Power REIT (NYSE-AMEX: PW and PW.PRA) (“Power REIT” or the “Trust”) today announced that it has acquired a 35-acre property located in Huerfano County, Colorado (the “Property”) through a wholly owned subsidiary (“PropCo”). The Property is strategically located in a part of southern Colorado that offers a very favorable business setting and growing environment for efficient and sustainable greenhouse cultivation.

The property currently has multiple greenhouses and support buildings which will be upgraded through a redevelopment plan that Power REIT will fund along with the new construction of additional greenhouse space. Upon completion, the Property will comprise approximately 102,800 square feet of greenhouse and related space. Power REIT’s total capital commitment for the project is approximately $3.9 million including the property acquisition cost. The Property also has ample acreage for future expansion which Power REIT intends to finance.

LEASE STRUCTURE

Concurrent with the acquisition, PropCo entered into a 20-year “triple-net” lease (the “Lease”) with Walsenburg Cannabis LLC (“WC”) which will operate the cannabis cultivation facility. The Lease covers approximately 22.2 acres of the 35 acre Property. The remaining and undeveloped 12.8 acres is available for future expansions.

The Lease requires WC to pay all property related expenses including maintenance, insurance and taxes. After the initial 20-year term, The Lease provides two, five-year renewal options and has a personal guarantee from WC’s President. Pursuant to the Lease, WC will maintain a medical marijuana license and will operate in accordance with all Colorado and municipal regulations. The Lease also prohibits retail sales from the Property.

The Lease, as structured, is immediately accretive to Core FFO by adding straight-line annual rent of approximately $729,000. This represents an unleveraged Core FFO yield of approximately 18.8% on Power REIT’s invested capital. After an initial deferred rent period, the rental payments enumerated in the Lease provide PropCo with a full return of its invested capital over the next three years after which PropCo receives an approximately 13% yield increasing thereafter at a rate of 3% per annum.

David Lesser, Power REIT’s Chairman and CEO, commented, “The acquisition is consistent with Power REIT’s investment strategy of focusing on sustainability including greenhouse crop cultivation which is less expensive and has a much lower carbon footprint than growing in an industrial property. This Property is positioned to allow WC to compete favorably within the Colorado market by providing both the infrastructure and a configuration that should allow rapid scale-up in a cost-effective manner relative to competing facilities. In addition, the Property has the potential for the significant expansion of the cultivation canopy, which will be implemented with a focus on becoming a low-cost producer of high-quality cannabis.”

WC is led by Jared Schrader, an experienced cannabis cultivation operator with a solid track record. Mr. Schrader grew revenue at a Colorado cannabis cultivation facility from annual revenue of $150,000 to weekly revenue of over $150,000 (i.e. > $8 million annually) over the span of two years. Simultaneous with Power REIT’s acquisition of the Property, Millennium Investment and Acquisition Company Inc. (“MILC”) provided a loan to WC and is seeking approval from the Colorado regulators to take an ownership stake in WC after which MILC would become a majority owner of WC in the form of a preferred equity ownership stake in a joint venture with the management team of WC. David H Lesser, Power REIT’s Chairman and CEO is also Chairman and CEO of MILC (ticker: MILC).

“We are excited to have the support of Power REIT to get this project growing, stated Jared Schrader, Walsenburg Cannabis’ President. We believe this property can quickly become a large-scale producer of cannabis and cannabis related products to serve the Colorado market. The Property is subdivided into five parcels that each have local approval for the cultivation of cannabis. This allows the Property to pursue a rapid growth plan given the nature of Colorado cannabis licensing which is based on a limited plant count initially per property. Once performance is demonstrated to the regulators, each property will have the potential to “tier-up” and add more plants. In addition, WC is focused on a “speed to revenue” approach given the start of operations in the spring growing season.”

