Disclaimer: I’m not a certified financial planner and this article is for informational purposes only. This article should not be taken as investment advice. Always do your own research and consider seeking the advice of a certified financial adviser before investing.

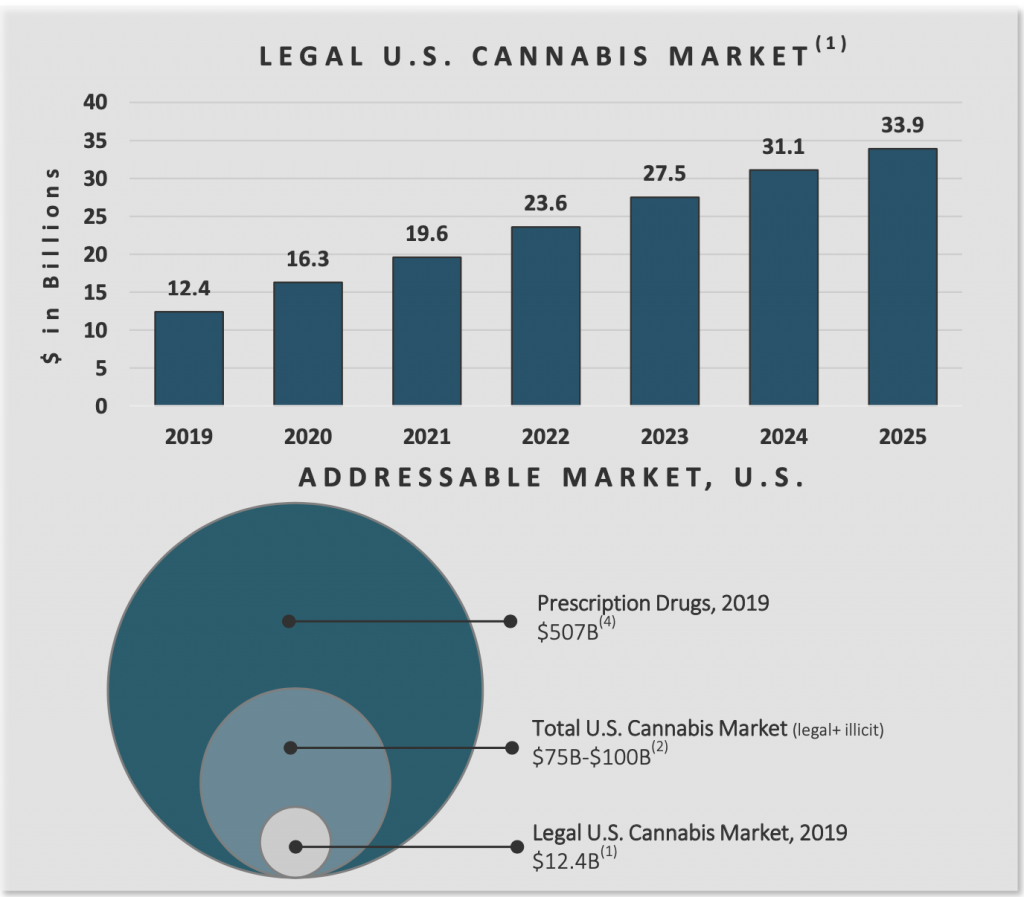

2021 will be the year of the cannabis investor. In 2020, the total U.S. legal and illicit cannabis market was estimated at $75-$100 billion dollars with the legal regulated market just over $16 billion. While the illicit market remains dominant, the legal market is expected to grow to $34 billion or twice the size in 2025.

Photo source: Curaleaf investor presentation.

In my view, no other industry will provide better returns in the stock market due to several major catalysts:

- A Biden/Harris administration will be cannabis-friendly and likely push for further decriminalization.

- The MSOS ETF and other Cannabis ETFs will continue to grow significantly, effectively acting as institutional investors.

- Democrats are favored to win the January 5th Senate runoff elections. If Democrats win both senate seats all cannabis stocks will rise even more significantly in 2021. Their victories will shorten the timeframe for federally rescheduling marijuana and passing the SAFE Act – combined will normalize the cannabis industry with banks and provide uplisting the major stock exchanges. Even if Republicans maintain control of the senate, the US cannabis industry will continue to see decriminalized, just at a slower pace.

- Continued state-level adult-use legalization – expect more states to legalize in 2021 (New York and Pennsylvania will be the big ones).

- 2020 saw lots of mergers and acquisitions (M&A) in the cannabis space and cannabis sector companies in 2021 should be just as aggressive, especially MSOs as many hit retail store limit caps in some states.

