- Revenue of $11.3 million in Q2 2021, a 147% increase over Q2 2020

- Strong brand performance, with approximately 897,395 Branded Units sold in Q2 2021 (an 82% increase over Q2 2020)

- Well-positioned for growth in the second half of 2021, following an accretive acquisition which expands our Core Markets to include Vermont

Toronto, Ontario–(Newsfile Corp. – August 26, 2021) – SLANG Worldwide Inc. (CSE: SLNG) (OTCQB: SLGWF) (“SLANG” or the “Company“), a leading global cannabis consumer packaged goods (CPG) company with a diversified portfolio of popular brands, today released financial results for the three and six months ended June 30, 2021. All figures in this press release are stated in Canadian dollars unless otherwise noted.

Financial Highlights:

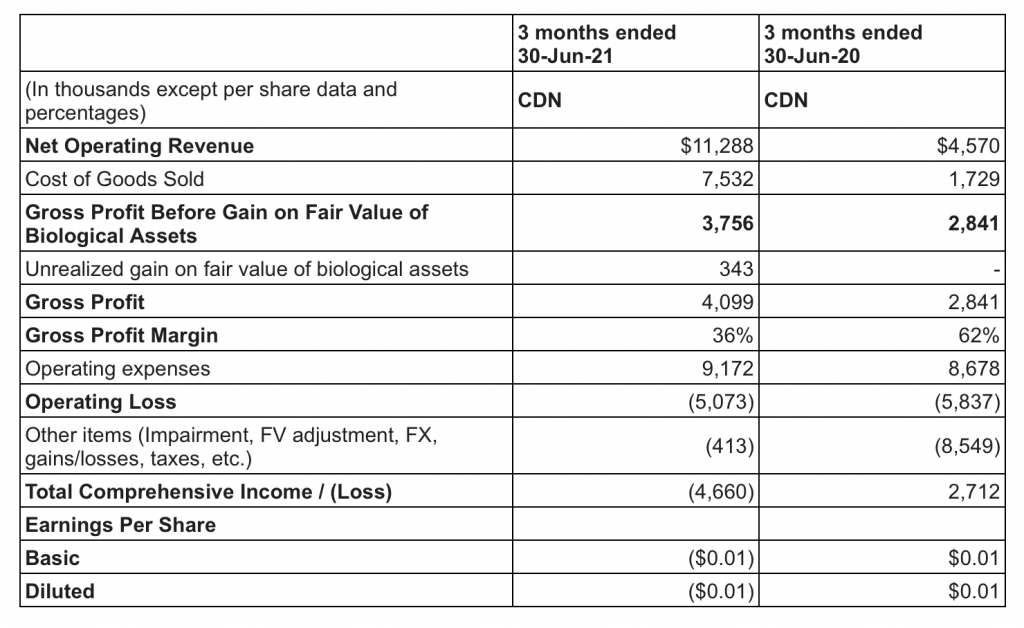

- Revenue for Q2 2021 was $11.3 million, compared with $4.6 million in Q2 2020 and $9.9 million in Q1 2021. The primary driver of year over year growth was a rebound in demand in the Company’s Core Markets of Colorado and Oregon as well as the consolidation of wholesale revenue. Strength in the Company’s Emerging Markets also contributed to sequential growth, as did the successful launch of new products, including Lunchbox Alchemy CBD.

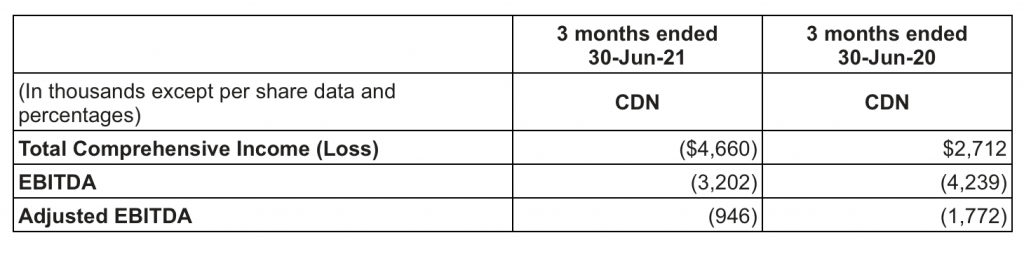

- Adjusted EBITDA was ($0.95 million) in Q2 2021, compared with ($1.8 million) in Q2 2020 and an improvement of approximately $10,000 over Q1 2021. The reduction of the Adjusted EBITDA loss is primarily attributable to an increase in revenue and a reduction in operating expenses.

- EBITDA of ($3.2 million) in Q2 2021, compared with ($4.2 million) in Q2 2020 and ($4.6 million) in Q1 2021. The improvement in EBITDA from the prior-year and prior-quarter represents a 24% and 31% improvement, respectively. The Company remains committed to prudently managing its operating expense on its mission to further improve efficiency.

