Sundial Growers Inc. (NASDAQ: SNDL) (“Sundial” or the “Company”) reported its financial and operational results for the third quarter ended September 30, 2021. All financial information in this press release is reported in millions of Canadian dollars and represents results from continuing operations, unless otherwise indicated.

The Company will hold a conference call and webcast at 10:30 a.m. EST (8:30 a.m. MST) on Friday, November 12, 2021. Please see the dial-in details within the release, as well as additional details on Sundial’s website at www.sndlgroup.com.

THIRD QUARTER 2021 OPERATIONAL AND INVESTMENT HIGHLIGHTS

- Net earnings of $11.3 million for the third quarter of 2021 compared to $71.4 million loss in the third quarter of the prior year.

- Adjusted EBITDA of $10.5 million for the third quarter of 2021, compared to an adjusted EBITDA loss of $4.4 million in the third quarter of 2020.

- Net revenue from Cannabis segments of $14.4 million for the third quarter of 2021, an increase of 57% over the second quarter of 2021 and an increase of 12% over the third quarter of 2020.

- Cannabis Cultivation and Production: Net revenue for the cultivation and production of cannabis was $8.2 million compared to $9.2 million in the previous quarter, a decline of 11%.

- Cannabis Retail: Net revenue for cannabis retail was $6.1 million following the acquisition of Inner Spirit Holdings Inc. (“Inner Spirit”) and the Spiritleaf retail network (“Spiritleaf”) during the third quarter.

- Gross margin from Cannabis segments was $1.8 million, including a loss of $1.9 million from cannabis cultivation and production compared to a loss of $19.5 million from that segment in the third quarter of 2020.

- Investment and fee revenue of $3.3 million, realized gains on marketable securities of $6.0 million and Sundial’s share of profitfrom equity accounted investees of $9.9 million for the third quarter of 2021 compared to Nil in the third quarter of the prior year, which preceded the start of these activities.

- $1.1 billion of cash, marketable securities and long-term investments at September 30, 2021, and $1.2 billion at November 9, 2021, with $571 million of unrestricted cash and no outstanding debt.

- Acquired Inner Spirit on July 20, 2021 and entered into an agreement to acquire Alcanna Inc. (“Alcanna’), Canada’s largest private liquor retailer, operating 171 locations, on October 7, 2021, subsequent to the end of the third quarter.

“Our third quarter results reflect the initial impact of the business transformation led by Sundial’s team over the last 10 months,” said Zach George, Chief Executive Officer of Sundial. “We remain focused on sustainable profitability and continued improvement in all aspects of our operations. Despite the ongoing challenges facing industry participants, our financial condition has never been stronger. Sundial is uniquely positioned relative to its peers as we seek to delight consumers and become a trusted industry partner. Our balance sheet strength enables our team to avoid short term pressures while working to improve the quality of our decision making. We expect that the achievement of our objectives will result in an aggregate base business that generates free cash flow in 2022.”

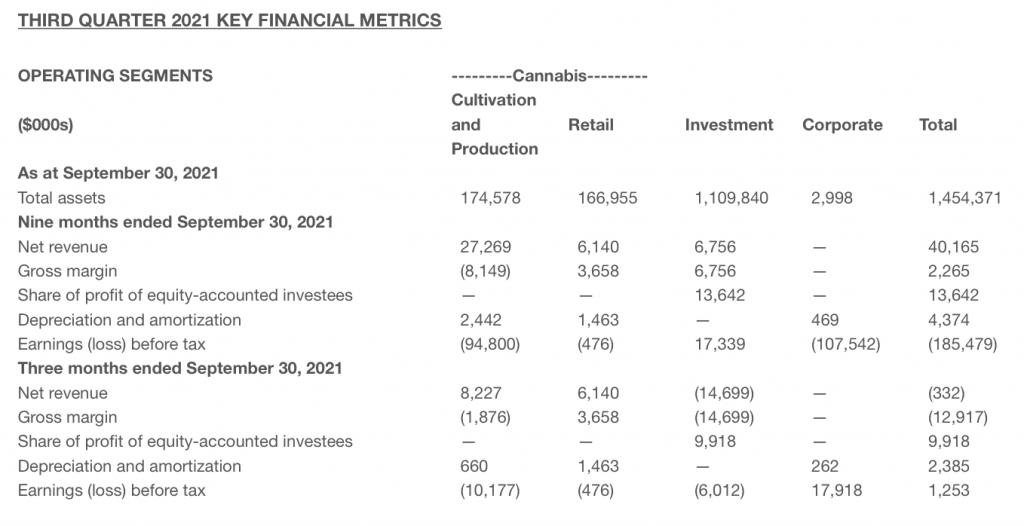

Sundial reports three operating segments including two Cannabis segments: Cultivation and production, and retail, which was added with the acquisition of Inner Spirit. The third segment is Investments. For the three and nine months ended September 30, 2020, Cannabis was the only reportable segment, and therefore no comparative segment information is available for the Investment or retail segments.

