- Q1 2021 Revenue of $23.8 million, including $9.7 million in March

- 2020 Revenue of $70.5 million

- Planet 13 accounted for 8.2% of all Nevada cannabis dispensary revenue in Q4

- 2020 EBITDA of $8.9 million

All figures are reported in United States dollars ($) unless otherwise indicated

LAS VEGAS, NV / ACCESSWIRE / April 5, 2021 / Planet 13 Holdings Inc. (CSE:PLTH) (OTCQB:PLNHF) (“Planet 13” or the “Company“), a leading vertically-integrated Nevada cannabis company, today announced its financial results for the three-month and twelve-month period ended December 31, 2020. Planet 13’s financial statements are prepared in accordance with International Financial Reporting Standards (“IFRS”).

“Based on our performance in March 2021, it is clear that Las Vegas is back.” Said Larry Scheffler, Co-CEO of Planet 13. “We dwarfed our single month record with $9.7 million in revenue in March, and we believe that as more people get vaccinated and Las Vegas continues to open, revenue will continue to increase. Looking back on 2020, we weathered the perfect storm of COVID-19 and the resulting 55% decrease in tourism and still increased revenue year over year, generating over $70 million while maintaining our share of the Nevada market.”

“With the rapid turn-around we’ve seen in Q1 and especially in March, it is clear that the improvements we made over the last year will pay dividends as normalcy returns to Las Vegas,” commented Bob Groesbeck, Co-CEO of Planet 13. “With tourism back on track, the SuperStore is performing well. Furthermore, our local-focused offerings including Medizin, curbside and delivery, and wholesale are helping us take a greater share of that market. Outside of Las Vegas, the Orange County SuperStore in California is on track and on budget for our projected opening in July. We poured everything we learned from two years running the greatest cannabis store in the world, into our Orange County location and are confident that this store will redefine the cannabis retail experience in California.”

Financial Highlights – Q4 – 2020

Operating Results

All comparisons below are to the quarter ended December 31, 2019, unless otherwise noted

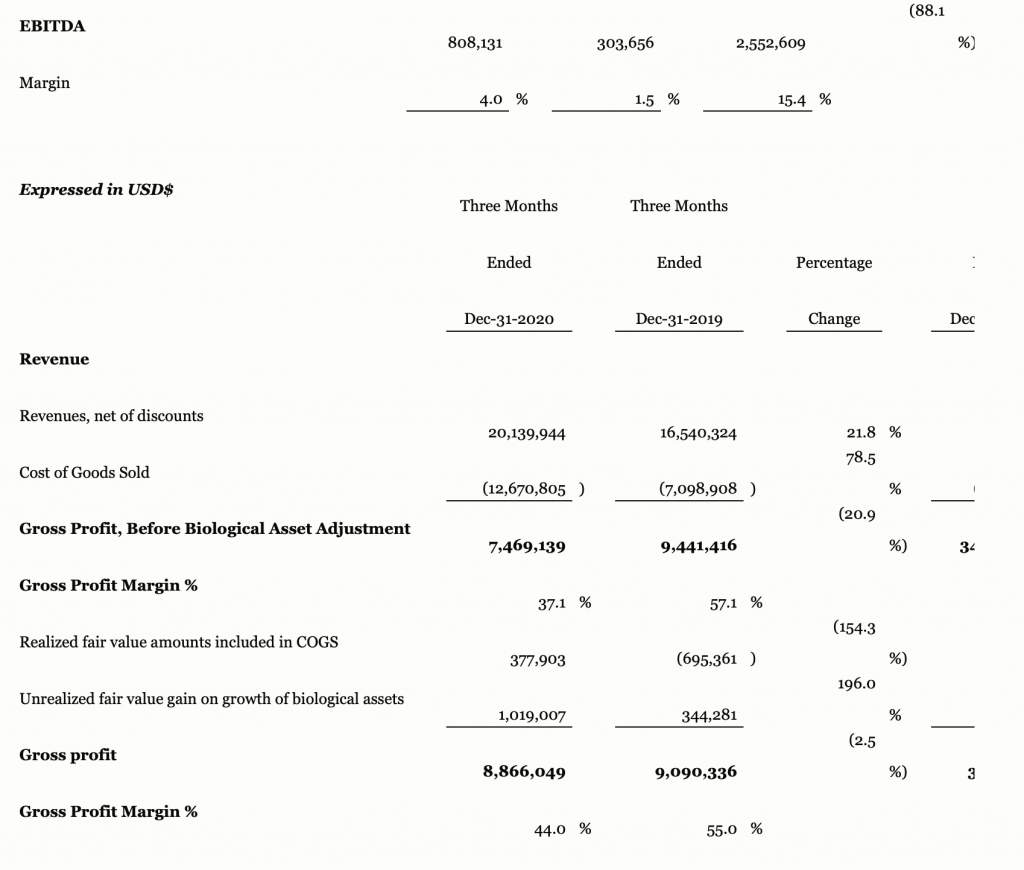

- Revenues were $20.1 million as compared to $16.5 million, an increase of 21.8%

- Gross profit before biological adjustments was $7.5 million or 37.1% as compared to $9.4 million or 57.1%

