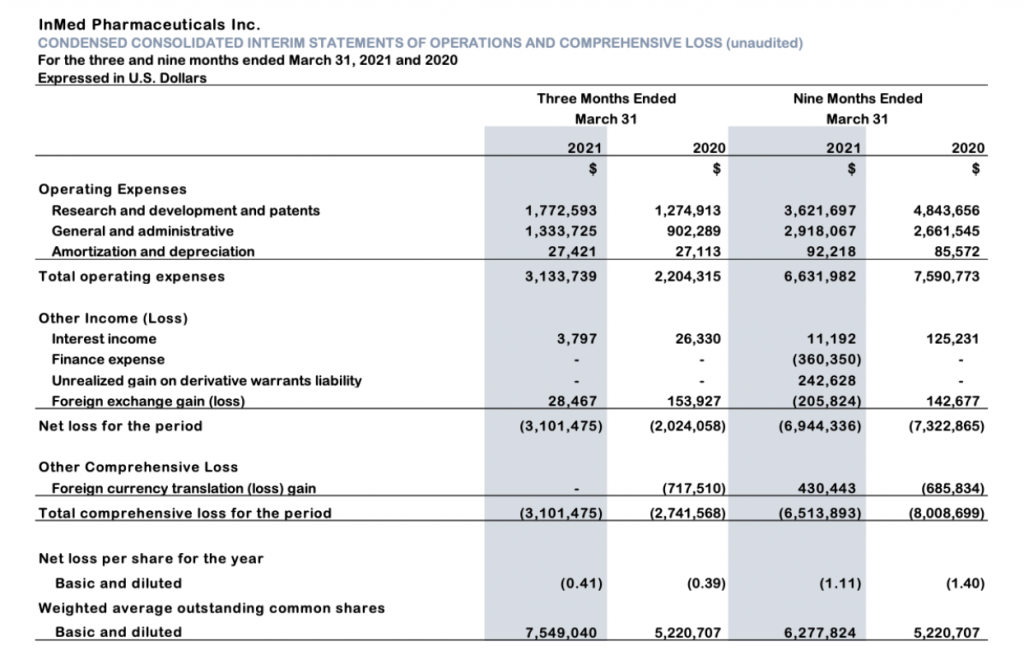

- For the three and nine months ended March 31, 2021, the Company recorded a net loss of $3.1 million and $6.9 million, or $0.41 and $1.11 per share, compared with a net loss of $2.0 million and $7.3 million, or $0.39 and $1.40 per share, for the three and nine months ended March 31, 2020.

- Research and development expenses were $1.8 million for 3Q21, compared with $1.3 million for the three months ended March 31, 2020. The increase in research and development and patents expenses was primarily due to increased spend on the INM-755 program, including the preparation during this period for the planned commencement of a Phase 2 trial. For the nine months ended March 31, 2021, research and development expenses totaled $3.6 million, compared with $4.8 million for the same period in fiscal 2020. The reduction in research and development and patents expenses was primarily due to decreased spending on the integrated cannabinoid manufacturing program and the INM-755 program, including decreased purchases of the active pharmaceutical ingredients used in INM-755 clinical trials. In addition, share-based payments were lower for the nine months ended March 31, 2021.

- The Company incurred general and administrative expenses of $1.3 million for 3Q21, compared with $0.9 million for the three months ended March 31, 2020. For the nine months ended March 31, 2021, general and administrative expenses totaled $2.9 million, compared with $2.7 million for the same period in fiscal 2020. The increase results from a combination of changes including substantially higher insurance fees, offset by lower share-based payments and lower legal costs associated with negotiating contracts and other matters in the current period and certain current year legal costs being capitalized to equity.

- The Company also incurred non-cash, share-based payments in connection with the grant of stock options, of $0.2 million for each of 3Q21 and the three months ended March 31, 2020. For the nine months ended March 31, 2021, non-cash, share-based payments totaled $0.4 million compared with $0.8 million for the comparable period in fiscal 2020. Share-based payments amounts are included within research and development expenses and general and administrative expenses.