Here are my top eight cannabis picks for 2021 with price targets:

1. AdvisorShares Pure US Cannabis ETF (Ticker: MSOS)

Current Price: $36.50

Exchange-Traded Funds, or ETFs, are a great way to gain sector exposure without needing to spend time researching or managing a portfolio. There are plenty of cannabis ETFs, but MSOS will be the best bet in 2021 as it exclusively invests in American companies.

By owning MSOS, you’ll currently spread your risk into 25 American-based cannabis or cannabis-related publically traded companies. For example, you’ll own the major Multi-State Operators (MSO) like Curalief, Green Thumb Industries, Trulieve and Cresco, the rising stars like TerrAscend, Ayr Strategies, Harvest Health, Columbia Care, the speculative plays like Jushi Holdings, Planet 13, C21 Investments, 4Front Ventures, Vireo Health, the “pick and shovel” play Grow Generation and the real estate plays Innovative Industrial Properties and Power REIT. The full holdings list can be seen here.

Because MSOS is traded on NYSEArca, there are call options available providing investors a way to add leverage. This is currently the only way to indirectly own options in US MSOs. Since cannabis is still illegal at the federal level in the US, MSOs can’t list on the US stock exchanges and currently trade on the Candian Stock Exchange (CSE)/ Over-The-Counter (OTC). This pick will not have the highest returns in 2021, but is right for most cannabis investors because like a mutual fund it offers diversity and is fully managed.

Full disclosure: I do not own any shares of MSOS directly. I own Jun 18 $35 and $45 calls – up 177% and 64%.

2. Trulieve (Ticker: TCNNF)

Current Price: $31.62

Trulieve had an amazing run in 2020 and it is my #1 pure cannabis play for 2021 for many reasons.

First, Trulieve owns more than half of the market share in Florida, America’s third most populous state that also ramps up with snowbirds (people who head south for the winter) and tourists. According to the Florida Department of Health’s most recent Office of Medical Marijuana Use (OMMU) report, Trulieve owned 55% of Florida’s medical marijuana market based on total weight sales. It’s an amazing achievement considering Trulieve only owns 23% of the retail stores in Florida. I’m unaware of any other MSO achieving 50% market share in any other state.

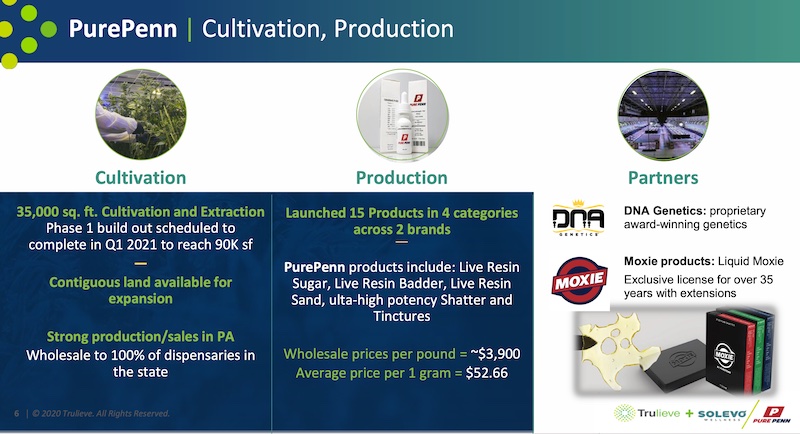

Second, while Trulieve currently dominates Florida, 2021 will be the year they truly become an MSO with operations in Pennsylvania and Massachusetts projected to add significant revenue and EBITDA (income before Uncle Sam and the banks take their cut). While 70 of Trulieve’s 75 operational dispensaries are in Florida, Trulieve jumped headfirst into Pennsylvania by closing their acquisition of both PurePenn and Solevo in November. PurePenn gives Truleive cultivation, extraction, and a deep wholesale market (100% of all PA cannabis retail stores).

Photo Source: Trulieve Investor Presentation.

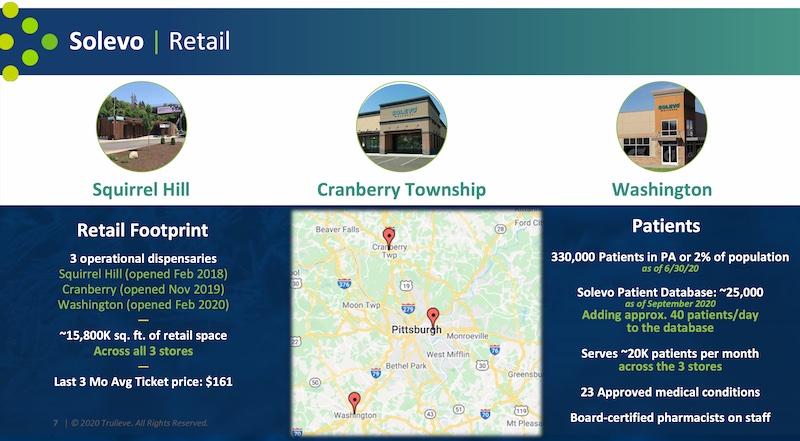

Solevo adds three dispensaries in the Pittsburgh area – the seed for retail growth in America’s sixth most populace state.