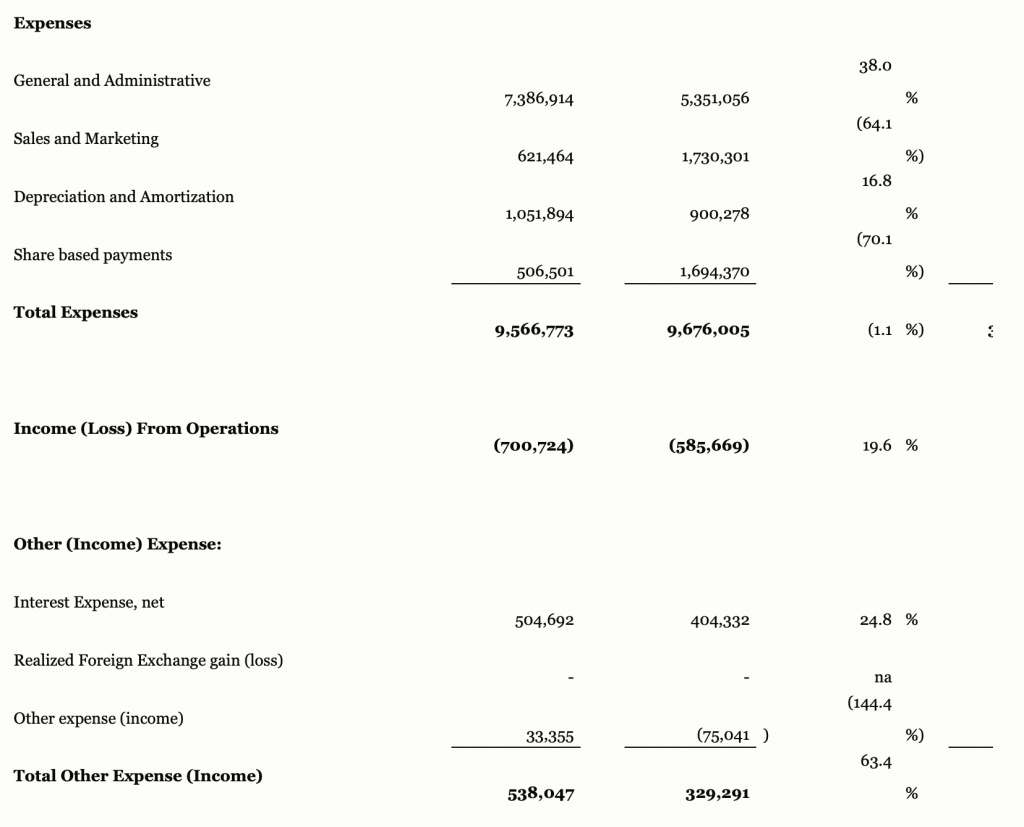

- Operating expenses, excluding non-cash compensation expense and depreciation and amortization, was $8.0 million as compared to $7.1 million, an increase of 13.1%