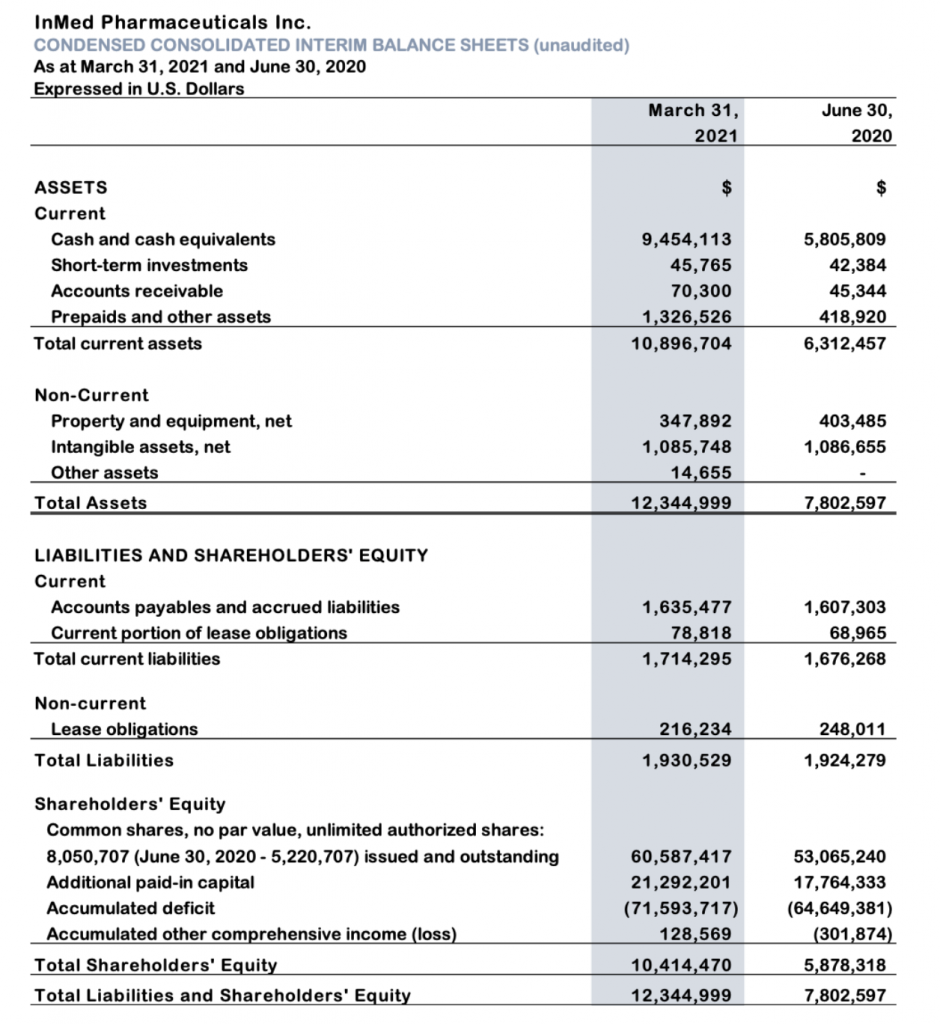

- At March 31, 2021, the Company’s cash, cash equivalents and short-term investments were $9.5 million, which compares to $5.8 million at June 30, 2020. The increase in cash, cash equivalents and short-term investments during the nine months to March 31, 2021, was primarily the result of the November 16, 2020 public offering and the February 16, 2021 private placement partially offset by cash outflows from operating activities.

- At March 31, 2021, the Company’s total issued and outstanding shares were 8,050,707. Including outstanding stock options and warrants, as at March 31, 2021, the Company had 11,415,228 shares on a fully diluted basis. During the three and nine months ending March 31, 2021, the weighted average number of common shares was 7,549,040 and 6,277,824, which is used for the calculation of loss per share for the respective interim periods.

Table 1: Condensed consolidated interim balance sheets (unaudited):

Table 2: Condensed consolidated interim statements of operations and comprehensive loss (unaudited):

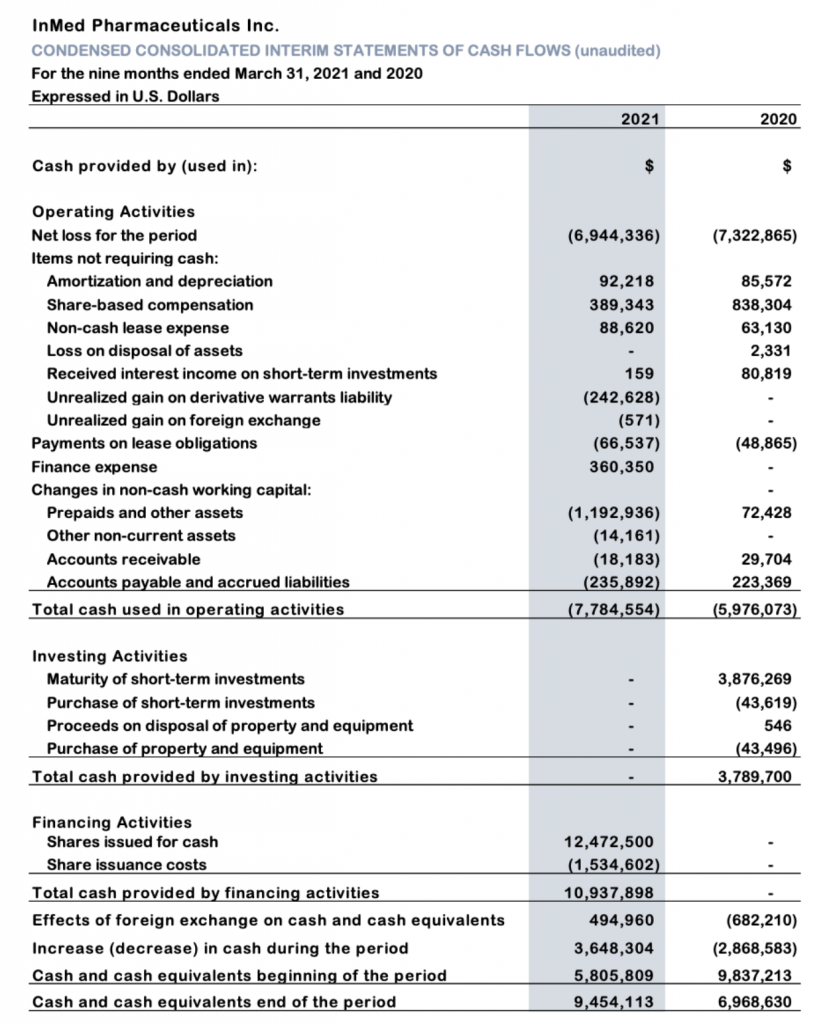

Table 3: Condensed consolidated interim statements of cash flows (unaudited):