Photo Source: Trulieve Investor Presentation.

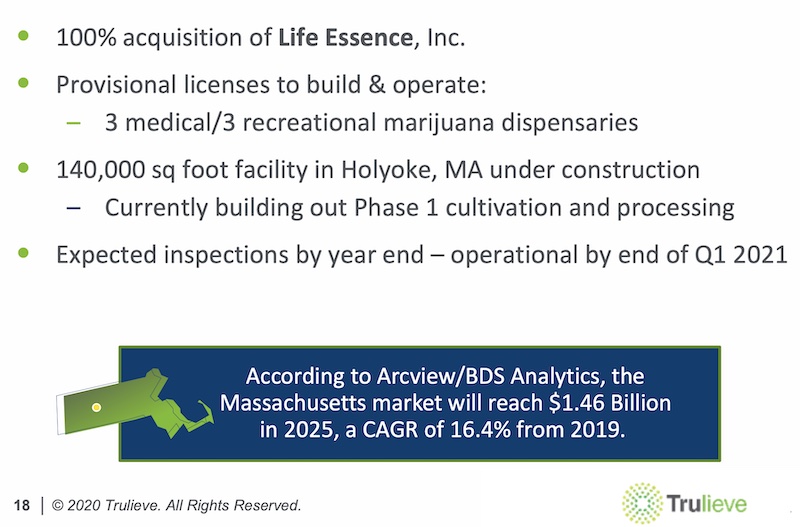

Through Truleive’s acquisition of Life Essence in Massachusetts, Trulieve expects three medical/recreational dispensaries to be operating by the end of Q1 2021.

Photo Source: Trulieve Investor Presentation.

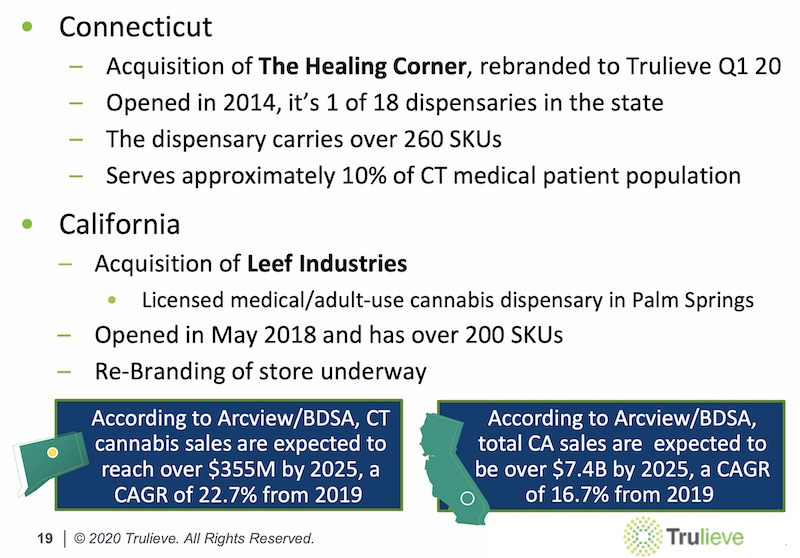

Trulieve also owns an overperforming dispensary in Connecticut (one of 18 stores in the state, while owning 10% of the market), another dispensary in California, was recently awarded a processor permit in West Virginia and there are reports Trulieve is looking into entering Texas, Virginia, and Georgia.

Photo Source: Trulieve Investor Presentation.

