Trulieve Cannabis Corp. (“Trulieve” or the “Company”) (CSE: TRUL) (OTCQX: TCNNF), and Harvest Health & Recreation Inc. (“Harvest”) (CSE: HARV, OTCQX: HRVSF) are pleased to announce the completion of the previously announced arrangement, pursuant to which Trulieve acquired all of the issued and outstanding subordinate voting shares, multiple voting shares and super voting shares (collectively the “Harvest Shares”) of Harvest (the “Transaction”).

Key Transaction Highlights and Benefits

- Increases Scale Across Our Hub Markets – creates at time of closing the largest U.S. cannabis operator across a combined retail and cultivation footprint basis with depth in key markets;

- Solidifies Position as the Most Profitable U.S. MSOs – establishes an outstanding platform of profitability and cash generation for continued growth, positioning the Company to execute on near-term opportunities in existing markets as well as future catalysts at both state and federal levels;

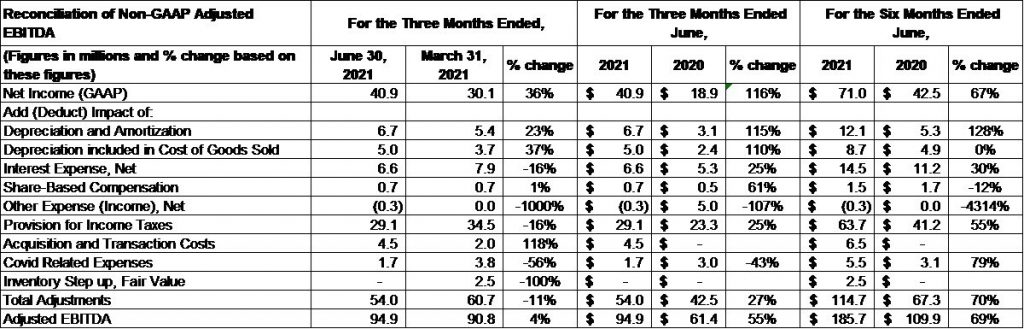

- Provides Leading Financial Metrics – reinforces superior financial performance relative to peers by delivering the strongest public company financial results among any U.S. reporting MSO. In the second quarter 2021, Trulieve reported revenues of $215.1 million, net income of $40.9 million, and Adjusted EBITDA1 of $94.9 million, and Harvest reported revenues of $102.5 million, net loss before non-controlling interest of $19.2 million, and Adjusted EBITDA2of $28.0 million. On a combined basis, in the second quarter 2021, Trulieve and Harvest had $317.6 million in reported revenue, the highest among U.S.public reporting cannabis companies;

- Delivers an Exceptional Retail and Wholesale Distribution Model – offers a robust retail network of 149 dispensaries across 11 states and 3 strategic regional hubs, with market leading positions in Arizona, Florida and Pennsylvania;

- Strengthens Industry Leading Balance Sheet – combines Trulieve and Harvest’s strong cash and cash equivalents of $289.0 million and $71.0 million, respectively, as of June 30, 2021, bolstered by Trulieve’s recently announced $350.0 million debt financing and Harvest’s $55.0 million proceeds from the sale of its Florida license;

- Extends Product Selection and Brands – adds successful line of Harvest brands, including Alchemy and Roll One, across multiple form factors to Trulieve’sportfolio of in-house brands and national brand partners; and

- Leverages Experience and Best Practices – combines proven management teams with established track records, enhancing operational excellence across cultivation, manufacturing, and retail.

Management Commentary

“The closing of this Transaction marks a transformational milestone in our company’s history and positions Trulieve as the leading medical and adult-use cannabis operator in the U.S.,” stated Kim Rivers, Chief Executive Officer at Trulieve. “I thank all our employees, both Trulievers and Harvesters, for their tireless efforts during this process. The combined footprint provides Trulieve with a solid foundation for continued growth and scale. We look forward to fully integrating Harvest as we continue to execute on our hub strategy in the U.S., creating an unrivalled brand and reputation in the marketplace and value for our shareholders.”

“This combination brings together two companies with depth and scale in key markets, providing a platform for growth for years to come,” said Steve White, CEO of Harvest. “Trulieve’s customer centric values match well with Harvest’s dedication to improving lives through the goodness of cannabis.”

Transaction Details

The Transaction was completed by way of a plan of arrangement (the “Arrangement”) under the provisions of the Business Corporations Act (British Columbia). Pursuant to the terms of the Arrangement, holders of Harvest Shares received 0.1170 of a subordinate voting share of Trulieve (each whole subordinate voting share, a “Trulieve Share”) for each subordinate voting share of Harvest (on a converted basis) held. In total, Trulieve issued an aggregate of 50,874,175 Trulieve Shares in connection with the Transaction in exchange for all of the issued and outstanding Harvest Shares. An early warning report in respect of Trulieve’s acquisition of all of the issued and outstanding Harvest Shares will be filed on SEDAR and made available under Harvest’s issuer profile at www.sedar.com.

It is anticipated that the subordinate voting shares of Harvest will be delisted from the Canadian Securities Exchange as of the close of trading on October 4, 2021, and Harvest intends to submit an application to the applicable securities regulators to cease to be a reporting issuer and terminate its public reporting obligations in due course.

Pursuant to the letter of transmittal mailed to shareholders of Harvest as part of the materials delivered in connection with the annual and special meeting of Harvest shareholders held on August 11, 2021, in order to receive the Trulieve Shares to which they are entitled, registered holders of Harvest Shares are required to deposit the share certificate(s) or DRS statements representing their Harvest Shares, together with a duly completed letter of transmittal, with Odyssey Trust Company, the depositary under the Arrangement. Shareholders whose Harvest Shares are registered in the name of a broker, dealer, bank, trust company or other nominee must contact their nominee to deposit their Harvest Shares.

For more information on the Arrangement, please see the news releases previously issued by Trulieve and Harvest along with Harvest’s management information circular dated July 13, 2021, prepared in connection with the Arrangement, all of which are available under Harvest’s profile at www.sedar.com or www.sec.gov/edgar.

Financial and Legal Advisors

Canaccord Genuity Corp. acted as exclusive financial advisor and DLA Piper (Canada) LLP and Fox Rothschild LLP acted as Canadian and United States legal counsel, respectively, to Trulieve. Canaccord Genuity Corp. also provided a fairness opinion to the Board of Directors of Trulieve.

Moelis & Company LLC acted as financial advisor and Bennett Jones LLP and Troutman Pepper Hamilton Sanders LLP acted as Canadian and United Stateslegal counsel, respectively, to Harvest. Haywood Securities Inc. provided a fairness opinion to the Special Committee of the Harvest Board of Directors.

Conference Call and Investor Presentation

Trulieve will hold a conference call and webcast to discuss the completion of the Transaction today at 8:00 AM EDT. The conference call may be accessed by dialing 1-855-669-9657 and entering conference ID 10160599. Access to the webcast will be available at Trulieve.com or Trulieve Acquires Harvest Webcast Call. In addition, an accompanying investor presentation will be available on the Investor Relations Events & Presentations page on the Trulieve website.