Chris Driessen, CEO of SLANG, said, “This was our fourth consecutive quarter of growth, with quarterly revenues reaching a record $11.3 million, an impressive 147% increase from the prior year period and a 14% increase from Q1 2021. Our record revenue during the quarter, together with improved operational efficiency, also led to an improvement in profit when compared with the prior year and prior quarter results. These improved topline and bottom-line results, both year over year and sequentially, were primarily driven by modifications in the operations in our Core Markets of Colorado and Oregon as we benefited from our consolidated supply chain. Our Colorado Core Market was the primary growth driver during the quarter, incurring the bulk of the increased demand. Of note, we also closed the acquisition of Allied Concessions Group, Inc. (“ACG“) in the quarter, although we have been consolidating its economics since December 31, 2020. We further strengthened our position in the Company’s Emerging Markets, as we successfully launched brand extensions and new products.”

“Looking ahead, SLANG is well positioned to leverage its cumulative operational experience from its Core Markets of Colorado and Oregon and is looking to rapidly expand in Vermont following our recent acquisition of HI-FI, the largest medical cannabis company in the state. Adding Vermont, including its four retail locations in the state, to our Core Market cohort, enables SLANG to begin recognizing revenue at the retail level in late Q3 2021. By offering SLANG’s existing line of products in Vermont, we create additional brand visibility, and anticipate top and bottom-line growth in the near-term as these direct customer sales are expected to generate higher margin. Overall, we are pleased with this quarter’s progress, as we continued to reduce operating expenses, while supporting the Company’s expanded capabilities, demonstrating once again the effectiveness of cost cutting initiatives taken by management over the past year.”

Operational Highlights and Growth Drivers:

SLANG continued to grow in its core markets of Colorado and Oregon, as well as executing on its Emerging Markets strategy where it employs an asset-light business model by forming strategic partnerships to establish a market presence in other U.S. states.

Subsequent to quarter end, SLANG created its third Core Market in Vermont, with the closing of the acquisition of High Fidelity, Inc. (“HI-FI“) the largest medical cannabis company in the state which services approximately 70 percent of registered patients. The acquisition expands SLANG’s operational footprint in Vermont to now include a 28,000-square-foot cultivation, production, lab, and retail distribution facility, with a planned 50,000-square-foot expansion expected to be completed in 2022. It also adds two of the five medical cannabis licenses in Vermont with four fully operational dispensaries, including in the Burlington area, with the ability to add two new retail dispensaries upon receipt of licenses. The acquisition of HI-FI is expected to be accretive to SLANG’s earnings in calendar 2021 and onward. Retail sales in Vermont for adult-use cannabis products are expected to begin in the fall of 2022, with sales expected to reach up to US$230 million in 2023.

In the second quarter, revenue growth in Colorado, the Company’s largest market, was driven by its Colorado-based distribution business, which enabled the Company to recognize wholesale revenue by distributing all SLANG branded products through sales directly to dispensaries. In June, the Company closed its previously announced acquisition of ACG, a manufacturing and distribution business based in Colorado. While the Company has been consolidating the economics of ACG since December 31, 2020, the integration of ACG into SLANG’s platform will allow the Company to control its supply chain from seed to wholesale of the entire portfolio of SLANG brands by consolidating and streamlining operations in Colorado.

In Oregon, the Company entered into an agreement to acquire NS Holdings, Inc. (“NSH“), to further bolster its manufacturing assets in the state. NSH is the parent company of GNT Oregon, LLC (“GNT“), the operating asset that produces O.pen, Bakked and District Edibles branded cannabis products at its licensed CO2 extraction and manufacturing facility in Portland, Oregon. The proposed acquisition of NSH follows SLANG’s acquisition of licensed manufacturer and distributor, Lunchbox Alchemy in Oregon.

The Company’s expansion strategy in its Emerging Markets continued to contribute to its revenue growth in the second quarter 2021 as it strives to consistently bring new and unique product SKUs to market through the launch of additional brands in new product verticals and the expansion of existing product lines. Subsequent to quarter end, the Company re-entered California, its largest Emerging Market and the largest cannabis market in the world, with the re-launch of its District Edibles product line (the previous best-selling gummy brand in CA) through its strategic partnership with Natura Life + Science (“Natura“). The Company expects to launch more SLANG-branded products to increase its market penetration in California. In Washington state, the Company launched one of its best-selling brands, O.pen, through a strategic partnership with Snowcrest LLC (“Snowcrest“), a cultivator and processor in Vancouver, WA, subsequent to the quarter end. As part of the partnership, Snowcrest manufactures the SLANG branded products, and SLANG’s sales and marketing teams work to place these products in dispensaries across the state.

Key Performance Indicators

The Company showed meaningful growth with 897,395 Branded Units sold in the second quarter of 2021, an increase of 82% compared to 493,662 Branded Units sold in Q2 2020; and 72.7 million Branded Servings were sold in Q2 2021, an increase of 64% compared to 44.3 million Branded Servings sold in Q2 2020. In addition to sequential sales improvements in the Core Markets of Colorado and Oregon, sales in certain Emerging Markets were notable contributors to the increase. Q2 2021 Branded Units and Servings included sales from the Emerging Market of California, marking the Company’s re-entry into the state through its Strategic Partner, Natura.