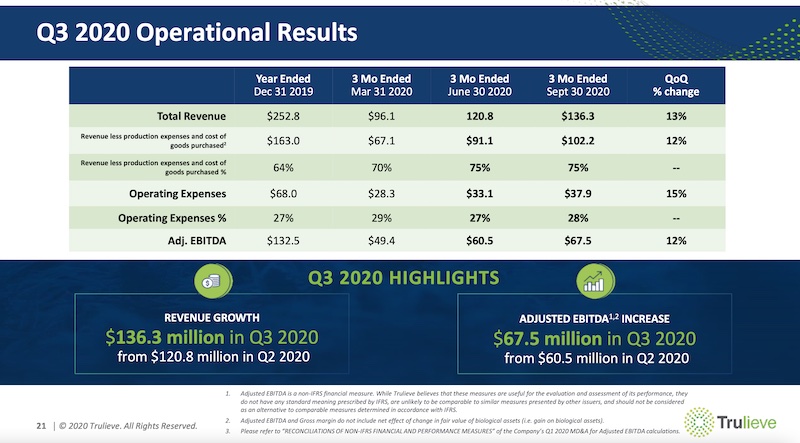

Finally, in my view, Trulieve has the best financials of the MSO’s when it comes to gross profit margins, profitability, and cash flow. In the last quarter, Trulieve achieved its 11th consecutive quarter of profitability with Adjusted EBITDA at 50% of revenue – unheard of in the cannabis industry. Trulieve ended Q3 with $193.4 million in cash, a significant war chest for future growth when also considering Trulive should easily top $800 million in revenue and $300 EBITDA in 2021.

Photo Source: Trulieve Investor Presentation.

There aren’t many sure things on Wall Street, but Trulieve is as good as it gets in the cannabis industry.

Potential 2021 Stock Catalysts:

- In my view, Trulieve’s next earnings report (4Q 2020) will significantly exceed estimates as analysts haven’t fully accounted for the Pennsylvania assets and edible sales in Florida. I see Trulieve beating expectation by a wide margin.

- Continued M&A – Truleive has a lot of cash and cash flow to grow organically in existing markets, but also to enter new markets like New York, Illinois, Arizona, Michigan, and New Jersey.

- There will be a major push to legalize adult-use cannabis in Florida in 2021 through legislation and a 2022 ballot initiative should gain traction.

Full Disclosure: Trulieve my top portfolio holding. I went long in October 2020 and currently up over 40%.

3. Cresco Labs (Ticker: CRLBF)

Current Price: $9.86

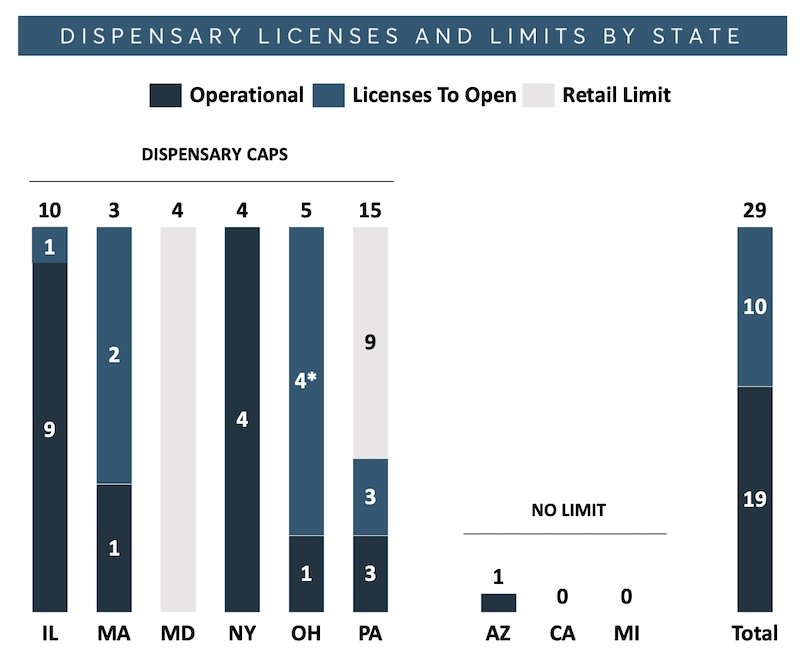

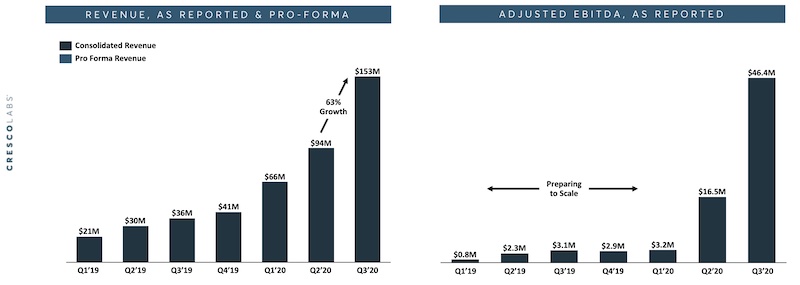

Cresco is located in nine states, has 15 production facilities holds 29 retail licenses. Cresco caught my attention when they reported year-over-year revenue growth of 323% last quarter and recently became my wholesale play.