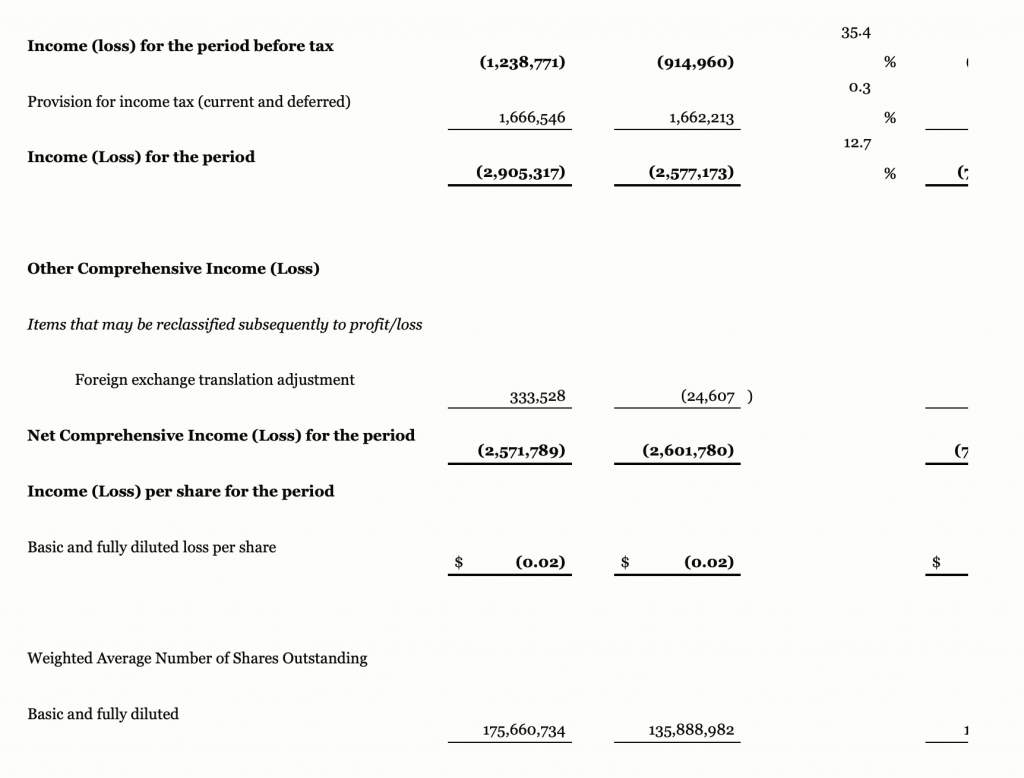

- Net loss before taxes of $1.2 million as compared to a net loss of $0.9 million

- Net loss of $2.9 million as compared to a net loss of $2.6 million

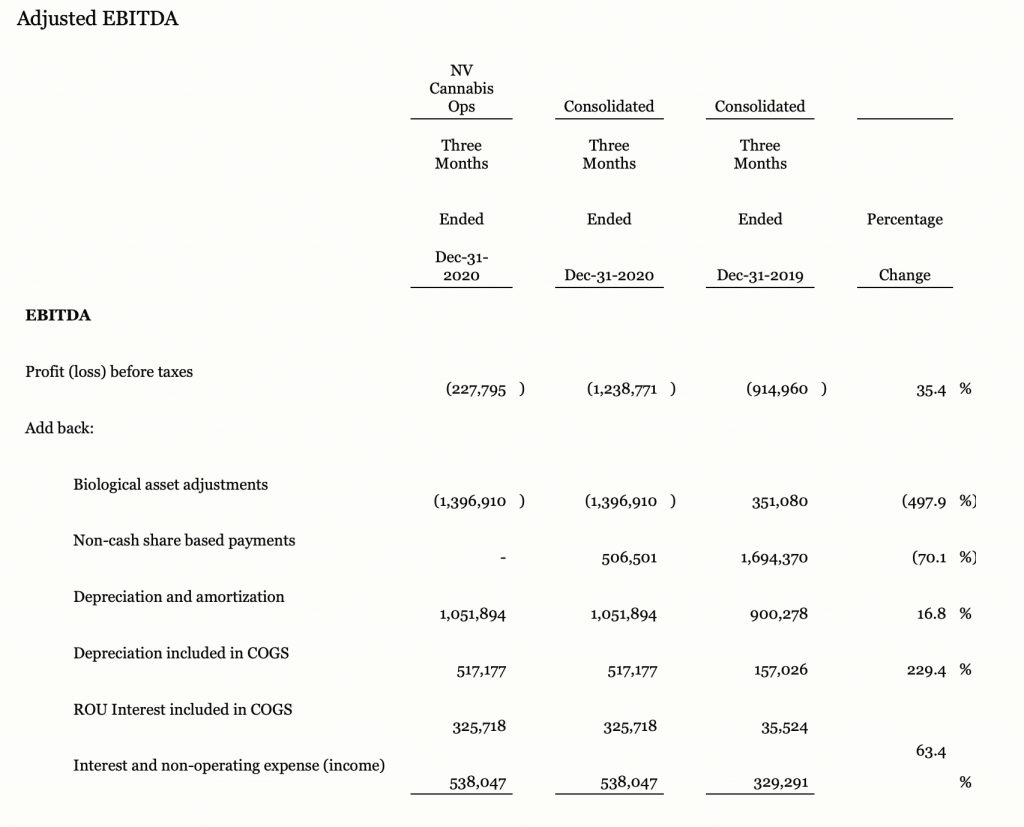

- Adjusted EBITDA of $0.3 million as compared to Adjusted EBITDA of $2.6 million

Balance Sheet

All comparisons below are to December 31, 2019, unless otherwise noted

- Cash of $79.0 million as compared to $12.8 million

- Total assets of $150.0 million as compared to $62.9 million

- Total liabilities of $29.3 million as compared to $21.6 million

Financial Highlights – Full Year – 2020

All comparisons below are to the year ended December 31, 2019, unless otherwise noted