Brand Leadership

SLANG’s brands continued to earn market-leading positions in its Core Markets in the second quarter of 2021. Highlights include: O.pen VAPE ranked as the #1 vape cartridge in Colorado; Firefly Mini was the #5 and O.pen was the #4 disposable vaporizer in Colorado; Bakked was the #5 dabbable distillate in Colorado (Source: BDSA).

During Q2 2021, SLANG’s Gross Merchandise Value (“GMV“), representing the total retail dollar value of SLANG branded products sold through all existing SLANG sales channels, whether directly by SLANG or by one of SLANG’s strategic partners, totaled $40,578,968. SLANG’s Q2 product and licensing revenue of $11,268,202, as reported in its Q2 2021 financial statements, represents 27.8% of GMV.

GMV is calculated by multiplying SLANG’s number of branded products sold in a period by the MSRP of those products sold. Furthermore, the total percentage of GMV captured by SLANG is an important metric in assessing brand performance as it determines SLANG’s proportion of total retail revenue captured. As a newly reported metric, the Company will continue to focus on GMV going forward and initiatives that will help increase SLANG’s percentage of GMV. Management expects the acquisition of HI-FI and a continued focus on ecommerce channels will have a meaningful impact on SLANG’s percentage of GMV in the remainder of 2021. HI-FI’s four retail locations in Vermont and direct to consumer sales via ecommerce will allow SLANG to recognize 100% of GMV on products sold via those channels.

Appointment of Director

The Company is pleased to announce that effective today, Mr. Shayne Lynn, former President of HI-FI, has been appointed to the Board of Directors. Mr. Lynn is the tenth director to be added to SLANG’s majority independent Board.

Second Quarter 2021 Financial Review

The consolidated financial statements were prepared in accordance with IFRS. The following is selected presentation of the Income Statement for the quarter end June 30, 2021

The Company reported $9.7 million of cash and cash equivalents at June 30, 2021, compared to $6.5 million at December 31, 2020.

Non-IFRS Measures

EBITDA, Adjusted EBITDA, Adjusted Gross Profit, Adjusted Gross Profit Margin, Gross Merchandise Value, Branded Unit volume and Branded Servings volume are non-IFRS financial measures that the Company uses to assess its operating performance. EBITDA is defined as net earnings (loss) before net finance costs, income tax expense (benefit) and depreciation and amortization expense. Management defines Adjusted EBITDA as EBITDA adjusted for other non-cash items such as the impact of unrealized fair values, share based compensation expense, impairments, one-time gains and losses, and one-time revenues and expenses. Management defines Adjusted Gross Profit and Adjusted Gross Margin as gross profit and gross margin adjusted for inventory fair value adjustments and fair value changes of biological assets. Gross Merchandise Value is defined as the total retail dollar value of SLANG branded products sold through all existing SLANG sales channels, whether directly by SLANG or by one of SLANG’s strategic partners. See the heading “Key Performance Indicators” in the Company’s management’s discussion and analysis for the three months ended June 30, 2021 (the “Q2 2021 MD&A“) for a description of how each of Branded Unit volume and Branded Servings volume is calculated. This data is furnished to provide additional information and are non-IFRS measures and do not have any standardized meaning prescribed by IFRS. The Company uses these non-IFRS measures to provide shareholders and others with supplemental measures of its operating performance. The Company also believes that securities analysts, investors and other interested parties, frequently use these non-IFRS measures in the evaluation of companies, many of which present similar metrics when reporting their results. As other companies may calculate these non-IFRS measures differently than the Company, these metrics may not be comparable to similarly titled measures reported by other companies. We caution readers that Adjusted EBITDA should not be substituted for determining net loss as an indicator of operating results, or as a substitute for cash flows from operating and investing activities.

See the Q2 2021 MD&A for a detailed reconciliation of EBITDA and Adjusted EBITDA to Operating Income / (Loss). SLANG’s financial statements and the Q2 2021 MD&A are available on SEDAR at www.sedar.com, and on the Company’s Investor Relations website at www.slangww.com.

Conference Call Details

Management plans to host an investor conference call today, August 26, 2021, at 10:00 am EDT to discuss the results.

| Timing: | Thursday, August 26, 2021 at 10:00 am EDT |

| Dial-in: | +1.833-529-0214 (US toll free) or +1.236-389-2114 (International) or +1.647-689-6824 (International) |

| Conference ID: | 8484189 |

| Webcast: | A live webcast can be accessed from the Investors section of Company’s website at www.slangww.com or at this link. A replay of the webcast will be archived on the Company’s website for one year. |

Share Issuance

The Company also announces that it has issued 3,666,673 common shares (611,074 common shares at a deemed price of $0.255 and 3,055,599 common shares at a deemed price of $0.209) in consideration of the provision of past services to the Company by a former director and executive officer. The issuance of the common shares is subject to Canadian Securities Exchange approval and a hold period expiring 4 months and 1 day from the date of issuance, unless waived by the Canadian Securities Exchange.