Strong Wholesale Game

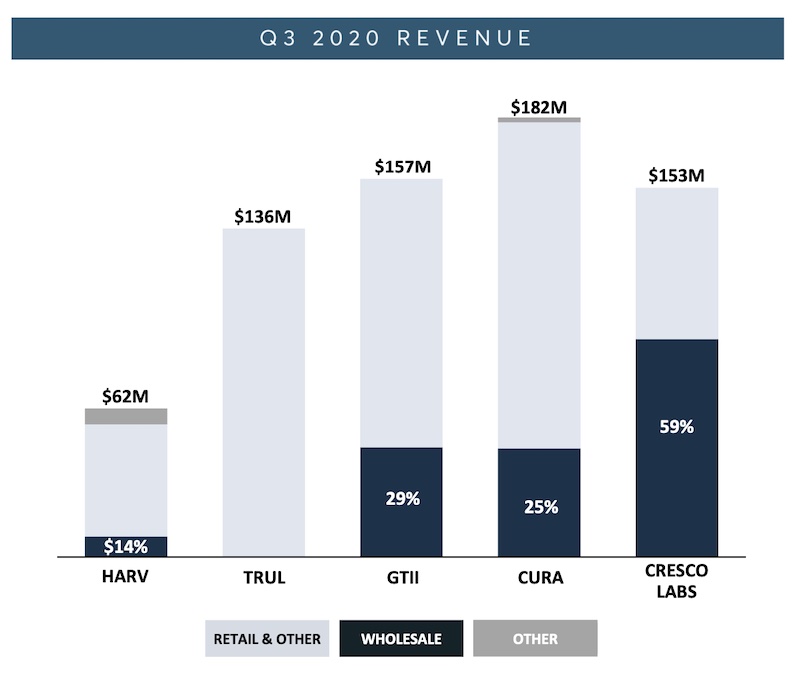

Wholesale is what separates Cresco from the other major MSOs, generating 59% of total revenue due to Cresco expanding their cultivation space in Illinois six-fold and quadrupling their cultivation space in Pennsylvania.

Photo Source: Cresco Labs Investor Presentation.

By contrast last quarter, wholesale accounted for 29% of Green Thumb Industries and 25% of CuraLeaf’s revenue, and none of Truleive’s (though that will change in 2021 in Pennsylvania and Massachusetts).

Photo Source: Cresco Labs Investor Presentation.

Cresco has a strong presence in California, growing wholesale revenue by 56% while the state is growing cannabis sales at 21%. Cresco also sells wholesale in Michigan. Wholesale was considered a risky strategy, but Cresco seems to be executing perfectly through aggressive grow/processing facility expansions and wholesale market share.

Cresco will significantly grow their retail presence by at least 50% in 2021

Cresco has 29 retail licenses with 20 of them currently open:

Photo Source: Cresco Labs Investor Presentation. Note: Cresco Opened their 10th Illinois store in December 2020.

In 2021, expect Cresco to open two retail stores in Massachusetts, add the four Ohio stores into the mix, add up to 12 more stores in Pennsylvania and continue to add stores through M&A. Expect up to four stores opened in Maryland as well.

Strong Financials

Cresco’s adjusted EBITDA last quarter grew from $52 million, up from $11 million year-over-year. Tripling revenue year-over-year is impressive, growing EBITDA by nearly 500% is even more impressive. Cresco ended last quarter with $58 million of cash and cash equivalents and very little debt, so expect the aggressive expansion to continue in 2021.

Photo Source: Cresco Labs Investor Presentation.

Potential 2021 Stock Catalysts:

- Thanks to New Jersey’s adult-use legalization ballot passing two months ago, New York and Pennsylvania have a good chance of legalizing adult-use through legislation in 2021 – each would be a major catalyst for Cresco.

- Continued M&A – Cresco had exploding growth due to M&A so don’t expect them to stop in 2021. With Arizona legalizing adult use, expect Cresco to expand in that market sooner than later. With New Jersey legalizing Cresco could look to enter that market. They have a strong wholesale presence in Maryland and the state allows for four retail stores.

Full Disclosure: Cresco is one of my newest purchases, but is already my second largest portfolio holding behind Trulieve. I’m currently down 0.11%.

4. Columbia Care (Ticker: CCHWF)

Current Price: $6.05

Columbia Care is the less expensive CuraLeaf cousin. Investors have flocked to CuraLeaf because they are in the most states possible (23) with the most retail stores (96) open through aggressive M&A the past few years. This land grab, or “shotgun” approach strategy, is to be in as many states as quickly as possible, the opposite of Trulieve’s initial approach of organic growth. As a stock, this strategy has paid off for Curaleaf as the company has the largest market cap of the US MSOs.