- Revenues were $70.5 million as compared to $63.6 million, an increase of 10.8%

- Gross profit before biological adjustments was $34.2 million or 48.5% as compared $36.5 million or 57.3%

- Operating expenses, excluding non-cash compensation expense, were $28.0 million as compared to $26.8 million, an increase of 4.3%

- Net loss before taxes of $0.8 million as compared to a net profit of $0.5 million

- Net loss of $7.9 million as compared to a net loss of $6.7 million

- Adjusted EBITDA of $8.9 million as compared to Adjusted EBITDA of $10.2 million

Q4 Highlights and Recent Developments

For a more comprehensive overview of these highlights and recent developments, please refer to Planet 13’s Management’s Discussion and Analysis of the Financial Condition and Results of Operations for the Three Months and Twelve Months Ended December 31, 2020 (the “MD&A“).

- On October 13, 2020, Planet 13 announced the addition of non-cannabis retail space to the Las Vegas SuperStore.

- On October 19, 2020, Planet 13 announced expanding the dispensary floor of the Las Vegas SuperStore.

- On October 19, 2020, Planet 13 announced a CDN$20 million bought deal public offering.

- On October 20, 2020, Planet 13 announced an upsize to bought deal public offering to CDN$25 million.

- On November 5, 2020, Planet 13 announced the closing of a CDN$28.8 million bought deal public offering.

- On November 20, 2020, Planet 13 announced opening the Medizin dispensary.

- On November 27, 2020, Planet 13 announced second closing under its asset purchase agreement.

- On December 10, 2020, Planet 13 announced winning multiple awards at Las Vegas Jack Herer Cup.

- On January 12, 2021, Planet 13 announced a CDN$50 million bought deal and upsizeing.

- On February 2, 2021, Planet 13 announced closing of CDN$69 million bought deal.

- On February 3, 2021, Planet 13 announced the start of construction on the Orange County SuperStore.

- On March 15, 2021 Planet 13 announced a partnership with Curaleaf Select to open shop-in-shop.

Results of Operations (Summary)

The following tables set forth consolidated statements of financial information for the three-month and twelve-month periods ending December 31, 2020 and December 31, 2019. For further information regarding the Company’s financial results for these periods, please refer to the Company’s annual financial statements for the period ended December 31, 2020 together with the MD&A, available on Planet 13’s issuer profile on SEDAR at www.sedar.com and the Company’s website https://www.planet13holdings.com.

Outstanding Shares

As of April 5, 2021, the Company had 140,330,574 common shares and 55,232,940 class A convertible, restricted voting shares issued and outstanding for a total of 195,563,514 shares outstanding. There were 184,168 options issued and outstanding of which all have fully vested. There were 9,700,341 warrants outstanding and 912,095 RSU’s outstanding of which nil RSUs had fully vested as at the date of this MD&A.

Conference Call

Planet 13 will host a conference call on Monday, April 5, 2021 at 5:00 p.m. EST to discuss its fourth quarter financial results and provide investors with key business highlights. The call will be chaired by Bob Groesbeck, Co-CEO, Larry Scheffler, Co-CEO, and Dennis Logan, CFO.

CONFERENCE CALL DETAILS

Date: April 5, 2021 | Time: 5:00 p.m. EST

Participant Dial-in: Toll Free 877-407-8035 or International 201-689-8035

Replay Dial-in: Toll Free 877-481-4010 or International 919-882-2331

(Available for 2 weeks)

Reference Number: 40511

Listen to webcast: https://bit.ly/393yrjE

Financial Measures

There are measures included in this news release that do not have a standardized meaning under generally accepted accounting principles (GAAP) and therefore may not be comparable to similarly titled measures and metrics presented by other publicly traded companies. The Company includes these measures because it believes certain investors use these measures and metrics as a means of assessing financial performance. EBITDA (earnings before interest, taxes, depreciation and amortization) is calculated as net earnings before finance costs (net of finance income), income tax expense, and depreciation and amortization of intangibles and is a non-GAAP financial measure that does not have any standardized meaning prescribed by IFRS and may not be comparable to similar measures presented by other companies.