- Asset value per share at September 30, 2021, including cash, loans, marketable securities and the Olds facility at net book value was approximately $1.4 billion or $0.70 per share (US$1.1 billion or US$0.55 per share).

- As of September 30, 2021 and November 9, 2021, the Company had an unrestricted cash balance of approximately $629 million and $571 million, respectively, and total common shares outstanding of 2.1 billion and 2.1 billion, respectively.

ALCANNA ACQUISITION

On October 7, 2021, the Company announced that it had entered into an arrangement agreement with Alcanna pursuant to which the Company will acquire all of the issued and outstanding common shares of Alcanna by way of a statutory plan of arrangement for total consideration of 387.3 million common shares of Sundial, with a value of approximately $346 million (the “Alcanna Acquisition”). The Alcanna Acquisition is expected to close in the fourth quarter of 2021, subject to customary closing conditions. Alcanna’s longstanding liquor business provides Sundial with stable cash generation through a mature and proven business model with trailing twelve months free cash flow of $16.4 million on a built-out retail platform.

Alcanna is a Canadian liquor retailer, operating predominantly in Alberta under its three retail brands, “Wine and Beyond”, “Liquor Depot” and “Ace Liquor”. Alcanna also holds an approximate 63% equity interest in Nova Cannabis Inc., a Canadian cannabis retailer operating stores across Alberta, Saskatchewan, and Ontario.

THIRD QUARTER 2021 RESULTS

CANNABIS RESULTS

The Company’s Cannabis operations are comprised of two segments: cannabis cultivation and production and, with the acquisition of Inner Spirit, cannabis retail.

CANNABIS CULTIVATION AND PRODUCTION

Sundial remains focused and committed to optimization of its cultivation and processing activities.

- Sundial’s ongoing investments in innovation and cultivation practices generated continued crop yield stability in the third quarter of 2021 with results at 51 grams per square foot versus 49 grams per square foot in third quarter of 2020.

- Sundial continues to achieve higher weighted average THC potency reaching its highest percentage results in the third quarter of 2021, validating the Company’s efforts and improvements in cultivation.

- Sundial launched its newest product innovation, Caviar Cones, in the third quarter of 2021 under the award-winning Top Leaf brand. This launch, the first of its kind in Canada, reinforces Sundial’s focused innovation pipeline of premium inhalables in the Canadian cannabis market. In the first four weeks after launch, the Top Leaf Forbidden Lemon Caviar Cone was the top-selling Pre-Roll SKU in all Spiritleaf stores in Alberta, Saskatchewan, and Manitoba (initial launch provinces).

- Sundial’s premium portfolio remains well positioned to focus on the higher margin inhalables segment. The Company grew share of premium flower despite a purposeful portfolio rationalization reducing its assortment by almost 80% and focusing on higher potency and quality flower in the third quarter of 2021 under Top Leaf.

GROSS MARGIN BEFORE FAIR VALUE ADJUSTMENTS

Gross margin before fair value adjustments from cannabis cultivation and production for the three months ended September 30, 2021was negative $4.9 million compared to negative $17.3 million for the three months ended September 30, 2020. The increase of $12.4million was due to a lower inventory obsolescence provision compared to the prior period as well as Sundial’s ongoing focus on cost optimization, reduction of harvest inventory subject to impairment and offering the most competitive and profitable strains and brands to its customers against the backdrop of industry-wide price compression and high relative operating costs at our premium facility.

NET REVENUE FROM CULTIVATION AND PRODUCTION

Net revenue from cultivation and production operations in the third quarter of 2021 was $8.2 million compared to $12.9 million in the third quarter of 2020, reflecting the Company’s continuing shift to branded sales from wholesales.

GROSS SELLING PRICE

Average gross selling price was $3.23 per gram in the third quarter of 2021, compared to $2.67 per gram in the third quarter of 2020. The increase of $0.56 per gram equivalent was mainly due to an increase in prices for sales to other LPs, partially offset by lower prices for provincial board sales. Average gross selling price per gram equivalent of branded products, net of provisions, was $3.31 per gram in the third quarter of 2021, compared to $3.19 per gram in the second quarter of 2021.

Full earnings release here.