With Columbia Care’s recent purchase of Green Leaf, they are now in 23 states with 87 retail stores, putting then seven stores behind CuraLeaf. There is something to be said about having a presence in every legal cannabis market in America.

Photo source: Columbia Care Investor Presentation.

Dominant retail presence in Colorado

Columbia Care has 24 stores in the most mature cannabis market of Colorado, 14 stores in Florida, 12 dispensaries open/or under development in Virginia, and five stores in California, the largest cannabis market in the world. These will provide the cash flow for their aggressive growth goals in New Jersey and Arizona (now fully legal) and New York, Florida, and Pennsylvania (All likely to be fully legal by the end of 2022).

Potential 2021 Stock Catalysts:

- New York and Pennsylvania have a good chance of legalizing adult-use and each alone would be a major catalyst for Columbia Care. Since Columbia Care is in every possible state to sell cannabis, every adult-use legalization benefits Columbia Care.

- There will be a major push to legalize adult-use cannabis in Florida in 2021 – through legislation and a 2022 ballot initiative.

Full Disclosure: Columbia Care is my fifth large cannabis play in my portfolio. I started a position last week and currently up 4%.

5. Ayr Strategies / Liberty Health Sciences (TICKER: AYRWF / LHSIF)

Current Price: $23.78

Ayr Strategies is my pick, but I purchased Liberty Health Sciences to take advantage of the buyout discount. On December 22, Ayr Strategies announced the acquisitions of Liberty Health Sciences in Florida and GSD in New Jersey. Liberty is a public company and GSD is private. By EBITDA multiples, Ayr is cheap compared to the big MSOs and these acquisitions finally got me interested in Ayr.

The purchase of Liberty shares is complex, but what investors need to know is Liberty shareholders will get 0.03683 of Ayr stock for each Liberty share they own. At the time of this writing, Ayr’s stock price is at $23.78 which means if the deal was closed today, Liberty shareholders would get just over $0.87 per share – Liberty shares currently sit at $0.80, almost a 10% discount. The discount is there because if the deal falls through, Liberty’s share price would likely tumble back to 40 cents or lower (price before buyout). This discount will narrow as the deal gets closer to closing – until then Liberty shares should generally track Ayr’s shares. There is also a protective provision for Liberty shareholders, if Ayr’s stock price is less than $23.08 at the closing day, the exchange ratio will be 0.0433.

Sound too complex? Just buy Ayr’s shares and avoid risk and complexity.

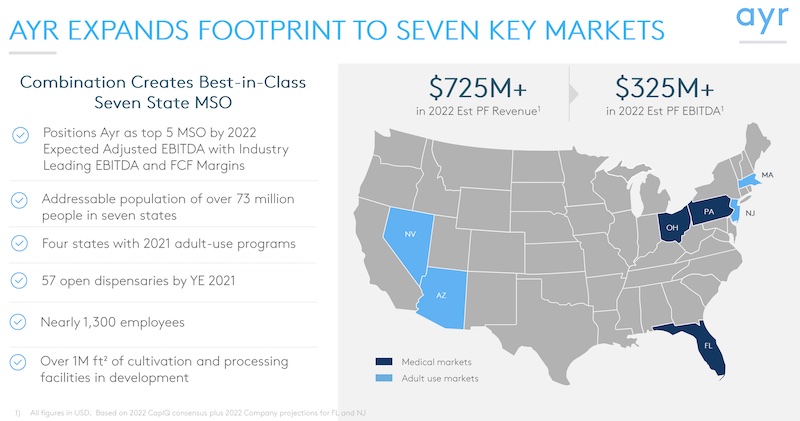

Taking Las Vegas to the rest of America

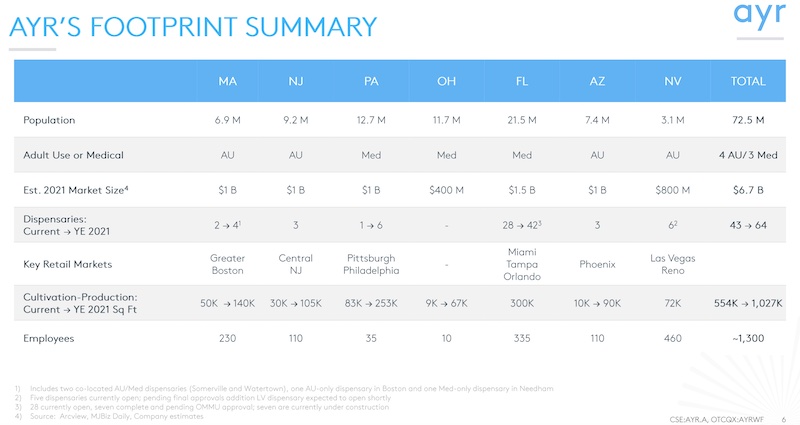

With the most recent acquisitions, Ayr is now in seven states – four with adult-use sales. Ayr’s main strength is it’s five (soon to be 6) cash-cow dispensaries in Las Vegas. If the Florida and New Jersey deals go through, Florida will immediately be Ayr’s core holding as Liberty would provide 28 operational stores with an additional 14 stores (7 ready to open, 7 under construction) in Florida likely by the end of 2021.