FORWARD CORE FFO PER SHARE

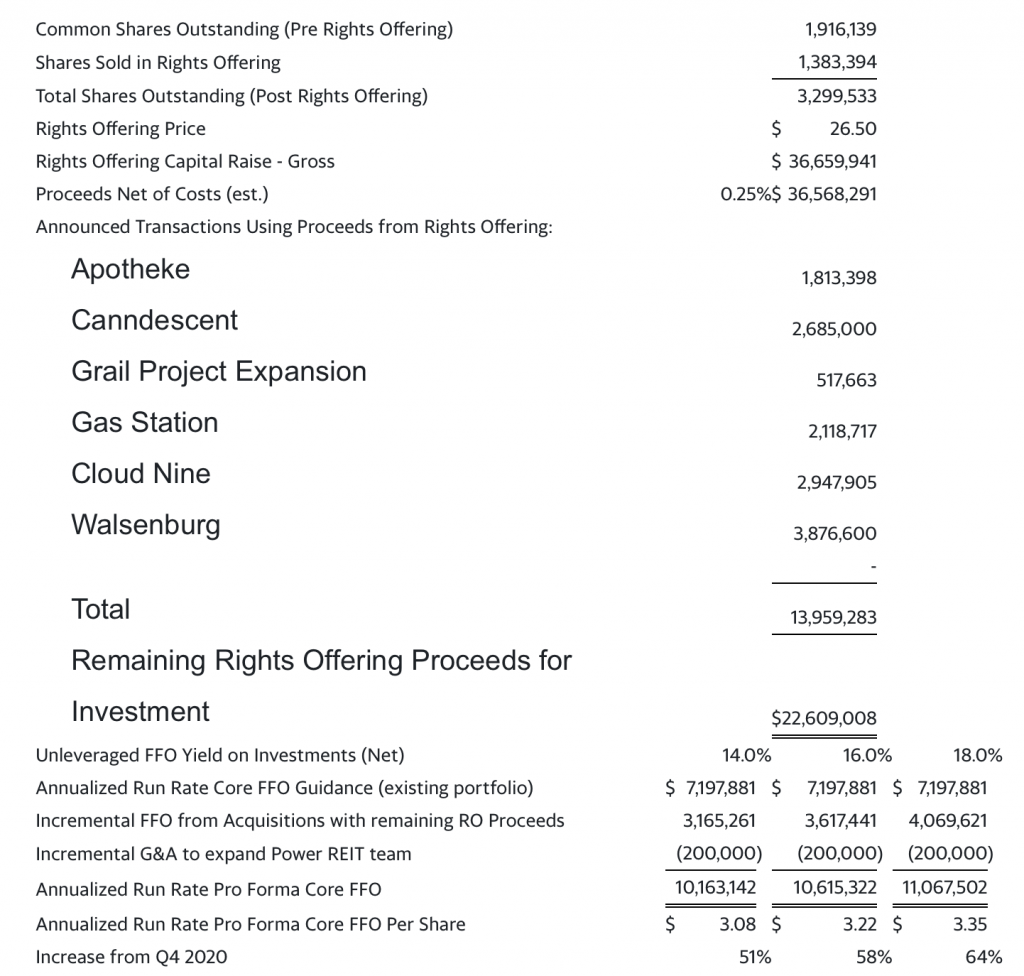

Power REIT has now announced transactions that deploy approximately $14 million of capital from its recently closed Rights Offering across several transactions. This leaves approximately $22.6 million to deploy. Power REIT’s current Core FFO run rate is approximately $7.2 million based solely on transactions closed and not taking into account deployment of additional capital as described in our most recently published Investor Presentation which is available at: www.pwreit.com/investors

Based on the impact from Power REIT’s recent Rights Offering and assuming the full deployment of its remaining proceeds into additional acquisitions at an average 16% yield to common equity, Power REIT estimates a forward Core FFO per share run rate of $3.22. However, it is important to understand that near-term quarterly results will likely be below this run-rate due to the timing of acquisitions and dilution from the additional shares issued pursuant to the Rights Offering that generated the available cash on Power REIT’s balance sheet for investment.

The following table provides a roadmap and sensitivity analysis for forward Core FFO per share:

Mr. Lesser concluded “We continue to generate dramatic growth since July 2019 when we embarked on our new business plan focused on Controlled Environment Agriculture properties. Power REIT’s relatively small size combined with the attractive investment yields that we are generating through CEA property acquisitions, positions us for continued outpaced growth. We believe Power REIT represents an attractive investment proposition based on our relatively low trading multiple than REIT peers with a clear growth trajectory.”