Photo source: Ayr Strategies Investor Presentation.

Financials look solid

According to Ayr’s latest investor presentation, Ayr’s 2023 Pro-forma revenue is for $725+ million and $325+ million Pro-forma EBITDA. Management pointed out that if Ayr was valued at the average MSO EV/EBITA of 13x, the stock would sit at $66/share. This gives you the potential share value, but the company has a lot to execute before we see $66.

Photo source: Ayr Strategies Investor Presentation

Ayr Strategies offers tremendous upside should the Liberty Health Sciences acquisition close in early 2021, effectively being two-thirds of Ayr’s retail footprint (42 of their 64 estimated store count).

Potential 2021 Stock Catalysts:

- Pennsylvania has a good chance of legalizing adult-use and would be a major catalyst for Ayr.

- There will be a major push to legalize adult-use cannabis in Florida in 2021 through legislation and a 2022 ballot initiative.

Full Disclosure: Liberty Health Sciences is my third largest cannabis play in my portfolio and I’m currently up 14%.

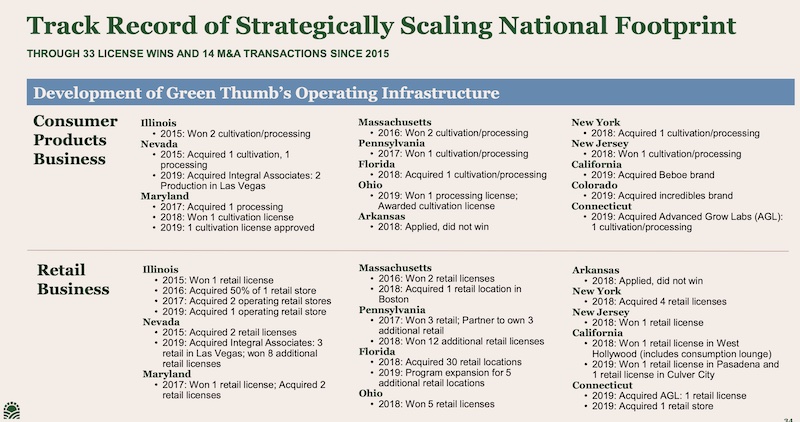

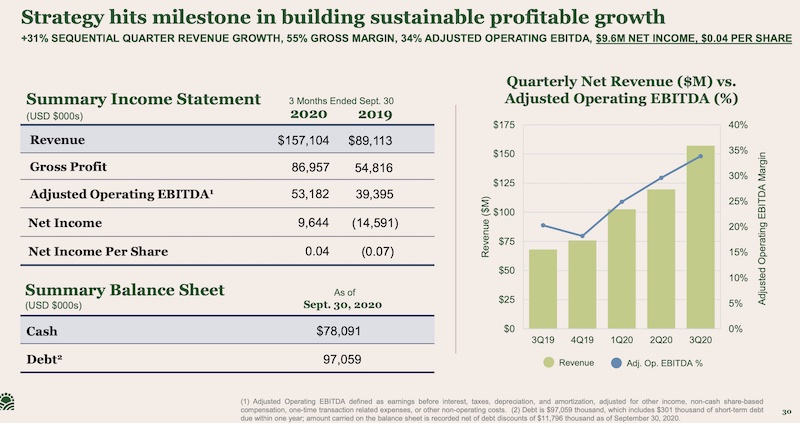

6. Green Thumb Industries (Ticker: GTBIF)

Current Price: $24.50

Green Thumb is the second largest MSO by market cap behind CuraLeaf, but unlike CuraLeaf is profitable. The company is in 12 states, has 49 stores open with 96 retail licenses – meaning they could nearly double their stores in 2021 without any new licenses or M&A. According to their investor presentation, Green Thumb’s near-term priorities markets are Illinois where they have eight operational stores, and Pennsylvania where they have 13 operational stores.

In their latest earnings report, Green Thumb’s revenue increased 31.3 % quarter-over-quarter and 131.1 % year-over-year to $157.1 million. They have $78 million in cash for 2021 growth.

I would rank Green Thumb higher, but similar to CuraLeaf, the stock is currently trading near fair value compared to other MSO’s. Along with Trulieve, Green Thumb should be considered a blue-chip of Cannabis.

Potential 2021 Stock Catalysts: Pennsylvania, New York, Connecticut and Florida should all legalize adult-use by the end of 2022.

Full Disclosure: Green Thumb is my fourth largest cannabis stock position and I’m currently up 27%.

7. Power REIT (Ticker: PW)

Current Price: $26.71

Everyone is trying to find the next Innovative Industrial Properties, up 153% in 2020, and currently pays a 2.70% dividend. Innovative Industrial Properties is a Real Estate Investment Trust (REIT) that rents to cannabis sellers. The company has been performing real estate buybacks with the top MSOs, basically buying MSO grow and processing facilities and leasing the facilities back to the MSO. This provides liquidity for the MSO and attractive rents for Innovative Industrial Properties.

Power REIT is about three years behind Innovative Industrial Properties, but aggressively moving into the space. Starting out as a railroad and solar panel farm REIT, Power REIT is aggressively building up their cannabis real estate inventory.

Power REIT’s market cap is $51 million compared to Innovative Industrial Properties’ $4 billion, so they are in two different leagues with Innovative Industrial Properties’ revenue being 10 times larger. But should Innovative Industrial Properties’ market cap be 78 times larger? Power RIET is one of the stocks owned by MSOS (as is Innovative Industrial Properties) and a good choice for those looking to diversify their cannabis portfolio with real estate. Innovative Industrial Properties is still a great investment going into 2021, but as Power REIT gets noticed by investors its stock could outperform Innovative Industrial Properties in 2021.

Potential Stock Catalysts: Expect dozens of announcements through 2021 regarding new land purchases and leases to cannabis companies. Power REIT should move with the cannabis sector as a whole. A dividend announcement would also move the stock higher.

Full Disclosure: Power REIT is my lowest cannabis stock holding.

8. Clever Leaves Warrants (Ticker: CLVRW)

Current Price: $1.54

You’ve likely heard of Single State Operators (SSO), Multi-State Operators (MSO), and Canadian Licensed Producer (LP), but you may not be familiar with Multi-National Operator Licensed Producer (MNO LP). Clever Leaves is the newest cannabis stock recently listed on the NASDAQ on December 21, 2020.

Clever Leaves primarily operates in Columbia and has already shipped cannabis to 14 different countries on five continents. Clever Leaves is one of four cannabis companies in the world that is EU GMP-certified vertically integrated botanical extractors (Aphria, Aurora, and Tilray are the others). This allows for higher price exports into Europe. Clever Leaves has started cultivation in Portugal and already has access to the German market by fully and partially owning two German distributors. In December, the company announced that they have already started to ship to Germany.

In South America, Clever Leaves already has a Latin America supply agreement with Canopy Growth and a multi-year deal in Brazil.

Clever Leaves’ stock has absolutely been pounded since their IPO and most recently the last trading day of 2020, down almost 10% – the warrants traded down 21% and sit at $1.54.

I could see the warrants trading at $6 by the end of 2021, but warrants are a riskier bet than stocks. A warrant gives you the right to purchase a stock share directly from the company instead of buying from another investor through a broker. For Clever Leaves, the Warrant gives you the right to buy Clever Leaves shares at $11.50 (the stock last traded at $8.90). The warrants expire on December 18, 2025, and offer a long-term minded investor the potential for some serious returns over the next few years. For example, in 2020 Truleive’s share price increased by 167%, but Truleive’s warrants increased by 723% – that my friends is leverage.

Potential Stock Catalysts: Mexico officially legalizing cannabis could be a short term catalyst, but delivering on earnings are the main Clever Leaves catalysts for 2021. Expect the company to get overlooked for much of the year until consistent earnings are delivered. This is a long-term play that should start paying off in the second half of 2021.

Full Disclosure: Clever Leaves warrants is one of my lowest portfolio positions, but I will be adding in 2021.

Honorable Mentions: Looking for more stocks? Investors also should consider in the following order: Curaleaf (CURLF), Innovative Industrial Properties (IIPR), Grow Generation (GRWG), SOL Global Investments (SOLCF), Vireo Health (VREOF), C21 Investments (CXXIF), Planet 13 Holdings (PLNHF), 4Front Ventures (FFTNF), HydroFarm Holdings (HYFM), Jushi Holdings (JUSHF), Aphria (APHA), and TerrAscend (TRSSF).

Take a minute to leave a comment and join our community forum to discuss these stocks and more!